Get the free notarized gift letter

Show details

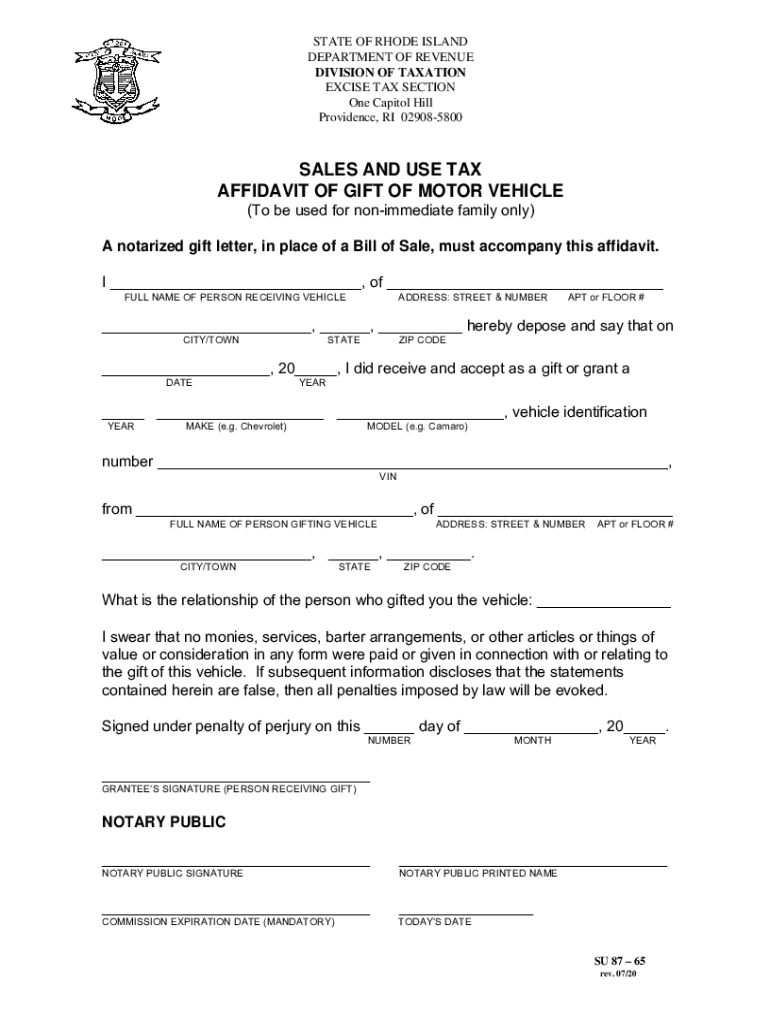

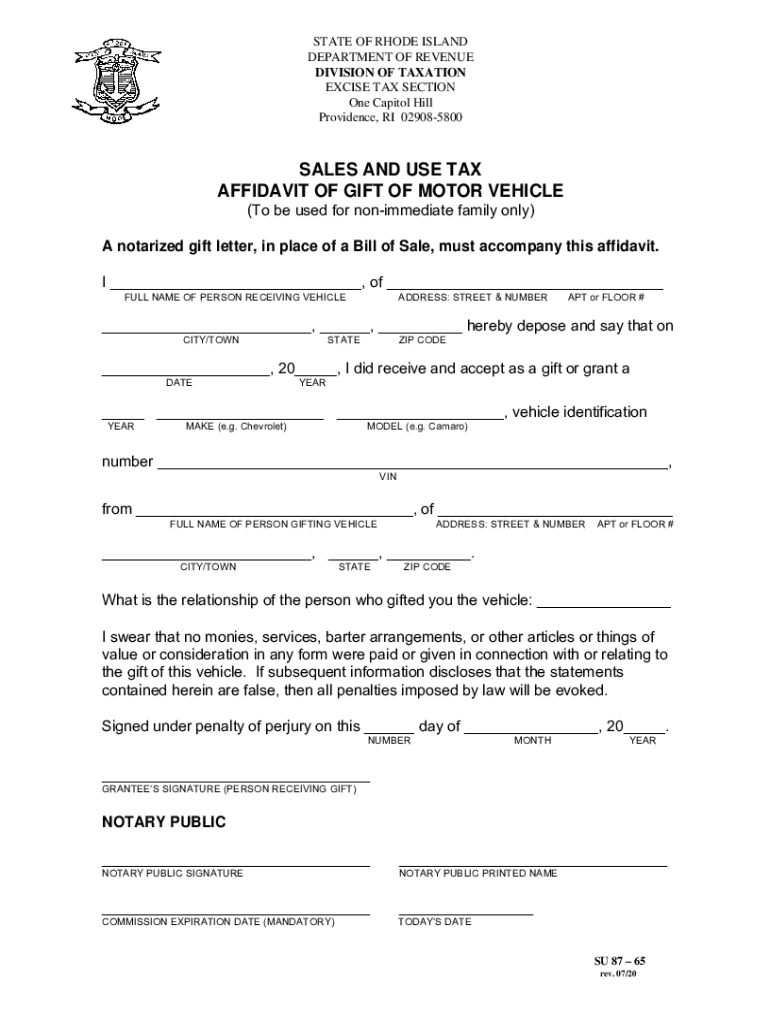

This document is used for the declaration of receiving a motor vehicle as a gift, specifically for non-immediate family members, and requires a notarized gift letter.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift letter template form

Edit your notarized gift letter form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notarized gift letter form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notarized gift letter form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notarized gift letter form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notarized gift letter form

How to fill out a notarized gift letter:

01

Begin by addressing the letter to the recipient. Include their full name and address.

02

State the purpose of the letter clearly. Clearly state that you are giving a gift and there are no strings attached or expectations of repayment.

03

Include a detailed description of the gift. Specify the type of gift, its value, and any important details related to the gift.

04

Provide your full name and contact information, including address and phone number.

05

Include a statement indicating that you are willingly and voluntarily giving the gift without any expectations or conditions.

06

State that you understand the legal implications of the gift and that you are aware that it cannot be revoked or reclaimed in the future.

07

Include a clause that acknowledges that the letter is being notarized for legal purposes and that you understand the implications of notarization.

08

Sign the letter and date it in the presence of a notary public. The notary will then sign and stamp the letter to authenticate it.

09

Make copies of the notarized gift letter for yourself, the recipient, and any other concerned parties.

Who needs a notarized gift letter?

01

Individuals who want to legally transfer ownership of a valuable asset as a gift to another person.

02

Those who want to ensure that the gift is properly documented and protected legally.

03

People who want to avoid any potential disputes or confusion regarding the gift in the future.

04

Anyone who wants to provide clear evidence of their intention to give a gift without any expectations of repayment.

05

Individuals who desire to establish a paper trail for tax or legal purposes in relation to the gift.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notarized gift letter form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your notarized gift letter form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make edits in notarized gift letter form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing notarized gift letter form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit notarized gift letter form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign notarized gift letter form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is sales and use tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. Use tax, on the other hand, is levied on the use of goods or services that are purchased without paying sales tax, typically for items bought out-of-state.

Who is required to file sales and use tax?

Generally, businesses that sell goods or services subject to sales tax must collect and remit sales tax to the state. Additionally, consumers who purchase items without paying sales tax are required to file use tax.

How to fill out sales and use tax?

To fill out a sales and use tax return, you typically need to gather sales records, determine the total sales amount, calculate the sales tax collected, and report these figures on the appropriate state tax form, including any exemptions or deductions.

What is the purpose of sales and use tax?

The primary purpose of sales and use tax is to generate revenue for state and local governments to fund public services such as education, infrastructure, and public safety.

What information must be reported on sales and use tax?

When filing sales and use tax, you must report the total sales amount, the amount of sales tax collected, any exempt sales, and the total use tax due, along with relevant business information such as tax identification numbers and contact details.

Fill out your notarized gift letter form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notarized Gift Letter Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.