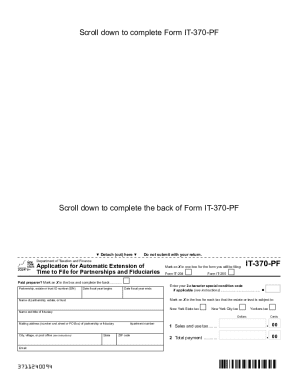

NY DTF IT-370-PF 2019 free printable template

Get, Create, Make and Sign NY DTF IT-370-PF

Editing NY DTF IT-370-PF online

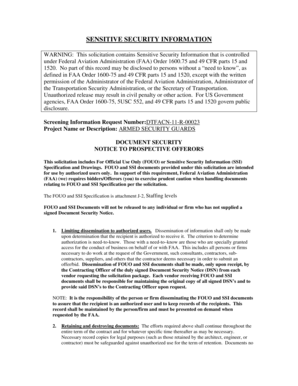

Uncompromising security for your PDF editing and eSignature needs

NY DTF IT-370-PF Form Versions

How to fill out NY DTF IT-370-PF

How to fill out NY DTF IT-370-PF

Who needs NY DTF IT-370-PF?

Instructions and Help about NY DTF IT-370-PF

Welcome, everyone. This is Dr. Super And today we will be going through our first lecture for our database class. I need to operate under the assumption that not everyone in the class has had experience with databases in the past. And so this first lecture is intended to bring everyone up to the same basic level of understanding with respect to several important database concepts. We have several objectives, which we will seek to achieve in this lecture. These are listed on the screen right now. First, we want to try to understand why storing data in a list is not necessarily a very good idea. It can cause many types of problems. Second, we want to see if we can gain some insight into why an organization might want to use a database. Third, we will see how the notion of related tables of data, which forms a core part of the relational database model, provides a basis for eliminating many of the problems which are associated with storing data in a list. We'll also explore the various components and elements that comprise a database or a database system. And we will learn about the purpose of something that we call a DBMS, a database management system. And along the way, we're going to explore some of the functions that a robust database application can provide to us. What, then, is the purpose of a database? Well, it's important to remember that a database does not have just a single purpose. Instead, there are several key advantages that databases provide. First, a database provides a repository for storing data. That's kind of implicit in the name. Database implies that we have a place to store data. However, what might not be so obvious is that databases provide an organizational structure for data. That is, we don't just have a place to store data, but the database also provides an organized structure into which those data can be placed. Finally, a database provides us with a mechanism for interacting with our data. Now, interacting with data can generally be described in four different operations. Here they're listed as querying, creating, modifying, and deleting data. But there's another more interesting acronym, which may help you to remember this. And that acronym is CRUD, C-R-U-D. This stands for create, read, update, and delete. These are the four basic operations that we can use when interacting with data. A key point to remember here is that, in business, there are many natural, hierarchical relationships among data. For example, a customer can place many orders. Another way of saying that is many orders can be associated with the same customer. Or another example is a department can have many employees, but a given employee might work in one, and only one, department. So these are hierarchical relationships among the data. And a relational database allows us to model and represent these relationships. Let's take a look at a list of data. What I mean by a list here is a simple, two-dimensional table of data. And in this table, we...

People Also Ask about

How much does it cost to extend taxes?

What happens if you miss IRS deadline 2022?

Can you still file 2022 taxes after deadline?

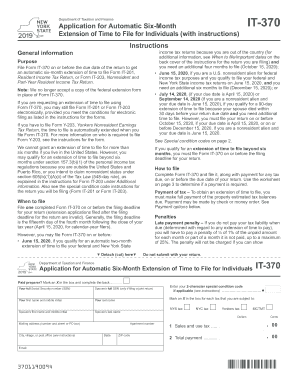

What is form it-370 PF?

What happens if you miss the tax deadline 2022?

Will the IRS extend the tax deadline again for 2022?

Do I need to file NY state extension?

What is an IT-370?

Is New York extension automatic?

How do I file an extension in New York?

Does NY accept NYS extension?

Do I need to file a NYS extension?

Do you have to pay taxes when you file an extension?

Is it necessary to file an extension for taxes?

Do I need to file a NY state extension?

What is the extended tax deadline for 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY DTF IT-370-PF?

How do I edit NY DTF IT-370-PF in Chrome?

Can I create an electronic signature for signing my NY DTF IT-370-PF in Gmail?

What is NY DTF IT-370-PF?

Who is required to file NY DTF IT-370-PF?

How to fill out NY DTF IT-370-PF?

What is the purpose of NY DTF IT-370-PF?

What information must be reported on NY DTF IT-370-PF?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.