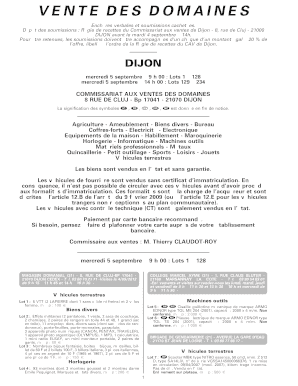

Get the free IRA Transfer Form - Matrix Advisors Value Fund

Show details

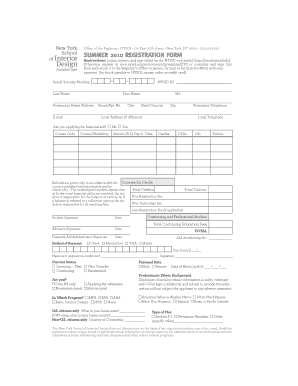

Matrix Advisors Value Fund ! IRA Transfer Form If this is for a new IRA Account, an IRA Application must accompany this form. Mail to: Matrix Advisors Value Fund c/o U.S. Ban corp Fund Services, LLC

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira transfer form

Edit your ira transfer form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira transfer form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira transfer form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ira transfer form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira transfer form

How to fill out an IRA transfer form?

01

Gather all necessary information: Before starting the form, make sure you have all the relevant information such as the names and contact information of both your current and new IRA custodians, as well as your account numbers.

02

Complete the personal details: Begin filling out the form by providing your personal information. This typically includes your name, address, Social Security number, and date of birth. Double-check the accuracy of the information before proceeding.

03

Specify the type of transfer: Indicate whether you want to perform a direct transfer or a rollover. A direct transfer involves moving funds from one IRA custodian directly to another, while a rollover implies temporarily withdrawing the funds and then depositing them in a new IRA account within 60 days.

04

Provide current account details: Enter the information about your existing IRA account, including the custodian's name, account number, and type of account (Traditional IRA, Roth IRA, etc.). This step is crucial to ensure the correct account is being transferred.

05

Identify the new IRA custodian: Fill in the information of the new custodian, including their name, address, and account number. Verify that the new custodian accepts the type of IRA you are transferring.

06

Specify the transfer amount: Indicate the amount you wish to transfer from your existing IRA account to the new custodian. Make sure it complies with the IRA contribution limits and any requirements imposed by your new custodian.

07

Choose the investment options: If applicable, select the investment options for your new IRA. This could include stocks, bonds, mutual funds, or other investment vehicles offered by the custodian. Be mindful of any associated fees or restrictions.

08

Review and sign the form: Carefully review all the information provided and make any necessary corrections. After ensuring everything is accurate, sign and date the form. Some custodians may require a witness signature as well.

Who needs an IRA transfer form?

An IRA transfer form is necessary for individuals who want to move their retirement savings from one IRA custodian to another. This could be due to various reasons such as changing custodians, seeking better investment options, or consolidating multiple retirement accounts. It is important to follow the proper procedures and complete the transfer form to ensure a smooth transfer of funds and avoid any potential tax consequences. Always consult with a financial advisor or tax professional for guidance specific to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira transfer form?

The IRA transfer form is a document used to transfer assets from one individual retirement account (IRA) to another.

Who is required to file ira transfer form?

Anyone looking to transfer assets between IRAs is required to file an IRA transfer form.

How to fill out ira transfer form?

To fill out an IRA transfer form, you will need to provide information about the sending and receiving IRA accounts, as well as the assets being transferred.

What is the purpose of ira transfer form?

The purpose of the IRA transfer form is to facilitate the transfer of assets between IRAs, while ensuring proper documentation of the transaction.

What information must be reported on ira transfer form?

The IRA transfer form typically requires information such as account numbers, account holders' names, and details of the assets being transferred.

How can I manage my ira transfer form directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your ira transfer form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit ira transfer form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your ira transfer form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the ira transfer form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ira transfer form in seconds.

Fill out your ira transfer form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Transfer Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.