Get the free SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS - cfo pitt

Show details

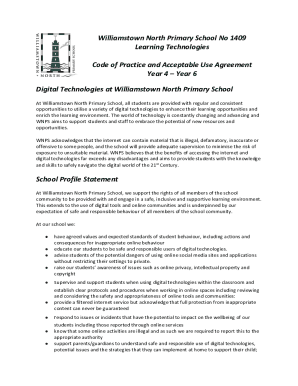

This guide provides detailed instructions for preparing subcontracting plans for small and disadvantaged businesses as required by Federal Acquisition Regulations. It outlines the responsibilities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign smalldisadvantaged business subcontracting plans

Edit your smalldisadvantaged business subcontracting plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

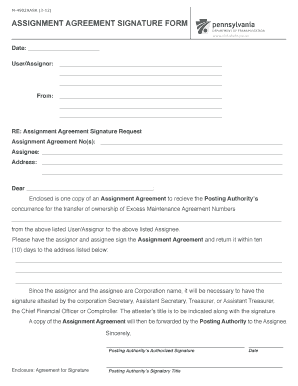

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your smalldisadvantaged business subcontracting plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing smalldisadvantaged business subcontracting plans online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit smalldisadvantaged business subcontracting plans. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

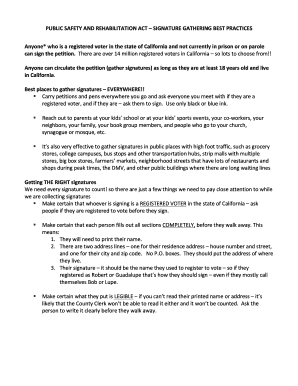

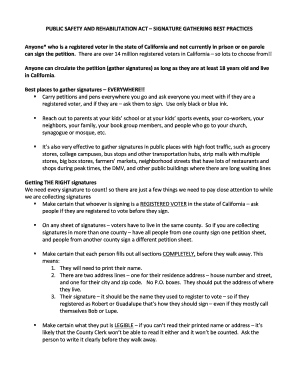

How to fill out smalldisadvantaged business subcontracting plans

How to fill out SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS

01

Review the requirements of the contract to determine if a subcontracting plan is necessary.

02

Identify the goals for subcontracting to small and disadvantaged businesses.

03

Include a description of how you will reach out to small and disadvantaged businesses.

04

Outline the types of work you will subcontract and the anticipated dollar value.

05

Provide a timeline for achieving subcontracting goals.

06

Explain how you will monitor and report progress toward your goals.

07

Include assurances that you will make efforts to be inclusive of small and disadvantaged businesses.

Who needs SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS?

01

Prime contractors who are awarded federal contracts above a certain dollar threshold.

02

Companies seeking to fulfill their socio-economic obligations to support small and disadvantaged businesses.

03

Organizations required to comply with federal regulations related to subcontracting.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as a small disadvantaged business?

Eligibility Criteria Small firms qualify as SDBs if they are at least 51 percent owned by one or more individuals who are socially and economically disadvantaged individuals who are citizens of the United States. For exceptions, see below.

What is included in a small business subcontracting plan?

For certain federal contracts, the sponsor will require a Small Business Subcontracting Plan (SBSP). This plan outlines specific goals for subcontracting to various types of small businesses and details the process for reaching those goals and reporting progress.

What are the risks of using subcontractors?

Performance Risks: Subcontractors may fail to meet project specifications, timelines, or quality standards, leading to delays, rework costs, and potential legal disputes.

What is the downside to subcontracting?

You may need to pay quarterly estimated taxes, depending on how much you make from your subcontracting work. If you decide to go freelance, you almost certainly won't receive benefits through an employer like you would as working for a general contractor.

What are the disadvantages of subcontracting?

You're on your own as a subcontractor, so you won't get any benefits employers offer, like sick and holiday pay, insurance, training opportunities or health benefits. You'll need to factor these costs into your pay. Working as a subcontractor can mean transient workplaces.

What is limitations on subcontracting?

Any work that a similarly situated entity further subcontracts will count towards the concern's 50 percent subcontract amount that cannot be exceeded. When a contract includes both supplies and services, the 50 percent limitation shall apply only to the supply portion of the contract.

Is SAM registration required for subcontractors?

As of 2024, subcontractors are not required to have a SAM Registration but they do need UEI number (Unique Entity Identifier). There are two ways to go about obtain a UEI: Doing the SAM Registration process on your own using online resources (can take 2-3 months)

What is the major disadvantage of subcontracting?

The downsides for subcontractors Because they are considered self-employed, a subcontractor must manage their own business, even while working for someone else. That includes figuring out their own taxes, benefits, and insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS?

Small/Disadvantaged Business Subcontracting Plans are strategies that larger businesses must develop to promote the inclusion of small and disadvantaged businesses in their subcontracting activities, primarily when they receive federal contracts.

Who is required to file SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS?

Businesses that receive federal contracts over a certain monetary threshold and are not small businesses themselves are required to file Small/Disadvantaged Business Subcontracting Plans.

How to fill out SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS?

To fill out a Small/Disadvantaged Business Subcontracting Plan, businesses must provide details about planned subcontracting goals, the types of small businesses to be utilized, and how they will encourage participation from these businesses. The plan must be submitted for approval as part of the contract proposal.

What is the purpose of SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS?

The purpose of Small/Disadvantaged Business Subcontracting Plans is to ensure that small and disadvantaged businesses have the opportunity to participate in federal contracting, thus promoting diversity and economic equity in government procurement.

What information must be reported on SMALL/DISADVANTAGED BUSINESS SUBCONTRACTING PLANS?

On Small/Disadvantaged Business Subcontracting Plans, businesses must report their goals for subcontracting to small and disadvantaged businesses, the methods used to achieve these goals, and the actual performance results against these goals during the contract period.

Fill out your smalldisadvantaged business subcontracting plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Smalldisadvantaged Business Subcontracting Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.