OH DoT D5 2020 free printable template

Show details

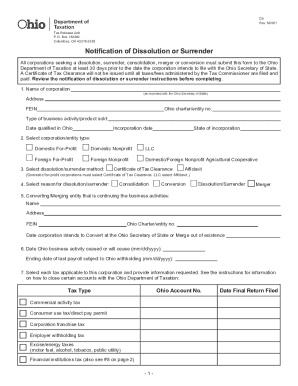

Ohio ID5 Rev. 10/20Depament of Taxation Tax Release Unit P.O. Box 182382 Columbus, OH 432182382Notication of Dissolution or Surrender All corporations seeking a dissolution, surrender, consolidation,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH DoT D5

Edit your OH DoT D5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH DoT D5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH DoT D5 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OH DoT D5. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH DoT D5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH DoT D5

How to fill out OH DoT D5

01

Obtain the OH DoT D5 form from the Ohio Department of Transportation website or at a local office.

02

Read the instructions provided with the form carefully to understand what information is required.

03

Fill out your personal information in the designated sections, including your name, address, and contact details.

04

Provide details about the vehicle, such as the make, model, year, and VIN (Vehicle Identification Number).

05

Complete any sections related to the purpose of the form, such as inspections or title transfers.

06

Double-check all information for accuracy and completeness before submission.

07

Sign and date the form as required.

08

Submit the completed form as instructed, either online or in person at the appropriate location.

Who needs OH DoT D5?

01

Individuals applying for vehicle registration or title transfer in Ohio.

02

Owners of vehicles needing inspection or compliance with state regulations.

03

Businesses involved in vehicle sales or leases within Ohio.

04

Non-residents who own vehicles registered in Ohio and need to meet state requirements.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a tax clearance certificate in Ohio?

To obtain the Certificate of Tax Clearance, corporate taxpayers must submit Form D5 “Notification of Dissolution or Surrender” to the Department after all applicable final returns are filed.

Where to find Ohio tax forms?

The Ohio Department of Taxation provides a searchable repository of individual tax forms for multiple purposes. Most forms are available for download and some can be filled or filed online.

Where do I get a clearance certificate?

This report can be issued by any Local Criminal Record Centre (LCRC). The prescribed fee is R80,00 per report. The Police Clearance Report issued must be handed to the applicant in person upon collection. Proof of identity must be presented when the report is collected.

How do I close an LLC in Ohio?

To dissolve your LLC in Ohio, you must provide the completed Certificate of Dissolution of Limited Liability Company / Cancellation of Foreign LLC form to the Secretary of State by mail, in person, or online. Ohio's SOS does not require original signatures.

How do I close my employer withholding account in Ohio?

Online through the Agency Website. Call: 410-260-7980 or 1-800-638-2937 Provide: Name, telephone number, Federal Employer Identification Number (FEIN), Central Registration Number (CRN), reason for closing account, and closing date.

What is a certificate of tax clearance Ohio?

Ohio Tax Clearance Certificates Certificates of tax clearance are required for a variety of business activities, ranging from reinstating or dissolving an entity to applying for a loan or a tax incentive. See the table below for information on obtaining a tax clearance certificate in Ohio.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit OH DoT D5 online?

With pdfFiller, the editing process is straightforward. Open your OH DoT D5 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the OH DoT D5 in Gmail?

Create your eSignature using pdfFiller and then eSign your OH DoT D5 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit OH DoT D5 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit OH DoT D5.

What is OH DoT D5?

OH DoT D5 is a form used in Ohio to report and document the distribution of fuel and the applicable fuel taxes.

Who is required to file OH DoT D5?

Businesses that distribute fuels in Ohio and are subject to fuel taxes are required to file OH DoT D5.

How to fill out OH DoT D5?

To fill out OH DoT D5, you need to provide information about the type and volume of fuel distributed, along with the applicable taxes and other required details.

What is the purpose of OH DoT D5?

The purpose of OH DoT D5 is to ensure that fuel distributors report their activities accurately for tax assessment and compliance purposes.

What information must be reported on OH DoT D5?

The information that must be reported on OH DoT D5 includes the distributor's name and address, fuel types, quantities distributed, and tax calculations.

Fill out your OH DoT D5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH DoT d5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.