Get the free LCFS Credit Transfer Form_10282011-v1 - arb ca

Show details

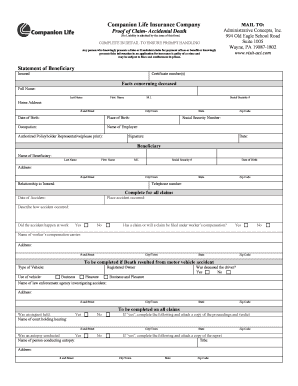

The LCFS Credit Transfer Form is utilized by the Air Resources Board to track and initiate the transfer of LCFS credits between sellers and buyers. It must be submitted for each credit transfer agreement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lcfs credit transfer form_10282011-v1

Edit your lcfs credit transfer form_10282011-v1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lcfs credit transfer form_10282011-v1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

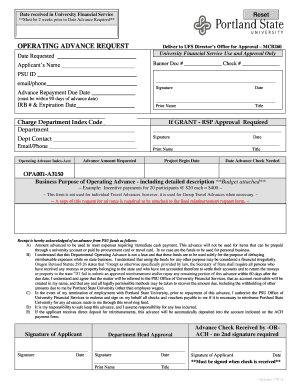

Editing lcfs credit transfer form_10282011-v1 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lcfs credit transfer form_10282011-v1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lcfs credit transfer form_10282011-v1

How to fill out LCFS Credit Transfer Form_10282011-v1

01

Obtain the LCFS Credit Transfer Form_10282011-v1 from the appropriate regulatory body.

02

Fill out the date at the top of the form.

03

Provide the name and contact information of the seller in the designated fields.

04

Enter the name and contact information of the buyer.

05

Fill in the credit transfer details, including the number of credits being transferred.

06

Include the relevant project or program name associated with the credits.

07

Sign and date the form to certify the accuracy of the information provided.

08

Submit the completed form to the designated authority as per the instructions.

Who needs LCFS Credit Transfer Form_10282011-v1?

01

Entities involved in the Low Carbon Fuel Standard (LCFS) program who are seeking to transfer credits.

02

Organizations that produce low carbon fuels.

03

Companies needing to meet LCFS compliance requirements.

Fill

form

: Try Risk Free

People Also Ask about

How much are LCFS prices over time?

Longer-term trends: For 2024 year-to-date, LCFS credit prices have averaged $59/MT, reaching an annual high of $68.75/MT on March 12th and a low of $41.50/MT on May 16th. The annual average credit price for 2023 was $73/MT. The maximum allowable credit price for June 1, 2024 through May 31, 2025 is $261.52.

What is an LCFS credit?

A low carbon fuel standard (LCFS) is an energy rebate program that offers credit-based incentives for the use of electric and low-carbon vehicles. This opens the door to additional revenue for EV fleet owners.

What is the price of LCFS credits?

Visible chart range: 12.4.2024 - 12.4.2025 NameChangeLast California LCFS Carbon Credit (USD/ton) -4.16% 59.90

How much is LCFS credits per kWh?

Over the past two years, the credits have hovered between $130-$210 per metric ton. EV Credit Generation Example: At the 2021 average price of $177 per metric ton, the effective value of the LCFS credit is currently $. 24 per kWh for grid-average electricity or $. 29 per kWh for zero-carbon electricity.

Can you sell LCFS credits?

The LCFS incentivizes use of electricity and hydrogen as low carbon transportation fuels by providing several opportunities to generate LCFS credits. These credits can be traded in the California LCFS credit market.

How much are LCFS credits worth?

Once valued at the maximum allowable credit price of $200/t CO2e USD (inflation adjusted), the California Low Carbon Fuel Standard (LCFS) price has been on a steady decline since 2021, and is currently valued at around $60/t CO2e (Figure 1).

Who pays for LCFS credits?

All of the state's utilities contribute LCFS credit revenue to fund the program, with the IOUs contributing 67 percent of their LCFS credit revenue. The California Clean Fuel Reward program takes the place of PG&E's, SCE's, and SDG&E's other on-bill credit and rebate programs, which they began offering in 2016.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LCFS Credit Transfer Form_10282011-v1?

The LCFS Credit Transfer Form_10282011-v1 is a document used for reporting and transferring credits under the Low Carbon Fuel Standard (LCFS) program, which aims to lower greenhouse gas emissions from transportation fuels.

Who is required to file LCFS Credit Transfer Form_10282011-v1?

Entities that generate or utilize LCFS credits, such as fuel producers, importers, or regulated parties, are required to file the LCFS Credit Transfer Form_10282011-v1.

How to fill out LCFS Credit Transfer Form_10282011-v1?

To fill out the LCFS Credit Transfer Form_10282011-v1, individuals or entities must provide relevant details including their LCFS credit account information, the amount of credits being transferred, and signatures as required by the form's instructions.

What is the purpose of LCFS Credit Transfer Form_10282011-v1?

The purpose of the LCFS Credit Transfer Form_10282011-v1 is to facilitate the accurate tracking and transfer of LCFS credits between parties, ensuring compliance with the LCFS regulations.

What information must be reported on LCFS Credit Transfer Form_10282011-v1?

The information that must be reported includes the parties involved in the transfer, the number of credits being transferred, the date of the transaction, and any necessary identification numbers associated with the credits.

Fill out your lcfs credit transfer form_10282011-v1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lcfs Credit Transfer Form_10282011-v1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.