Get the free Confirmation of deductible RRSP contributions

Show details

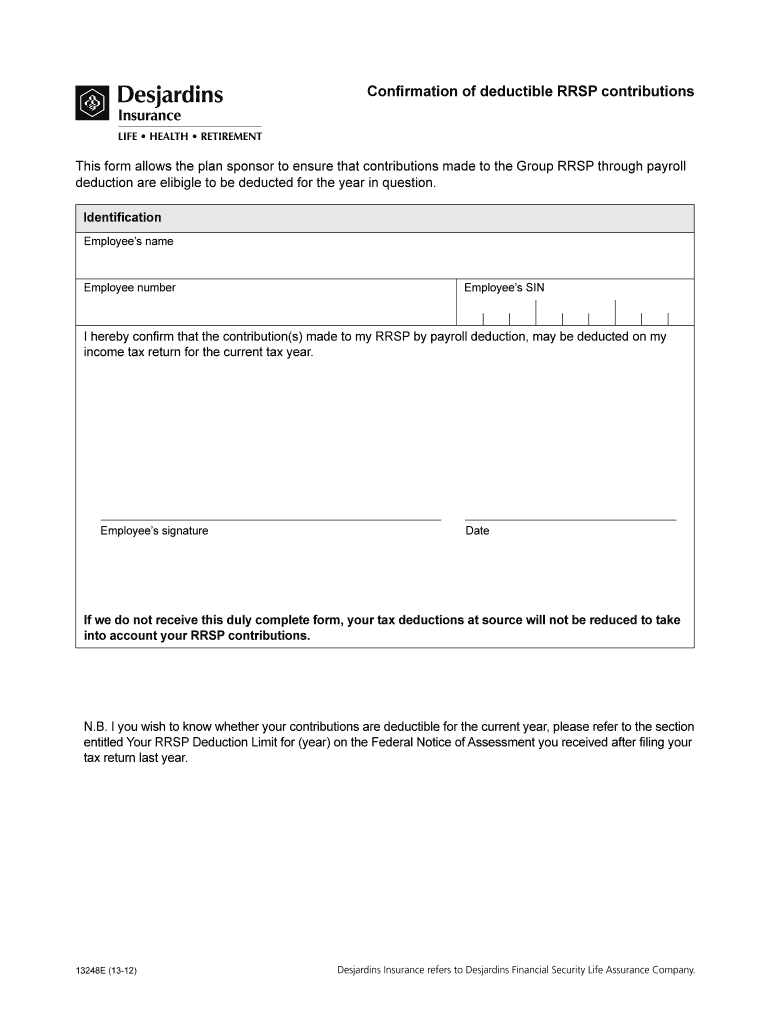

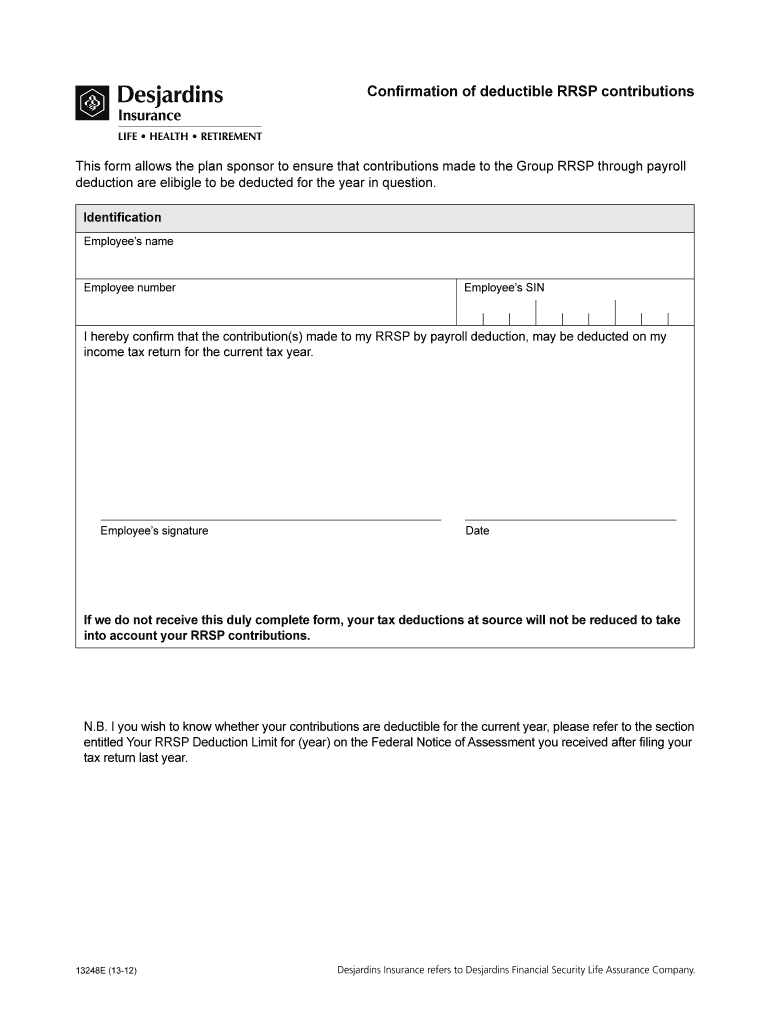

Confirmation of deductible RESP contributions This form allows the plan sponsor to ensure that contributions made to the Group RESP through payroll deduction are eligible to be deducted for the year

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign confirmation of deductible rrsp

Edit your confirmation of deductible rrsp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your confirmation of deductible rrsp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing confirmation of deductible rrsp online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit confirmation of deductible rrsp. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out confirmation of deductible rrsp

How to Fill Out Confirmation of Deductible RRSP:

01

Obtain the necessary form: Start by acquiring the form for the confirmation of deductible RRSP from the appropriate financial institution or government agency. This form may also be available online for download.

02

Provide personal information: Begin by filling out the personal information section of the form. This typically includes your full name, address, social insurance number, and contact information. Make sure to write legibly and double-check the accuracy of the information provided.

03

Report RRSP contributions: Indicate the amount of RRSP contributions made during the tax year for which you are claiming deductions. This amount should include the total contributions made by both you and your spouse, if applicable. You may need to refer to your RRSP statements or receipts to accurately report the contributions made.

04

Declare contribution period: Specify the contribution period to which the reported contributions belong. Typically, this will be the tax year for which you are filing your taxes. Ensure the dates provided are within the correct tax year as per the guidelines set by the tax authorities.

05

Declare outstanding contributions: If any RRSP contributions were made within the first 60 days of the following tax year, you need to report them as outstanding contributions. Specify the amount and the contribution period to which they belong. Note that these contributions may be eligible for deductions in the current or subsequent tax years.

Who needs confirmation of deductible RRSP?

01

Individuals contributing to an RRSP: Anyone who has made contributions to a Registered Retirement Savings Plan (RRSP) during the tax year may need a confirmation of deductible RRSP. This includes both salaried employees and self-employed individuals.

02

Individuals claiming deductions: Individuals who intend to claim deductions for their RRSP contributions on their annual tax return will require a confirmation of deductible RRSP. This document serves as evidence of the contributions made and the deductions being claimed.

03

Taxpayers subject to audit or review: Taxpayers who are more likely to face a tax audit or review by the tax authorities may need to provide a confirmation of deductible RRSP. This helps support the legitimacy of their deductions and ensures compliance with tax regulations.

04

Individuals applying for financial assistance: Some financial assistance programs or loans may require applicants to provide evidence of their RRSP contributions and deductions. In such cases, a confirmation of deductible RRSP can serve as proof of the contributions made.

05

Anyone seeking to track RRSP contributions: Even if you do not currently need a confirmation of deductible RRSP, it is generally a good practice to keep track of your RRSP contributions and deductions. This ensures accurate reporting and simplifies the process of claiming deductions in future tax years.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit confirmation of deductible rrsp in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your confirmation of deductible rrsp, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit confirmation of deductible rrsp straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing confirmation of deductible rrsp, you can start right away.

How can I fill out confirmation of deductible rrsp on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your confirmation of deductible rrsp. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is confirmation of deductible rrsp?

Confirmation of Deductible RRSP is a form that verifies the contributions made to a Registered Retirement Savings Plan (RRSP) and allows individuals to claim a tax deduction for those contributions.

Who is required to file confirmation of deductible rrsp?

Individuals who have made contributions to their RRSP account and wish to claim a tax deduction for those contributions are required to file Confirmation of Deductible RRSP.

How to fill out confirmation of deductible rrsp?

To fill out Confirmation of Deductible RRSP, individuals must provide their personal information, details of the RRSP contributions made, and any unused contribution room from previous years.

What is the purpose of confirmation of deductible rrsp?

The purpose of Confirmation of Deductible RRSP is to allow individuals to claim a tax deduction for the contributions they have made to their RRSP account, thereby reducing their taxable income.

What information must be reported on confirmation of deductible rrsp?

Information such as the individual's name, social insurance number, RRSP contribution amount, and any unused contribution room from previous years must be reported on Confirmation of Deductible RRSP.

Fill out your confirmation of deductible rrsp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Confirmation Of Deductible Rrsp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.