Get the free heirship affidavit texas

Show details

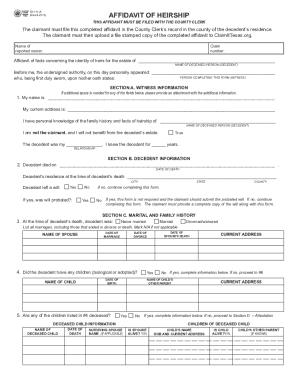

53111A (Rev.520/5)AFFIDAVIT OF HEIRS Hips THIS AFFIDAVIT MUST BE FILED WITH THE COUNTY CLERK. The claimant must file this completed affidavit in the County Clerks record in the county of the decedents'

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign heirship affidavit texas

Edit your heirship affidavit texas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your heirship affidavit texas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing heirship affidavit texas online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit heirship affidavit texas. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out heirship affidavit texas

How to fill out TX 53-111-A

01

Obtain the TX 53-111-A form from the Texas Department of Insurance website or local office.

02

Fill out the required personal information, including your name, address, and contact details.

03

Provide detailed information about the service or support you are requesting.

04

Attach any necessary documentation or evidence to support your request.

05

Review your completed form for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the form via mail, email, or in person, according to the instructions provided.

Who needs TX 53-111-A?

01

Individuals or businesses seeking assistance or authorization from the Texas Department of Insurance.

02

Claimants wanting to report an insurance-related issue or request information.

03

Those needing to apply for specific insurance-related benefits or services in Texas.

Fill

form

: Try Risk Free

People Also Ask about

What happens when you file an affidavit of heirship in Texas?

Affidavit of Heirship for Texas Property. Using a properly recorded Affidavit of Heirship, the Texas property records and the property tax records are updated to transfer the property from the deceased's name to the names of the heirs at law without probate.

How do you get an affidavit of heirship in Texas?

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county. The first page usually costs more than the other pages.

What happens after an affidavit of heirship is filed in Texas?

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so. At that point, the deed most commonly used to transfer the property is a General Warranty Deed.

Can I do my own affidavit of heirship in Texas?

An affidavit of heirship must be signed and sworn to before a notary public by a person who knew the decedent and the decedent's family history. This person can be a friend of the decedent, an old friend of the family, or a neighbor, for example.

Can a heir file a affidavit of heirship Texas?

Who can witness an affidavit of heirship? The person witnessing the affidavit should not be an heir, related to the deceased, or have any interest in the estate.

Who can witness an affidavit of heirship in Texas?

The Affidavit of Heirship can only be effective if it has been taken before a notary public and signed by 2 people that are not beneficiaries of the decedent's estate. Each of the 2 witnesses can be a person who knew the decedent or a family member with no interest in the property.

Who fills out an affidavit of heirship in Texas?

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the “AFFIANT”.

What papers do I file for heirship in Texas?

A loved one or heir of the decedent must file an affidavit of heirship with the county clerk of the counties in which the decedent owned property or resided at the time of death.

What is required for an affidavit of heirship in Texas?

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

How much does it cost to do an heirship in Texas?

The total cost for filing an Administration and Heirship with citations and service fees is $660.00. For more information about the County Clerk's services and fees, please contact the Clerk's office at (817) 579-3222.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find heirship affidavit texas?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific heirship affidavit texas and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in heirship affidavit texas?

With pdfFiller, the editing process is straightforward. Open your heirship affidavit texas in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my heirship affidavit texas in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your heirship affidavit texas and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is TX 53-111-A?

TX 53-111-A is a tax form used in Texas for specific reporting requirements related to franchise tax.

Who is required to file TX 53-111-A?

Entities that meet certain criteria for franchise tax obligations in Texas must file TX 53-111-A.

How to fill out TX 53-111-A?

To fill out TX 53-111-A, follow the instructions provided on the form, ensuring that all required information such as entity details and financial data are accurately completed.

What is the purpose of TX 53-111-A?

The purpose of TX 53-111-A is to report franchise tax information and ensure compliance with state tax regulations.

What information must be reported on TX 53-111-A?

The information required on TX 53-111-A includes the entity's identifying information, revenue, deductions, and any other data pertinent to calculating the franchise tax liability.

Fill out your heirship affidavit texas online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Heirship Affidavit Texas is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.