Get the free Finance Department Revenue Management Division

Show details

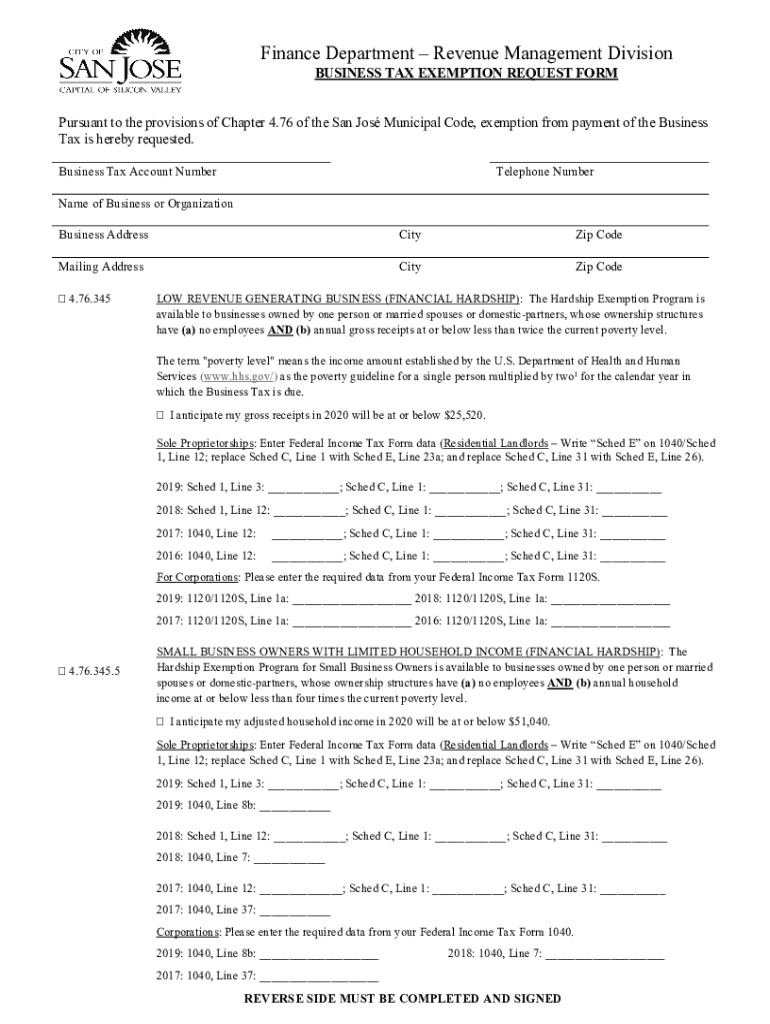

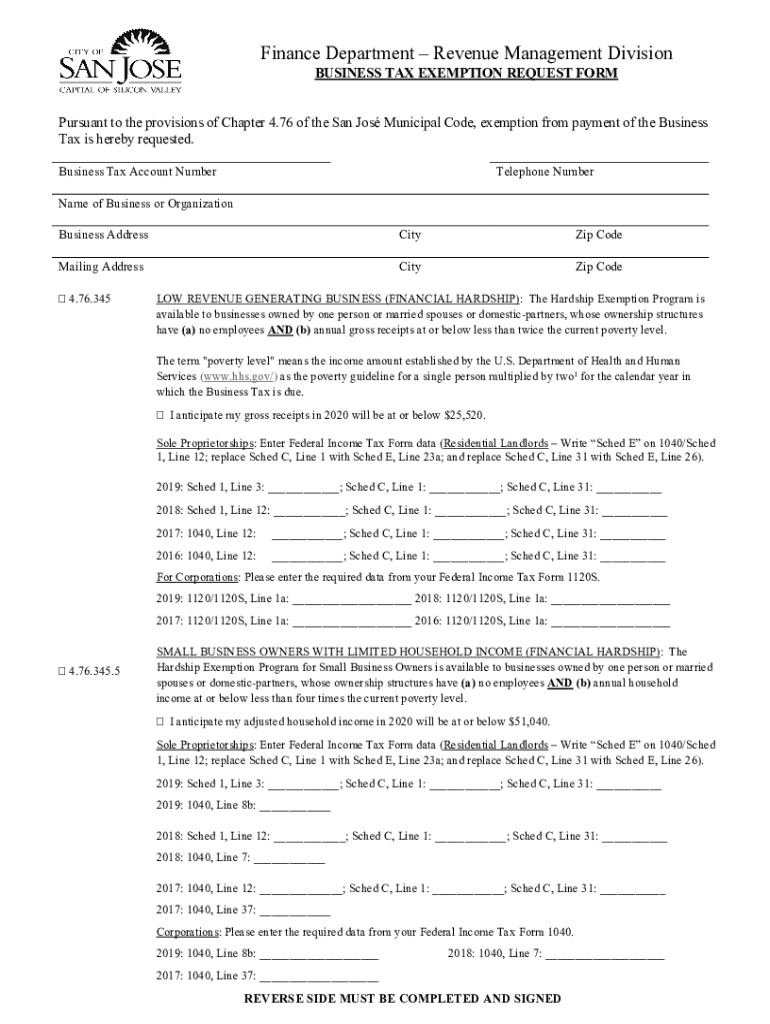

Finance Department Revenue Management Division BUSINESS TAX EXEMPTION REQUEST FORM Pursuant to the provisions of Chapter 4.76 of the San Jo's Municipal Code, exemption from payment of the Business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign finance department revenue management

Edit your finance department revenue management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your finance department revenue management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit finance department revenue management online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit finance department revenue management. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out finance department revenue management

How to fill out finance department revenue management

01

Gather all financial data related to revenue such as sales records, invoices, receipts, and financial statements.

02

Create a revenue management system to track and record all incoming and outgoing revenue.

03

Develop a revenue forecast by analyzing historical data and market trends.

04

Monitor and analyze revenue streams to identify any discrepancies or opportunities for improvement.

05

Implement strategies to increase revenue, such as pricing adjustments, promotions, or cost reduction.

06

Ensure compliance with financial regulations and accounting standards.

07

Regularly review and update revenue management processes to adapt to changing business needs.

08

Generate reports and communicate revenue performance to key stakeholders.

09

Continuously evaluate the effectiveness of revenue management strategies and make adjustments accordingly.

Who needs finance department revenue management?

01

Finance departments of companies of all sizes require revenue management to ensure accurate and efficient handling of financial transactions.

02

Businesses that rely on multiple revenue streams, such as those in the hospitality, retail, or service industries, benefit greatly from revenue management.

03

Start-ups and growing companies need revenue management to establish financial stability and effectively manage cash flow.

04

Investors and stakeholders depend on accurate revenue management to make informed business decisions and assess the financial health of a company.

05

Government agencies and non-profit organizations also require revenue management to effectively manage their finances and allocate resources efficiently.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit finance department revenue management from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including finance department revenue management, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the finance department revenue management electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your finance department revenue management in seconds.

Can I edit finance department revenue management on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share finance department revenue management from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is finance department revenue management?

Finance department revenue management refers to the processes and strategies employed by an organization's finance department to oversee, monitor, and optimize revenue generation, ensuring that income is maximized while costs are controlled.

Who is required to file finance department revenue management?

Organizations that generate revenue, such as corporations, businesses, and non-profits, are typically required to file finance department revenue management reports as part of their financial compliance and reporting obligations.

How to fill out finance department revenue management?

To fill out finance department revenue management, organizations should gather financial data, categorize revenue streams, enter figures accurately into designated templates, and provide relevant explanations or notes as necessary.

What is the purpose of finance department revenue management?

The purpose of finance department revenue management is to ensure accurate tracking of revenue, identify trends, optimize pricing strategies, and enhance overall financial performance to support organizational goals.

What information must be reported on finance department revenue management?

Information that must be reported includes total revenue, revenue by category, cost of goods sold, operating expenses, net profit margins, and any significant changes in revenue streams compared to previous periods.

Fill out your finance department revenue management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Finance Department Revenue Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.