Get the Group Tax-Free Savings Account (TFSA) - Desjardins Life Insurance

Show details

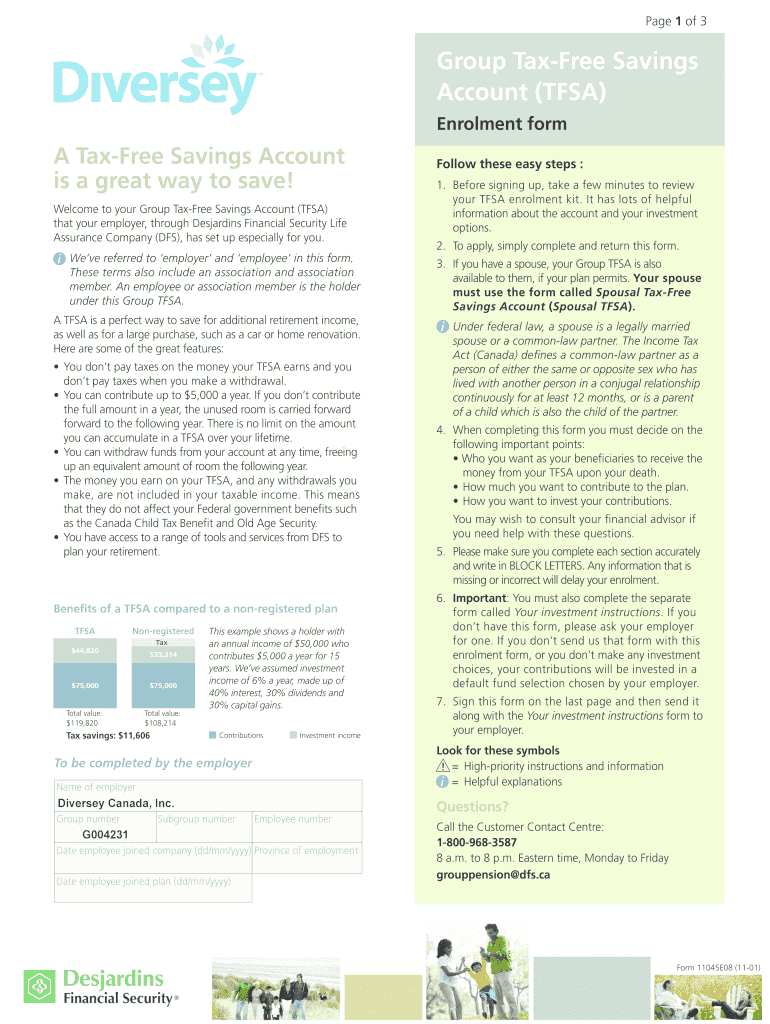

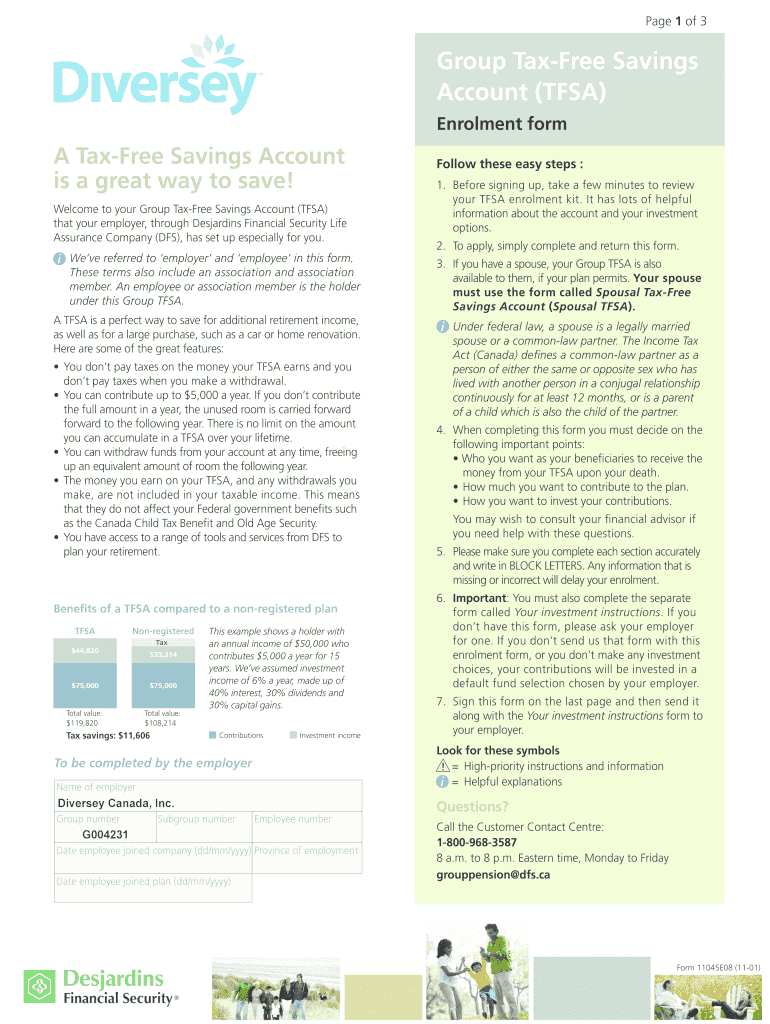

Page 1 of 3 Group Tax-Free Savings Account (FSA) Enrollment form A Tax-Free Savings Account is a great way to save! Welcome to your Group Tax-Free Savings Account (FSA) that your employer, through

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group tax- savings account

Edit your group tax- savings account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group tax- savings account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group tax- savings account online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit group tax- savings account. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group tax- savings account

How to Fill Out Group Tax-Savings Account:

01

Obtain the necessary forms: Begin by obtaining the required forms for opening a group tax-savings account. These forms can typically be found on the website of your financial institution or obtained directly from a representative.

02

Provide necessary information: Fill in the required information on the application form. This typically includes personal details such as your name, address, contact information, and social security number. Ensure that all the information provided is accurate and up to date.

03

Choose the appropriate account type: There may be different types of group tax-savings accounts available, such as traditional IRAs or 401(k) plans. Select the account type that best aligns with your financial goals and needs. Consider factors such as contribution limits, tax advantages, and withdrawal restrictions.

04

Determine the contribution amount: Decide on how much you want to contribute to your group tax-savings account. Take into account your financial situation, long-term goals, and any applicable contribution limits set by the government. Be aware of any employer matching contributions, if available, that could further boost your savings.

05

Set up automatic contributions: To ensure consistent savings, consider setting up automatic contributions to your group tax-savings account. This can be done by linking your bank account or paycheck directly to the account. By automating your contributions, you can avoid the temptation to spend the money elsewhere and steadily grow your savings.

06

Review and sign the documents: Review all the information provided on the forms for accuracy and completeness. Make sure you understand the terms and conditions, contribution rules, and any potential fees. Once you are satisfied, sign the necessary documents to finalize the account opening process.

Who Needs a Group Tax-Savings Account?

01

Small business owners: Small businesses often establish group tax-savings accounts, such as Simplified Employee Pension (SEP) IRAs or SIMPLE IRAs, to provide retirement benefits to their employees. This allows the employees to save for their future while providing tax advantages for the employer.

02

Employees seeking tax advantages: Individuals who want to maximize their tax savings and take advantage of retirement account contributions may opt for a group tax-savings account. These accounts can provide tax deductions or tax-free growth, depending on the account type and contribution method.

03

Individuals with financial goals: Anyone with long-term financial goals, such as saving for retirement or a down payment on a home, can benefit from a group tax-savings account. These accounts provide an opportunity to save and invest money in a tax-advantaged manner, allowing individuals to grow their savings more effectively.

04

Savers looking for employer contributions: Some employers offer matching contributions to employees' group tax-savings accounts, such as 401(k) plans. This means that for every dollar you contribute, your employer may contribute a certain amount as well. This can significantly boost your savings and provide an additional incentive to open a group tax-savings account.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my group tax- savings account directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your group tax- savings account and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete group tax- savings account online?

Filling out and eSigning group tax- savings account is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the group tax- savings account electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your group tax- savings account and you'll be done in minutes.

What is group tax- savings account?

Group tax-savings account is a type of savings account that allows multiple individuals to contribute funds for tax-saving purposes.

Who is required to file group tax- savings account?

Any group of individuals who wish to save taxes collectively can file a group tax-savings account.

How to fill out group tax- savings account?

To fill out a group tax-savings account, all members of the group must agree on the contribution amounts and designate a primary account holder.

What is the purpose of group tax- savings account?

The purpose of group tax-savings account is to provide a collective platform for individuals to save taxes by pooling their resources.

What information must be reported on group tax- savings account?

The group tax-savings account must include the names and contribution amounts of all members, as well as details of any tax benefits received.

Fill out your group tax- savings account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Tax- Savings Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.