IRS 5227 2020 free printable template

Show details

Form5227SplitInterest Trust Information Return OMB No. 15450196 See separate instructions. Go to www.irs.gov/Form5227 for instructions and the latest information. Do not enter social security numbers

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5227

Edit your IRS 5227 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5227 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 5227 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 5227. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5227 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5227

How to fill out IRS 5227

01

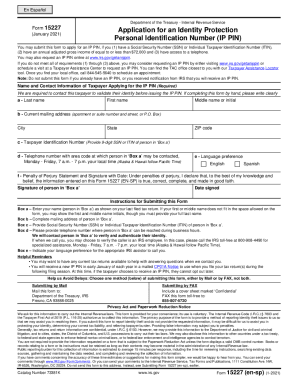

Obtain the IRS Form 5227 from the official IRS website.

02

Provide your name, address, and taxpayer identification number at the top of the form.

03

Fill out Part 1 of the form by selecting the appropriate box for the type of trust (charitable remainder trust, etc.).

04

Complete Part 2, detailing the annual accounting period and distribution amount.

05

In Part 3, report any income generated from the trust and distributions made to beneficiaries.

06

Fill out Part 4 with information regarding any taxes owed by the trust.

07

Sign and date the form where indicated.

08

Submit the completed form to the IRS by the specified deadline.

Who needs IRS 5227?

01

Individuals or entities managing a charitable remainder trust.

02

Trustees of certain types of trusts who must report income and distributions.

03

Taxpayers who need to disclose information about qualified trusts.

Fill

form

: Try Risk Free

People Also Ask about

Does a CRUT need to file a tax return?

Taxes on Income Payments From a Charitable Remainder Trust Payments from a charitable remainder trust are taxable to the non-charitable beneficiaries and must be reported to them on Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions and Credits.

What is the extended due date for charitable remainder trust?

Is a charitable remainder trust required to file an annual return with the IRS or State Governments? Filed with the Internal Revenue Service. This form is due by April 15 and may be extended to July 15 and October 15. IRS Form Schedule K-1, Beneficiary's Share of Income, Deductions, Credits, etc.

What is a 5227 form for?

Use Form 5227 to: Report the financial activities of a split-interest trust. Provide certain information regarding charitable deductions and distributions of or from a split-interest trust. Determine if the trust is treated as a private foundation and subject to certain excise taxes under Chapter 42.

Can I file Form 5227 electronically?

Electronic filing of Form 5227 is available with release 2022-3.1 / 2022.03010 available on 3/19/23. For a type L or P trust, that requires both the 1041 and 5227, you can electronically file the federal 1041 and the state(s) with the federal 1041. You can also electronically file the 5227.

What is due date form 5227?

A calendar year Form 5227 is due by April 15, 20YY. A short-year final return is due by the 15th day of the 4th month following the termination.

What is the extended due date of Form 5227?

For calendar year 2022, file Form 5227 by April 18, 2023. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia – even if you don't live in the District of Columbia. Extension of time to file. Use Form 8868 to request an automatic extension of time to file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS 5227?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the IRS 5227 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit IRS 5227 online?

The editing procedure is simple with pdfFiller. Open your IRS 5227 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the IRS 5227 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your IRS 5227 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is IRS 5227?

IRS Form 5227 is used to report information about a trust that has a tax-exempt status or qualifies for certain tax benefits, allowing the IRS to track the comprehensive distribution of trust income and assets.

Who is required to file IRS 5227?

Trustees of certain types of trusts, such as non-grantor trusts or trusts with tax-exempt status, are required to file IRS Form 5227.

How to fill out IRS 5227?

To fill out IRS Form 5227, the filer must provide details about the trust, including the name, address, Employer Identification Number (EIN) of the trust, income, expenses, distributions, and any applicable deductions as per the instructions provided with the form.

What is the purpose of IRS 5227?

The purpose of IRS Form 5227 is to ensure transparency in the financial activities of trusts and to help the IRS monitor compliance with tax laws and regulations pertaining to tax-exempt trusts.

What information must be reported on IRS 5227?

The IRS Form 5227 must report information such as the name and address of the trust, the EIN, trust income, distributions made, and any relevant expenses and deductions associated with the trust's activities.

Fill out your IRS 5227 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5227 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.