Get the free Loan for Disadvantaged Students - uthsc

Show details

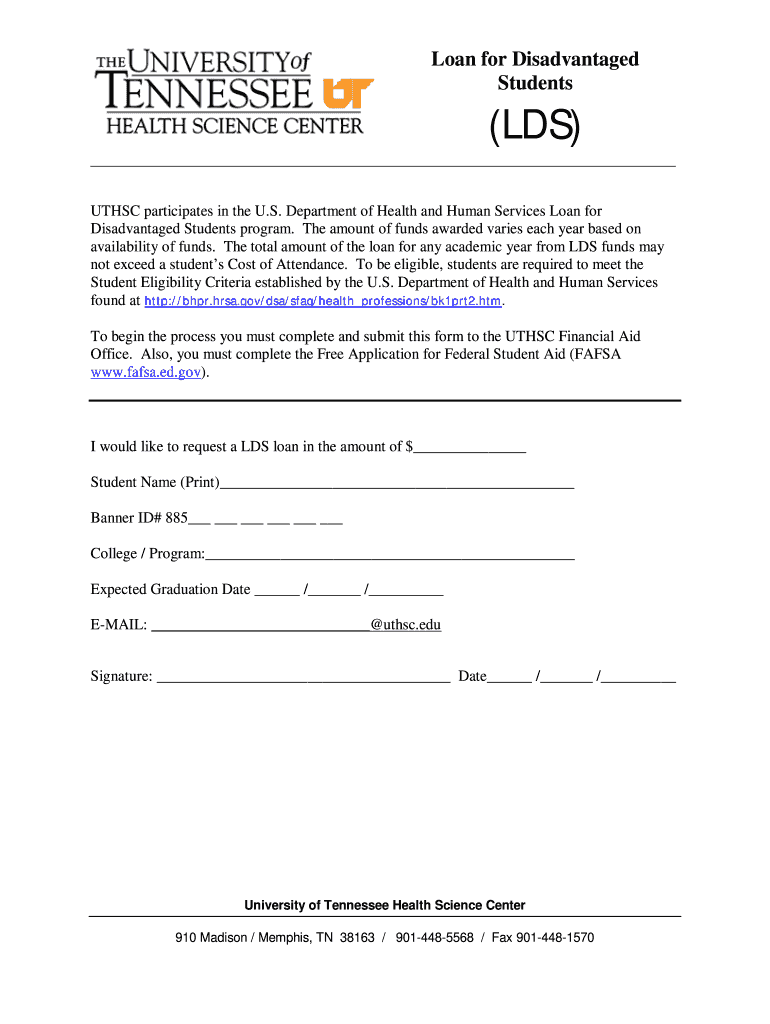

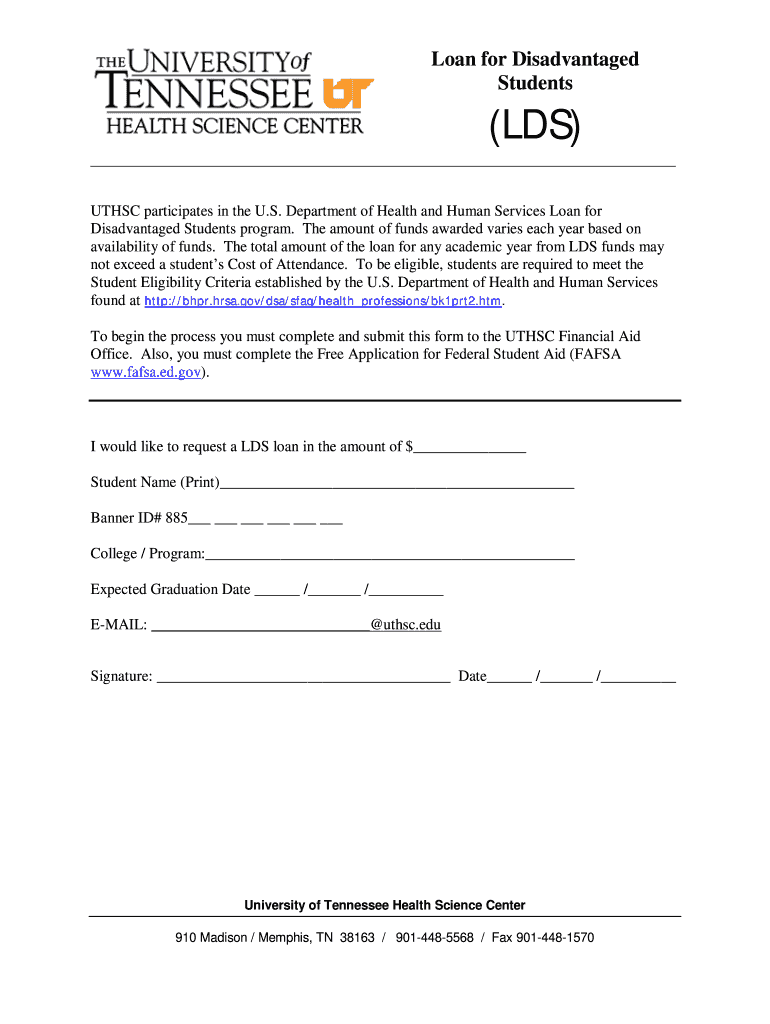

This form is used to apply for the Loan for Disadvantaged Students (LDS) program administered by UTHSC, which assists eligible students with funding based on their Cost of Attendance. Students must

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan for disadvantaged students

Edit your loan for disadvantaged students form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan for disadvantaged students form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan for disadvantaged students online

Follow the steps below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan for disadvantaged students. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan for disadvantaged students

How to fill out Loan for Disadvantaged Students

01

Research available Loan for Disadvantaged Students programs.

02

Gather necessary documentation, such as income statements and proof of disadvantage.

03

Complete the application form with accurate personal and financial information.

04

Provide any required essays or personal statements that explain your situation.

05

Submit the application by the specified deadline.

06

Follow up with the loan office to check the status of your application.

Who needs Loan for Disadvantaged Students?

01

Students from low-income families.

02

First-generation college students.

03

Students facing significant financial hardships.

04

Individuals from underserved communities.

05

Students who have faced systemic disadvantages in education access.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as hardship for student loans?

It is a circumstance in which the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan, exceeds 15 percent (for IBR) or 10 percent (for Pay As You Earn) of the difference between your adjusted gross income (AGI) and 150 percent of the poverty line for your family size in the

What are the 4 types of college loans?

Federal student loans are issued by the federal government and offer benefits such as fixed interest rates and income-driven and flexible payment plans. There are four types of federal student loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans and Direct Consolidation Loans.

What are the 4 types of student loans?

Federal Loans There are four types of Direct Loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans. Direct Subsidized Loans are made to eligible undergraduate students based on financial need. Your school determines the amount you can borrow.

Can foreign students have student loans?

International students have various options for financing their education in the United States, including private student loans and scholarships. The key, of course, is understanding those options and being able to determine which types of financial aid best suit your needs and eligibility.

What is a type 4 student loan?

Older loans (from England or Wales) and loans taken out in Northern Ireland, are called plan 1 loans. Loans taken out in Scotland are called plan 4 loans. There is a newer type of student loan, called plan 5, which includes most loans taken out in England from August 2023 onwards.

Who is eligible for scholarships for disadvantaged students?

Basic Criteria/Eligibility Requirements A U.S. citizen, national, or lawful permanent resident. From a disadvantaged background (economically or educationally, based on HRSA definitions; see below) Demonstrate financial need of at least half the cost of tuition, as indicated on the FAFSA.

What's the difference between subsidized and unsubsidized loans?

The most common types of federal student loans are Direct Loans, Parent PLUS Loans, Graduate PLUS Loans, Stafford Loans, Consolidation Loans, Perkins Loans, and Federal Family Education Loans (FFEL).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan for Disadvantaged Students?

The Loan for Disadvantaged Students is a federal student loan program designed to provide low-interest loans to students from disadvantaged backgrounds who demonstrate financial need.

Who is required to file Loan for Disadvantaged Students?

Students from disadvantaged backgrounds who are enrolled in eligible health profession programs and demonstrate financial need are required to file for the Loan for Disadvantaged Students.

How to fill out Loan for Disadvantaged Students?

To fill out the Loan for Disadvantaged Students application, a student must complete the Free Application for Federal Student Aid (FAFSA) and indicate their interest in the program. Additional institution-specific forms may be required.

What is the purpose of Loan for Disadvantaged Students?

The purpose of the Loan for Disadvantaged Students is to promote access to higher education for students from underrepresented and economically disadvantaged backgrounds by providing them with financial assistance.

What information must be reported on Loan for Disadvantaged Students?

Applicants must report personal and financial information, including income, family size, and educational background, on the FAFSA to determine their eligibility for the Loan for Disadvantaged Students.

Fill out your loan for disadvantaged students online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan For Disadvantaged Students is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.