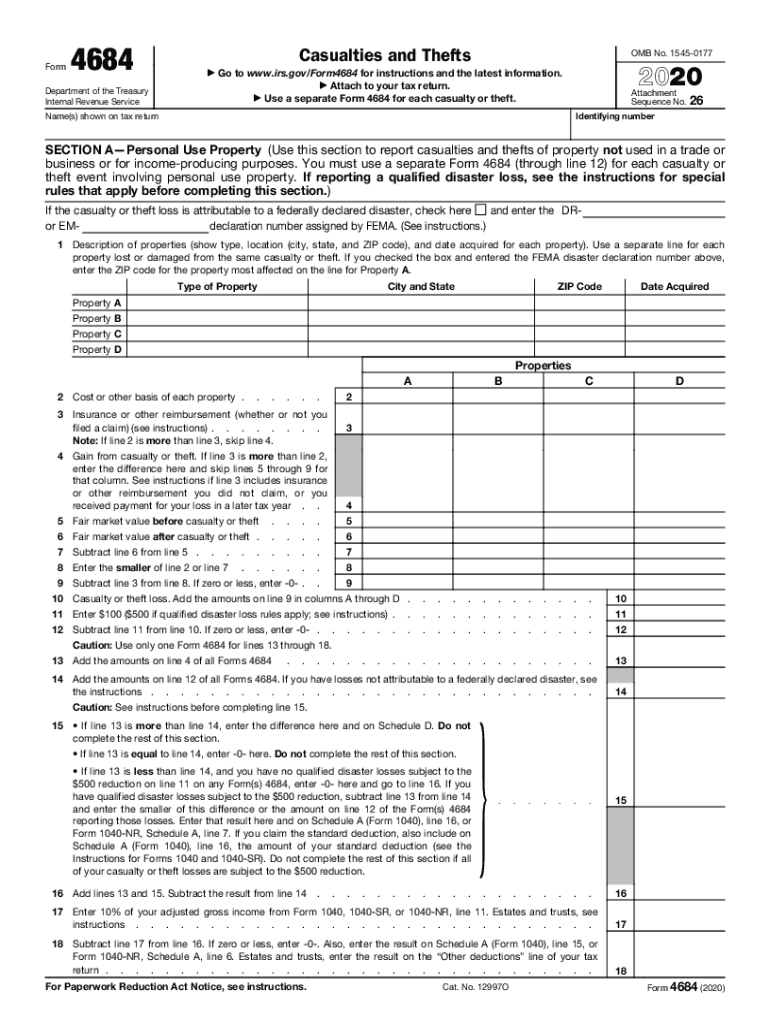

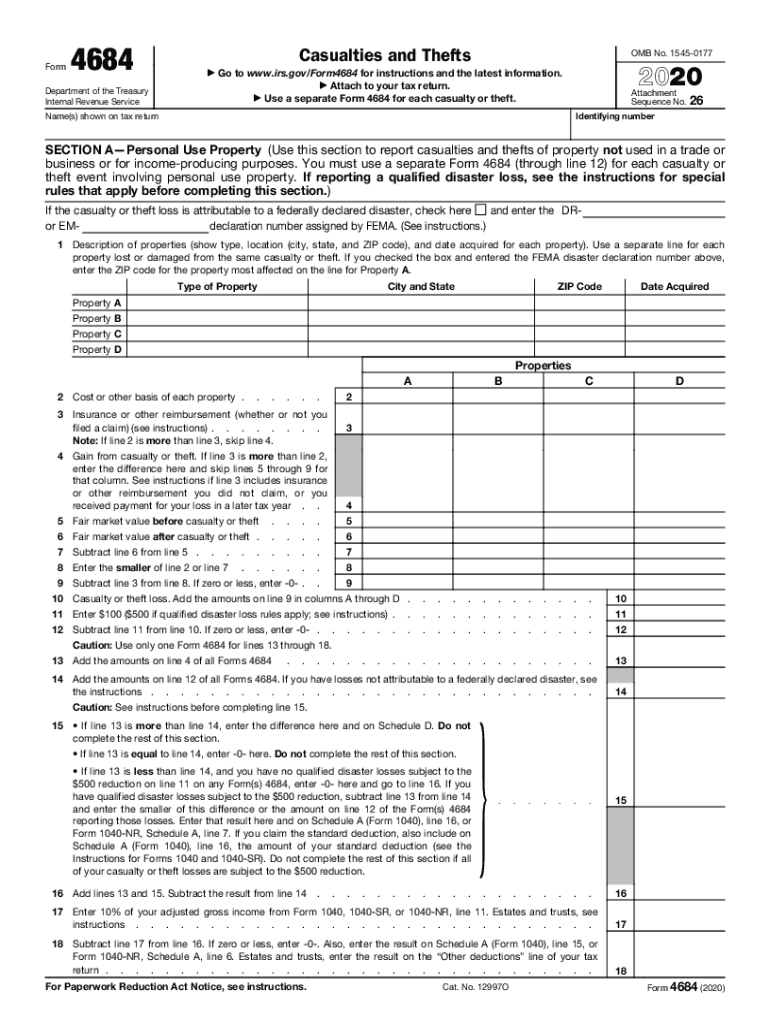

IRS 4684 2020 free printable template

Get, Create, Make and Sign IRS 4684

How to edit IRS 4684 online

Uncompromising security for your PDF editing and eSignature needs

IRS 4684 Form Versions

How to fill out IRS 4684

How to fill out IRS 4684

Who needs IRS 4684?

Instructions and Help about IRS 4684

Its KB double used coffee talk on FM 94 7 and am 1450 and L lets go to Everett Hughes for the insider report good morning Everett, and today we are still inside the Schedule A and were gonna look at another one of the three or four farms that close to the schedule a and you know you've heard if you have a casualty stepped or lost it might be deductible on your tax returns aha have you heard that on just now yes, but I hear about it a lot my during tax season because everybody's heard about it, and they want to know if they can do it well this form it's a form 46 84, and it flows right into line 20 of the schedule a casualty theft were a worksheet and there's two different kinds of casualty losses one is business hmm which is pretty much a hundred percent and the other one is reduced by ten percent of your adjusted gross income minus another hundred dollars and here's what you have to do on the form 46 84 you have to start with a description of the casualty or theft you have to put in when they twin the theft or casualty started then you have to tell what kind of property was it personal or business employment or income producing property you have to check that you have to check all these other categories was they used in a passive activity on and on and on it goes already people are saying well I don't know now if you've had the loss of the personal residence there's a part of this schedule you have to fill out regarding that, and then you have to fill out whether the casualty was repaid by any form of insurance now here's what catches a lot of people they had to count earlier theft home was burned burglarized or whatever they had a 20 thousand dollar loss, and they want to ride out to 20 thousand dollar loss but as you're going through this farm in schedule he finds out that well wait a minute the insurance company reimbursed them 25000 well guess what they don't have a casualty theft or loss because the insurance company reimbursed them but for the casualty theft or loss, but they can't be taxed on that money from it no okay no no you know, but they certainly don't get any additional loss well there are some cases where they might be taxed, but generally there is always exceptions but generally no data stone they're just not able to to to deduct an additional casually theft or loss if they've been reimbursed do you have a police report to women well you know what you're right, and you've got to put the date down on that, and you have to have all of these things done to be able to deduct this casualty theft or loss you've got to have the date you bought at the cost of it the fair market value before the event the fair market value after the event was it a total loss Mr now if it's a personal use was it a collectible yes or no and then all of these different things you have to check, and you know its really true if you've had a casualty theft or loss I don't think you want to do it on Turbo Tax no I don't think so either you might get some...

People Also Ask about

What is a 4684 tax form?

When can you claim casualty losses?

What is an example of a casualty and or theft loss?

What is considered a theft loss for tax purposes?

How is net deductible casualty loss calculated?

How do you prove casualty loss?

How do you calculate disaster loss?

Are personal casualty losses deductible in 2022?

What are qualified disaster distributions?

What is a qualified disaster for Form 4684?

What qualifies as a casualty loss?

What is casualty and/or theft loss?

Do I need to file Form 4684?

What qualifies for a casualty loss deduction?

How do I claim disaster loss on my taxes?

What is an example of a casualty and or theft loss?

What is a net qualified disaster loss?

What does the IRS consider a qualified disaster?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 4684?

How do I execute IRS 4684 online?

How do I fill out the IRS 4684 form on my smartphone?

What is IRS 4684?

Who is required to file IRS 4684?

How to fill out IRS 4684?

What is the purpose of IRS 4684?

What information must be reported on IRS 4684?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.