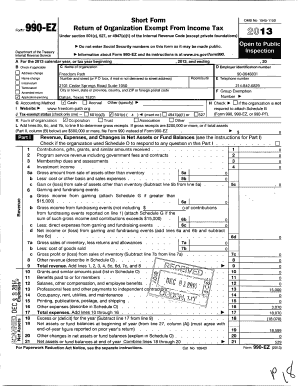

Get the free Total assets 1 6 , 9 7 0 . - Charity Blossom - irs990 charityblossom

Show details

Short FOURTH, obvious 1545-1150 * Return of Organization Exempt From income Tax Form 990,EZ Under section 501(c), 527, or 4947(a)(1) of the ltiliatitatrnalillttfiveniie Code (except black lung benefit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign total assets 1 6

Edit your total assets 1 6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your total assets 1 6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit total assets 1 6 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit total assets 1 6. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out total assets 1 6

How to fill out total assets 1 6:

01

Start by gathering all the necessary financial information such as bank statements, investment account statements, and any property ownership documents.

02

List all your liquid assets, including cash, savings accounts, and certificates of deposit. Include their respective values.

03

Calculate the value of your investment assets, such as stocks, bonds, mutual funds, and retirement accounts. Make sure to include any supporting documentation.

04

Assess the value of any real estate properties you own. Consider the market value or appraised value of each property.

05

Add up the value of any vehicles you own, such as cars, boats, or motorcycles. Use fair market value when determining their worth.

06

Include the value of any other significant assets that you possess, such as artwork, jewelry, or valuable collectibles. Obtain professional appraisals if necessary.

07

Finally, add up all the values from steps 2 to 6 to determine your total assets.

Who needs total assets 1 6:

01

Individuals who are applying for loans or mortgages may need to provide a breakdown of their total assets to lenders. This helps the lender assess the borrower's financial strength and repayment capacity.

02

Business owners may need to determine their total assets to have a clear understanding of the value of their company. This information can be crucial for evaluating the business's financial health, attracting investors, or applying for financing.

03

Executors of estates may require a comprehensive list of total assets to determine the estate's value and distribute assets according to a will or legal requirements.

04

Investors or financial advisors may need to calculate total assets to assess a person's net worth, make investment decisions, or provide financial planning advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my total assets 1 6 in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your total assets 1 6 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify total assets 1 6 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your total assets 1 6 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send total assets 1 6 for eSignature?

Once your total assets 1 6 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

What is total assets 1 6?

Total assets 1 6 refers to the sum of all assets owned by an individual or organization as reported on a specific financial document.

Who is required to file total assets 1 6?

Individuals or organizations that are mandated by law or regulations to submit financial reports are required to file total assets 1 6.

How to fill out total assets 1 6?

To fill out total assets 1 6, one must list down all assets owned and their corresponding values as per the instructions provided on the reporting document.

What is the purpose of total assets 1 6?

The purpose of total assets 1 6 is to provide an accurate representation of an individual or organization's financial standing by detailing their accumulated assets.

What information must be reported on total assets 1 6?

One must report details of all assets owned, their values, and any relevant information pertaining to these assets on total assets 1 6.

Fill out your total assets 1 6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Total Assets 1 6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.