Get the free Multi-Family Tax Exemption

Show details

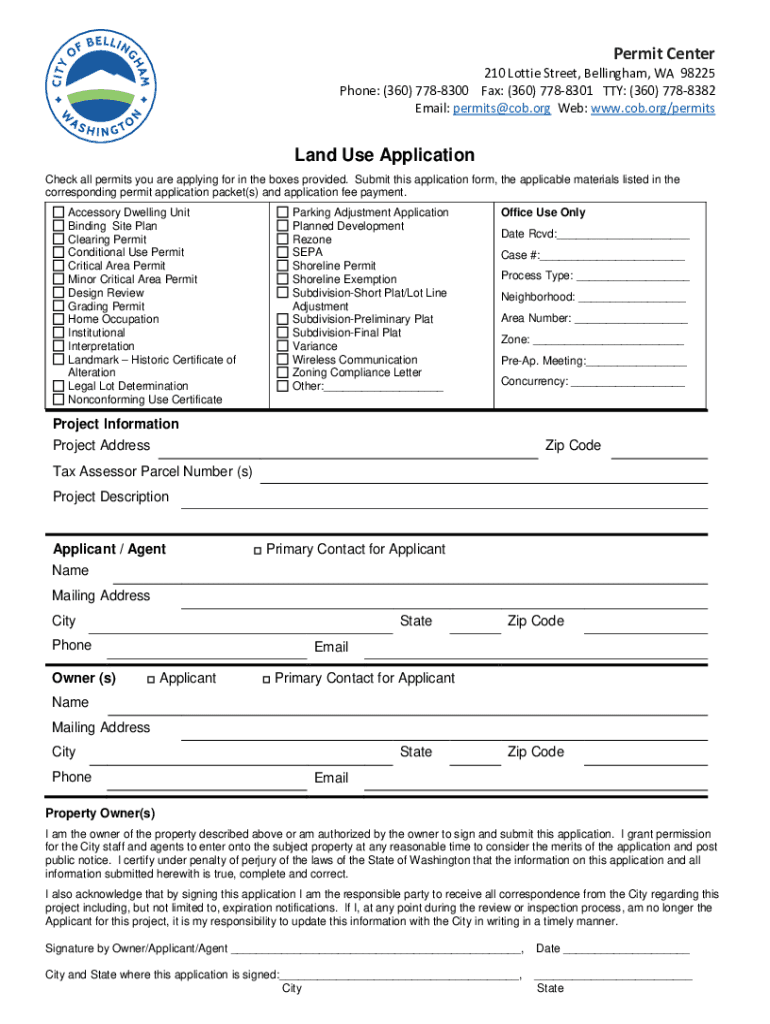

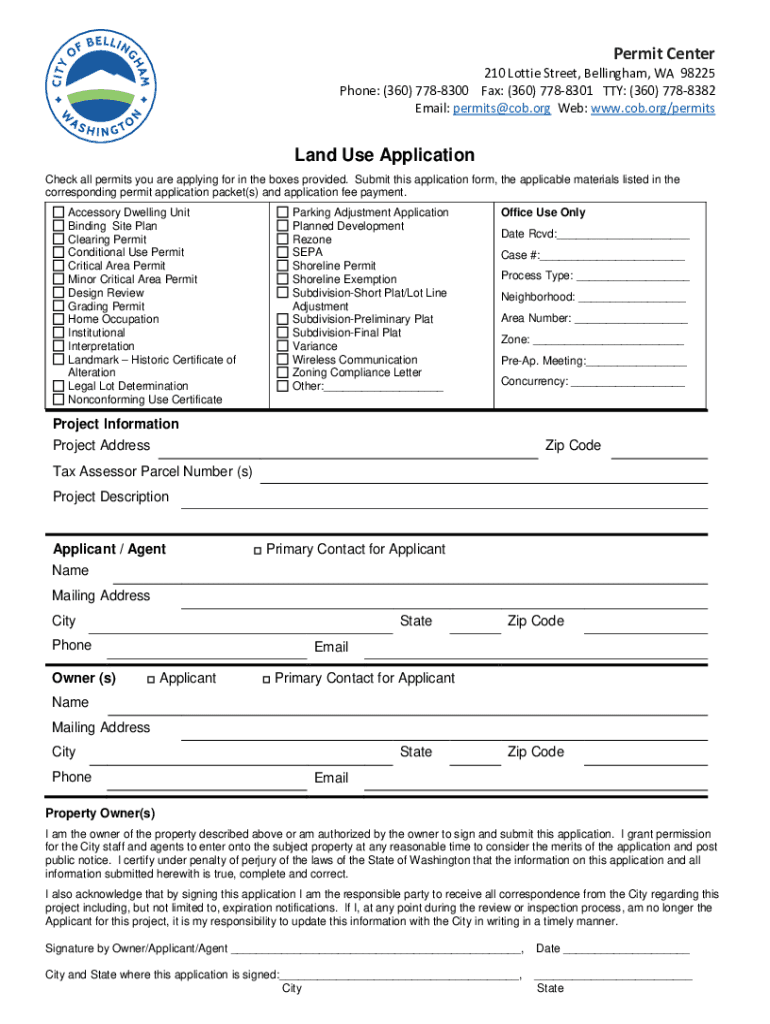

Permit Center210 Lottie Street, Bellingham, WA 98225

Phone: (360) 7788300 Fax: (360) 7788301 TTY: (360) 7788382

Email: permits@cob.org Web: www.cob.org/permitsLand Use Application

Check all permits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign multi-family tax exemption

Edit your multi-family tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multi-family tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing multi-family tax exemption online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit multi-family tax exemption. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out multi-family tax exemption

How to fill out multi-family tax exemption

01

To fill out a multi-family tax exemption, follow these steps:

02

Obtain the necessary application form from your local tax authority.

03

Read the instructions carefully and gather all the required documents, such as property ownership proof, income statements, and tenant information.

04

Fill out the application form accurately, providing all the requested information.

05

Attach the required documents to the application form.

06

Double-check all the information and documents before submitting the application.

07

Submit the completed application form and documents to the designated tax authority office or online portal, as instructed.

08

Keep copies of the application and supporting documents for your records.

09

Wait for the tax authority to review your application and make a decision.

10

If approved, you may be eligible for a multi-family tax exemption, which can result in reduced property taxes for qualifying multi-family properties.

11

Make sure to comply with any ongoing reporting or renewal requirements to maintain the tax exemption status.

12

Note: The exact process and requirements may vary depending on the jurisdiction. It is advisable to consult with your local tax authority or seek professional assistance for specific guidance.

Who needs multi-family tax exemption?

01

Multi-family tax exemption is typically needed by individuals or organizations who own or manage multi-family properties, such as apartment buildings or condominium complexes.

02

These individuals or organizations may seek a multi-family tax exemption to obtain property tax relief for their qualifying multi-family properties.

03

The specific eligibility criteria and requirements for multi-family tax exemption vary by jurisdiction, but they generally aim to support affordable housing initiatives and incentivize the development or preservation of rental housing units.

04

Owners or managers of multi-family properties who meet the necessary eligibility criteria may apply for a multi-family tax exemption to potentially reduce their property tax burden and make their rental units more affordable to tenants.

05

It is important to consult with your local tax authority or research the applicable regulations to determine if you qualify for a multi-family tax exemption in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in multi-family tax exemption without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit multi-family tax exemption and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit multi-family tax exemption on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign multi-family tax exemption. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete multi-family tax exemption on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your multi-family tax exemption. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is multi-family tax exemption?

The multi-family tax exemption is a program that provides property tax reductions for multi-family housing developments, aimed at encouraging affordable housing.

Who is required to file multi-family tax exemption?

Property owners or developers of multi-family housing units that wish to benefit from the tax exemption are required to file for the multi-family tax exemption.

How to fill out multi-family tax exemption?

To fill out the multi-family tax exemption form, applicants need to complete the required sections of the application, including property information, ownership details, and supporting documentation related to the property.

What is the purpose of multi-family tax exemption?

The purpose of the multi-family tax exemption is to reduce financial burdens on property owners and encourage the development and maintenance of affordable housing options for residents.

What information must be reported on multi-family tax exemption?

Applicants must report information such as property location, ownership details, the number of units, type of housing, and any relevant income or rental data.

Fill out your multi-family tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multi-Family Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.