Get the free ANNUAL AUDITED REPORT PART lil Spicer Jeffries LLP

Show details

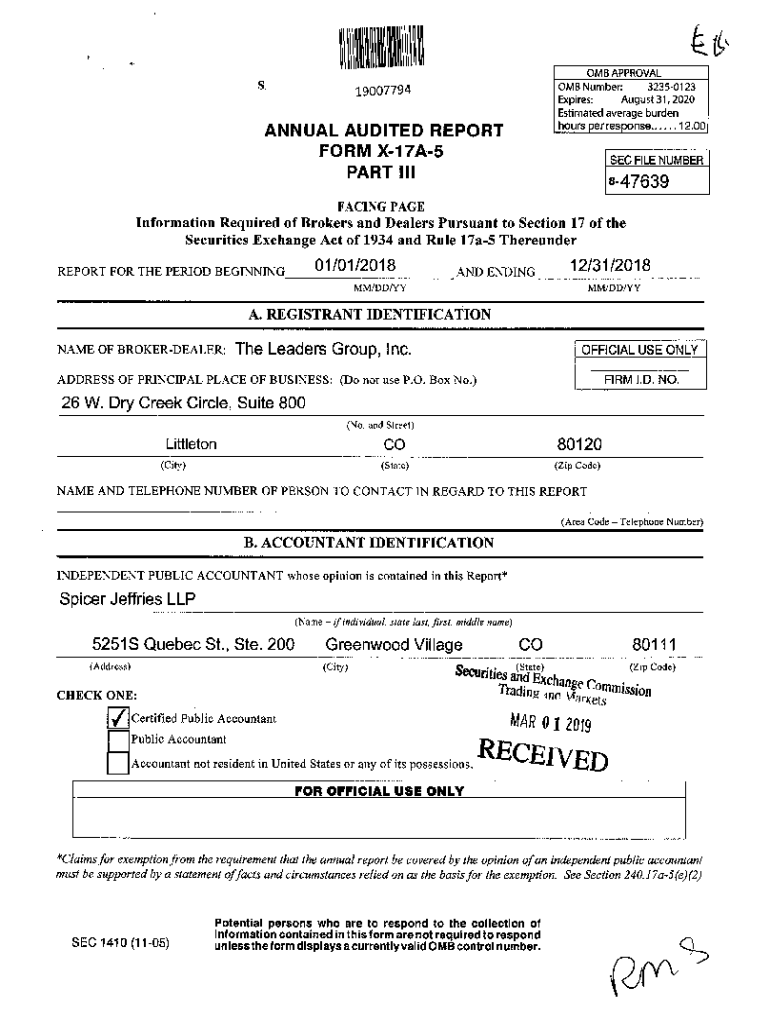

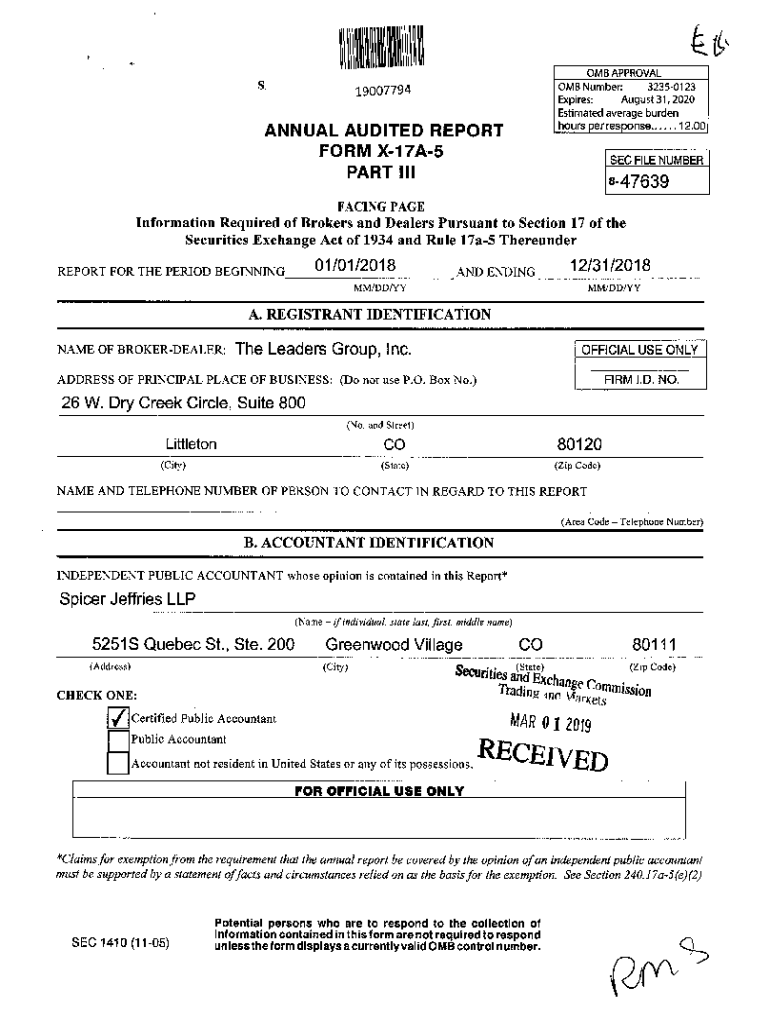

OMB APPROVALS:19007794OMB Number:

32350123

Expires:

August 31, 2020Estimated average burdenANNUAL AUDITED REPORThoursperresponse......12.00FORM X17A5SECFILENUMBERPART lile47639FACING PAGEInformationRequired

of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual audited report part

Edit your annual audited report part form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual audited report part form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual audited report part online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual audited report part. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual audited report part

How to fill out annual audited report part

01

To fill out the annual audited report part, follow these steps:

02

Start by gathering all the necessary financial documentation, such as income statements, balance sheets, and cash flow statements.

03

Review the previous year's audited report to understand the format and information required.

04

Begin with the basic information section, including the name of the company, fiscal year-end date, and any major events or changes during the reporting period.

05

Move on to the financial statements section and fill out the income statement, balance sheet, and cash flow statement in a detailed and accurate manner.

06

Provide supporting schedules and notes to the financial statements, explaining any significant accounting policies, methodologies, or assumptions used.

07

Include any additional required schedules or disclosures specific to your industry or regulatory requirements.

08

Ensure that all numbers are accurate and that the report is free from material errors or misstatements.

09

Have the report reviewed by internal or external auditors to ensure compliance and accuracy.

10

Make any necessary adjustments or corrections recommended by the auditors.

11

Once all the information is filled out and verified, sign and date the report to authenticate it.

12

Submit the completed annual audited report to the appropriate regulatory authorities or stakeholders as per the designated deadline.

13

Always consult with professionals or accounting experts if you encounter any doubts or complexities during the report preparation process.

Who needs annual audited report part?

01

Various entities and individuals may require the annual audited report part, including:

02

- Shareholders or investors: They need the report to assess the financial health and performance of the company in which they have invested.

03

- Financial institutions: Lenders or banks often request audited reports to evaluate the creditworthiness and financial stability of a business before extending loans or credit.

04

- Regulatory authorities: Government agencies or industry regulators may require audited reports to ensure compliance with accounting and financial reporting standards.

05

- Potential buyers or partners: When a company is looking for a buyer or considering a merger or partnership, the interested parties may request audited reports to evaluate the financial standing and potential risks associated with the transaction.

06

- Tax authorities: Audited reports provide a reliable source of financial information for tax filing and verification purposes.

07

- Internal management: Companies utilize audited reports to assess their own performance, identify areas of improvement, and make strategic decisions based on accurate financial data.

08

It is crucial to understand the specific requirements and regulations of each entity or individual requesting the annual audited report part, as they may vary depending on the circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit annual audited report part from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your annual audited report part into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send annual audited report part to be eSigned by others?

When you're ready to share your annual audited report part, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute annual audited report part online?

pdfFiller has made it easy to fill out and sign annual audited report part. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is annual audited report part?

The annual audited report part is a comprehensive financial report that includes the audited financial statements of an organization, providing a clear picture of its financial position and performance over the fiscal year.

Who is required to file annual audited report part?

Typically, publicly traded companies, financial institutions, and certain large private entities are required to file an annual audited report part as mandated by regulations.

How to fill out annual audited report part?

To fill out the annual audited report part, organization representatives must gather financial data, ensure accuracy, and follow specific formatting rules set by regulatory authorities, often with the assistance of an external auditor.

What is the purpose of annual audited report part?

The purpose of the annual audited report part is to provide transparency, ensure accountability, and offer stakeholders an accurate depiction of the organization’s financial health, which aids in decision making.

What information must be reported on annual audited report part?

The information typically required includes the balance sheet, income statement, cash flow statement, statement of changes in equity, notes to the financial statements, and the auditor's opinion.

Fill out your annual audited report part online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Audited Report Part is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.