Get the free student loans - UTSA One StopEnrollment Services - education utsa

Show details

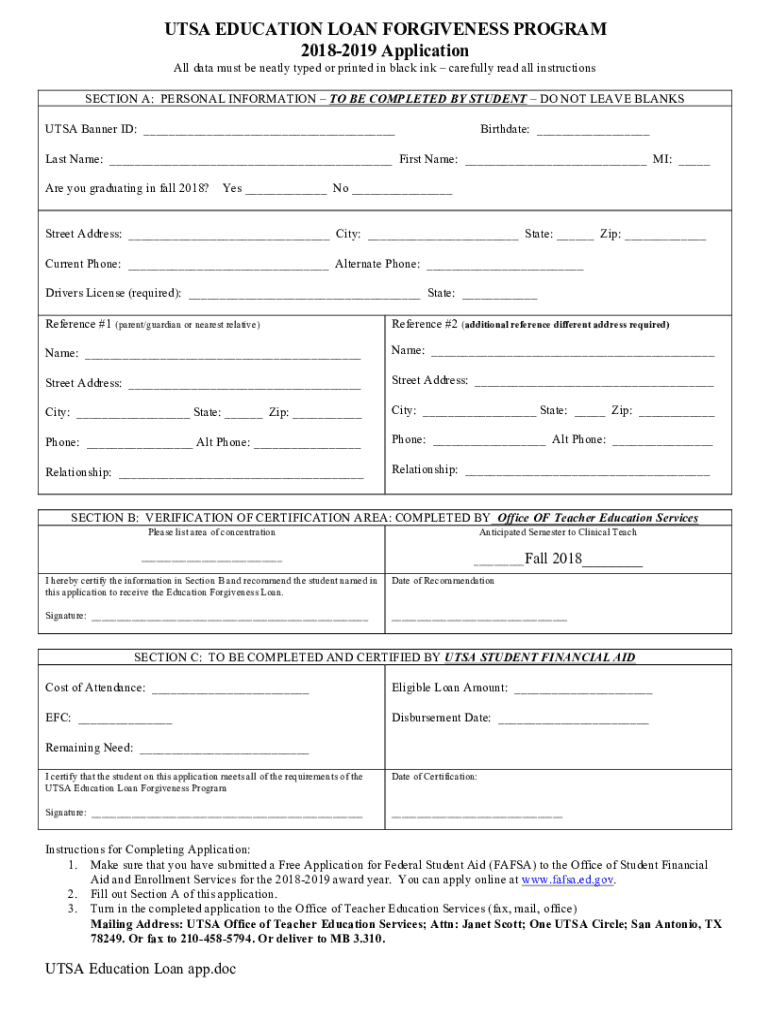

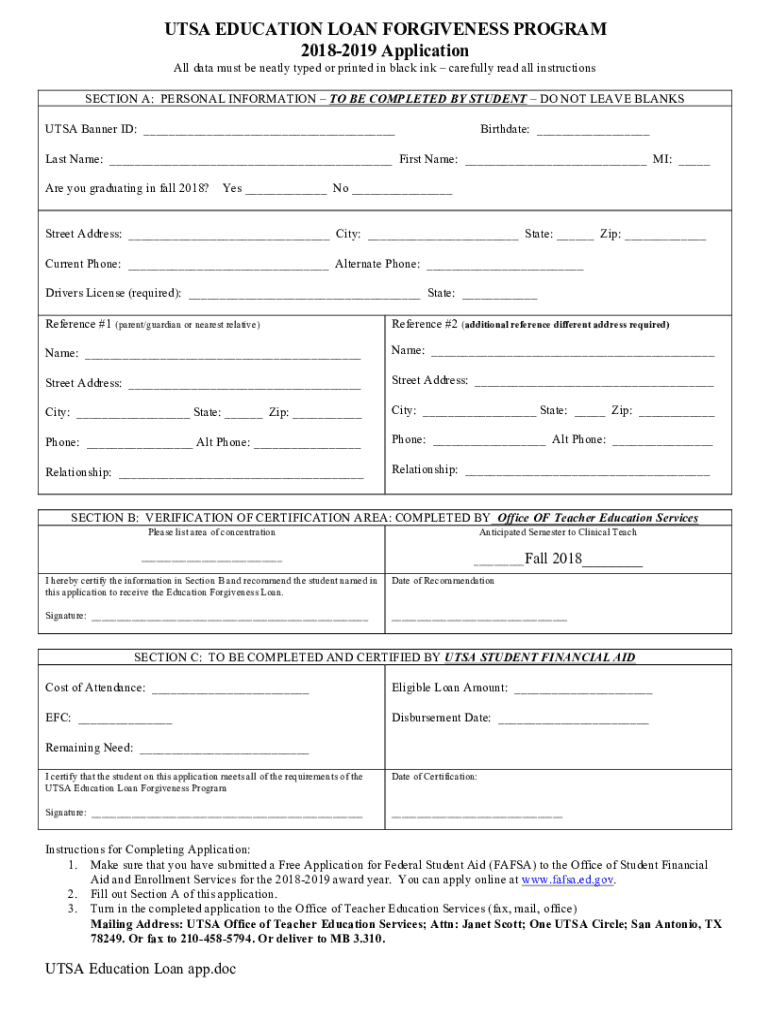

UTSA EDUCATION LOAN FORGIVENESS PROGRAM 20182019 Application All data must be neatly typed or printed in black ink carefully read all instructions SECTION A: PERSONAL INFORMATION TO BE COMPLETED BY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student loans - utsa

Edit your student loans - utsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student loans - utsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing student loans - utsa online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit student loans - utsa. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student loans - utsa

How to fill out student loans - utsa

01

Step 1: Gather all necessary documents and information. This may include your social security number, tax returns, and banking information.

02

Step 2: Research different types of student loans available and determine which option is the best fit for you.

03

Step 3: Complete the Free Application for Federal Student Aid (FAFSA) form, providing accurate and up-to-date information.

04

Step 4: Review and compare loan offers from different lenders, considering factors such as interest rates, repayment terms, and loan limits.

05

Step 5: Once you have chosen a lender, carefully read and sign the loan agreement, making sure to understand the terms and conditions.

06

Step 6: Use the loan funds to pay for your educational expenses, such as tuition, books, and living costs.

07

Step 7: Keep track of your loan repayment schedule and make timely payments to avoid any penalties or negative impact on your credit score.

08

Step 8: If you encounter difficulty in repaying your loans, explore options such as income-driven repayment plans or loan consolidation.

09

Step 9: Stay informed about any changes in loan policies, regulations, or opportunities for loan forgiveness or cancellation.

10

Step 10: Gradually repay your student loans in full, taking advantage of any opportunities to reduce interest costs or repay earlier if possible.

Who needs student loans - utsa?

01

Students who are pursuing higher education at the University of Texas at San Antonio (UTSA) and require financial assistance may need student loans.

02

Those who do not have sufficient funds to cover their educational expenses, such as tuition fees, textbooks, housing, or transportation, may need student loans.

03

Students from low-income backgrounds or families with limited financial resources may rely on student loans to finance their education.

04

Individuals who wish to invest in their future and enhance their career prospects through obtaining a degree or further education often require student loans.

05

International students studying at UTSA and facing financial constraints may also need student loans to support their educational pursuits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get student loans - utsa?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific student loans - utsa and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the student loans - utsa in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your student loans - utsa right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit student loans - utsa on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share student loans - utsa on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is student loans - utsa?

Student loans at UTSA refer to the financial aid programs that provide students with funds to cover their educational expenses, which must be repaid with interest.

Who is required to file student loans - utsa?

Students who wish to obtain financial assistance for their education at UTSA are required to file for student loans, typically those needing help covering tuition, fees, or other related expenses.

How to fill out student loans - utsa?

To fill out student loans at UTSA, students must complete the Free Application for Federal Student Aid (FAFSA) and follow the specific loan application procedures provided by the university.

What is the purpose of student loans - utsa?

The purpose of student loans at UTSA is to provide financial support to students who do not have sufficient funds to pay for their educational costs, enabling them to pursue their academic goals.

What information must be reported on student loans - utsa?

Students must report personal financial information, including income, assets, family size, and details about previous education, when applying for student loans at UTSA.

Fill out your student loans - utsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Loans - Utsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.