Get the free F Total assets

Show details

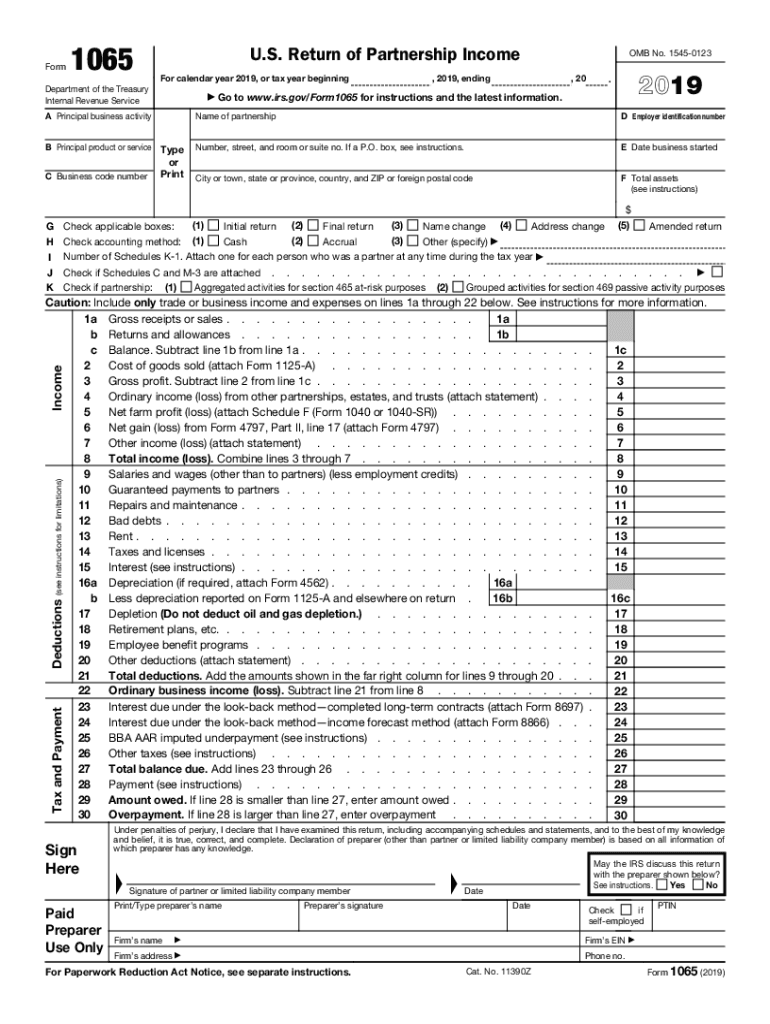

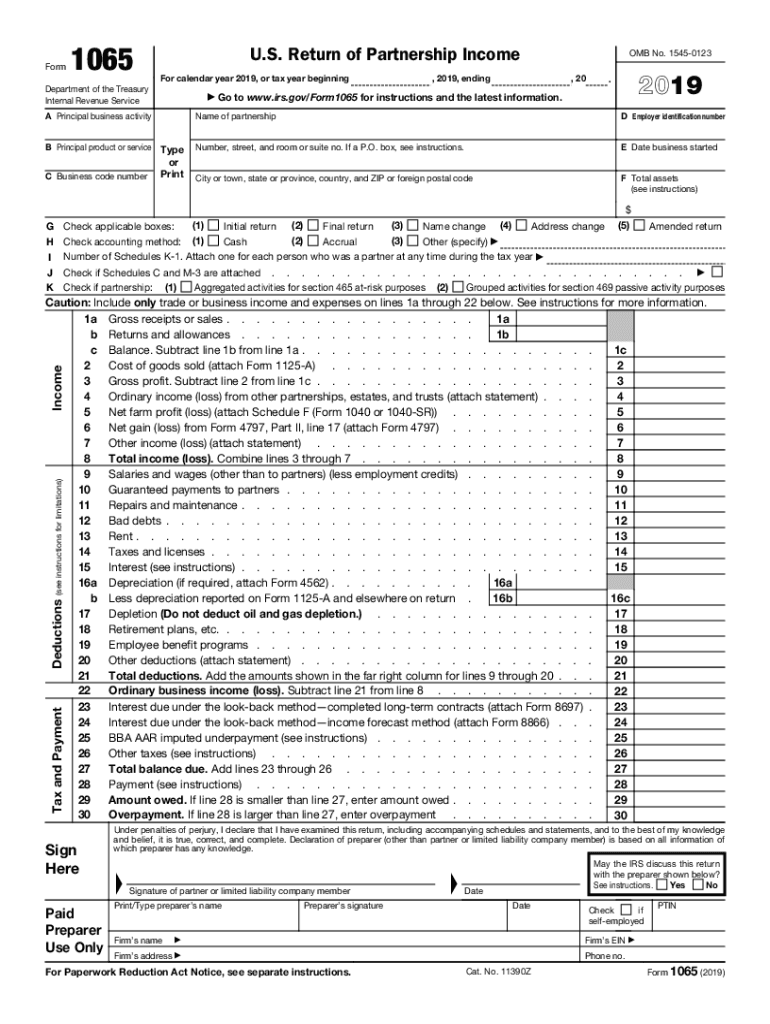

Form1065U. S. Return of Partnership Income

For calendar year 2019, or tax year beginningDepartment of the Treasury

Internal Revenue Service Principal business activity

B Principal product or service

C

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign f total assets

Edit your f total assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your f total assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing f total assets online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit f total assets. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out f total assets

How to fill out f total assets

01

To fill out f total assets, follow these steps:

1. Start by gathering all relevant financial documents, such as bank statements, investment statements, and property deeds.

02

Calculate the value of any cash or cash equivalents you have, such as savings accounts or money market funds.

03

Include the value of any investments, such as stocks, bonds, or mutual funds.

04

Determine the value of any real estate or other property you own. This includes the market value of your primary residence, any additional properties, and any other valuable assets.

05

Add up the value of any vehicles or other valuables you have, such as jewelry or artwork.

06

Subtract any debts or liabilities you have from the total value of your assets. This will give you your net worth.

07

Finally, make sure to update your total assets regularly to reflect any changes in value or new acquisitions.

Who needs f total assets?

01

Filing total assets is necessary for various individuals and organizations, including:

02

- Individuals who want to evaluate their financial health and track their net worth.

03

- Financial institutions and lenders who need to assess an individual's creditworthiness before approving loans or extending credit.

04

- Estate planners and attorneys who need to determine the value of an individual's assets for estate planning or legal purposes.

05

- Insurance companies that require accurate asset valuation for policy underwriting and coverage determination.

06

- Investors and analysts who use total assets as a key metric to assess the financial strength and investment potential of companies.

07

- Government agencies and regulators that track and oversee financial markets and institutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit f total assets online?

The editing procedure is simple with pdfFiller. Open your f total assets in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the f total assets in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your f total assets and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete f total assets on an Android device?

Use the pdfFiller app for Android to finish your f total assets. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is f total assets?

F total assets refers to the total value of all assets owned by an organization, including cash, investments, property, and other physical or intangible assets.

Who is required to file f total assets?

Organizations, businesses, and entities that meet certain financial thresholds or regulatory requirements are typically required to file f total assets.

How to fill out f total assets?

To fill out f total assets, you need to gather financial statements, accurately assess the value of all assets, and input the data into the designated forms or reports required by regulatory authorities.

What is the purpose of f total assets?

The purpose of f total assets is to provide a comprehensive overview of an entity's financial position, which can be used for assessments, audits, and regulatory compliance.

What information must be reported on f total assets?

Information required to be reported on f total assets includes the type of assets, their valuation, and the total amount categorized under different asset classes.

Fill out your f total assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

F Total Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.