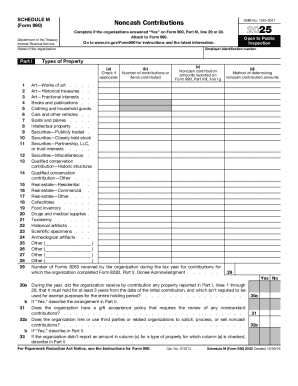

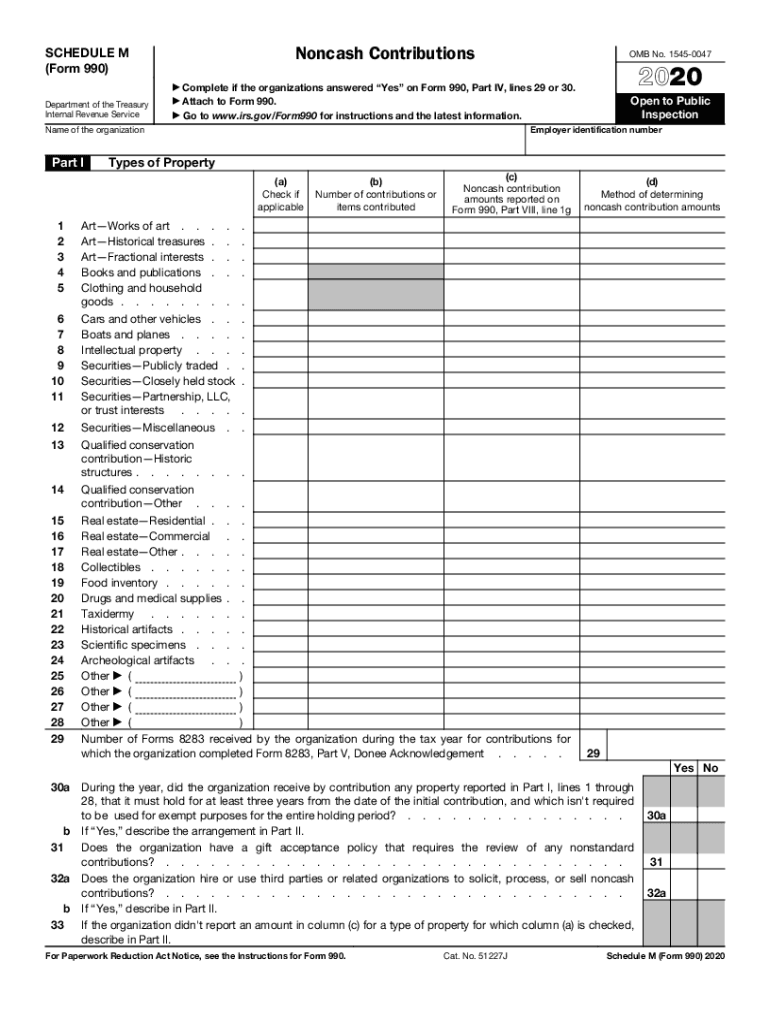

IRS 990 - Schedule M 2020 free printable template

Instructions and Help about IRS 990 - Schedule M

How to edit IRS 990 - Schedule M

How to fill out IRS 990 - Schedule M

About IRS 990 - Schedule M 2020 previous version

What is IRS 990 - Schedule M?

Who needs the form?

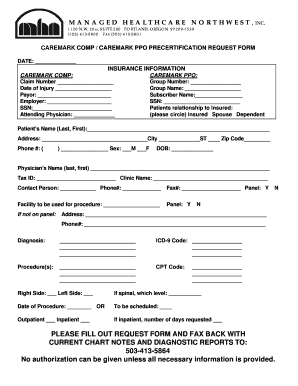

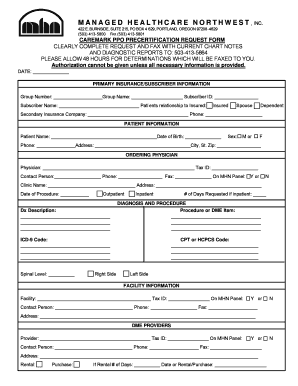

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule M

What should I do if I need to correct a mistake on my IRS Schedule M form?

If you've made an error on your IRS Schedule M form, you will need to submit a corrected version of the form. This can typically be done by preparing a new Schedule M and clearly indicating that it is a correction. Ensure that you explain the nature of the mistake in a brief accompanying letter if relevant.

How can I verify the receipt and processing of my IRS Schedule M form submission?

You can check the status of your IRS Schedule M form after submission through the IRS website or by contacting the IRS directly. Make sure to keep a copy of your submitted form as proof, and refer to any tracking number provided in your e-filing confirmation.

What legal considerations should I keep in mind when e-filing the IRS Schedule M form?

When e-filing the IRS Schedule M form, ensure that you meet all necessary legal requirements, including the acceptability of e-signatures. Additionally, be cautious about privacy and data security, as your personal information will be transmitted electronically. Always verify the security measures of the e-filing system you are using.

How do I handle a notice or letter from the IRS regarding my Schedule M form?

If you receive a notice or letter from the IRS related to your Schedule M form, carefully read the content to understand the issue. Prepare any necessary documentation to respond, and if required, contact the IRS for clarification or to resolve any outstanding questions promptly.

Are there common errors associated with the IRS Schedule M form, and how can I avoid them?

Common errors when completing the IRS Schedule M form include incorrect taxpayer identification numbers or misreported figures. To avoid these pitfalls, double-check all your entries against your records and ensure consistent data across your other tax documents or submissions.