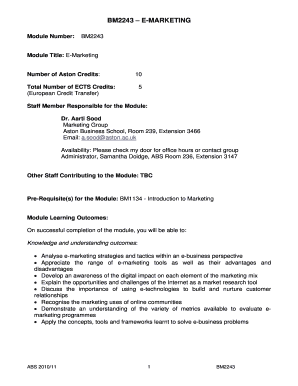

Get the free Equity Release Plan - Application Form - Vow Financial - vow com

Show details

DEL App Form 06 6/3/06 11:32 PM Page 1 Vision Equity Living Pty Limited ABN 57 111 895 473 www.visionequity living.com.AU Level 12, 25 Bligh Street, Sydney NSW 2000 Tel 02 9233 6500 Fax 02 9233 6511

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equity release plan

Edit your equity release plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equity release plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit equity release plan online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit equity release plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out equity release plan

How to fill out an equity release plan:

01

Research and gather information: Start by understanding what equity release plans are, the different types available, and the eligibility criteria. Research reputable providers and compare their offerings. Consider seeking independent financial advice to ensure you make an informed decision.

02

Assess your needs and goals: Evaluate your financial situation, including your retirement plans, healthcare needs, and any outstanding debts. Determine whether an equity release plan aligns with your objectives and if it is the right option for you.

03

Seek legal and professional advice: Engage the services of a solicitor who specializes in equity release to guide you through the legal process. A qualified financial advisor can provide valuable insights and recommendations based on your circumstances.

04

Obtain a key facts illustration (KFI): Request a KFI from potential lenders. The KFI outlines the main features, costs, and risks associated with the equity release plan. Review it thoroughly with your financial advisor and address any queries or concerns.

05

Complete application and disclosure forms: The lender will provide you with application and disclosure forms. Fill them out truthfully and accurately, ensuring you understand the terms and conditions outlined. Disclose all relevant information regarding your property and finances.

06

Property valuation: The lender will arrange for an independent valuation of your property. Its current market value will affect the amount you can release through the equity release plan.

07

Receive an offer and consider it carefully: Once the lender approves your application, they will provide you with an offer. Go through the offer document, paying close attention to the interest rates, fees, and other conditions. Seek advice if needed.

08

Engage the solicitor: Instruct your solicitor to proceed with the legal work required for the equity release plan. They will handle the necessary paperwork and liaise with the lender on your behalf.

09

Complete the process and receive funds: After all legal formalities are completed and the cooling-off period has elapsed, you will receive the funds from the equity release plan in a lump sum, as regular income, or a combination of both, depending on your preference.

10

Regular reviews and monitoring: Continually assess the performance of the equity release plan, particularly if it affects inheritance plans or future aspirations. Regularly review your circumstances and consult with professionals to ensure the plan remains suitable.

Who needs an equity release plan:

01

Retirees with limited pension income: Individuals who have retired and rely on a fixed pension income may benefit from a regular income stream or a lump sum obtained through an equity release plan to supplement their funds.

02

Homeowners with substantial home equity: Individuals who own a property with a significant portion of their wealth tied up in it may consider using an equity release plan to release a portion of the property's value to support their financial needs.

03

Individuals with specific financial goals: Those with specific financial goals, such as funding home improvements, paying for long-term care, or clear existing debts, may find an equity release plan a suitable option to access the required funds.

04

Individuals without dependents or limited inheritance concerns: As an equity release plan involves releasing a portion of the property's value, individuals who do not have significant concerns about leaving an inheritance to their loved ones or dependents may find it an attractive solution for their financial needs.

05

Those seeking flexibility and control: Equity release plans offer various options, such as lifetime mortgages or home reversion plans, providing flexibility and control over how funds are obtained and used. Individuals looking for financial flexibility may find value in these options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is equity release plan?

Equity release plan is a financial product that allows homeowners, typically older individuals, to access the equity in their home without having to sell the property.

Who is required to file equity release plan?

Homeowners who are considering releasing equity from their home are required to file an equity release plan.

How to fill out equity release plan?

To fill out an equity release plan, homeowners need to provide details about their property, the amount of equity they wish to release, and their personal financial details.

What is the purpose of equity release plan?

The purpose of an equity release plan is to provide homeowners with a way to access the value of their property without having to sell it, allowing them to use the funds for retirement, medical expenses, or other financial needs.

What information must be reported on equity release plan?

The information reported on an equity release plan typically includes details about the property, the amount of equity being released, interest rates, fees, and repayment options.

How can I send equity release plan for eSignature?

Once your equity release plan is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in equity release plan?

With pdfFiller, the editing process is straightforward. Open your equity release plan in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit equity release plan on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign equity release plan on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your equity release plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equity Release Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.