Get the free Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs ...

Show details

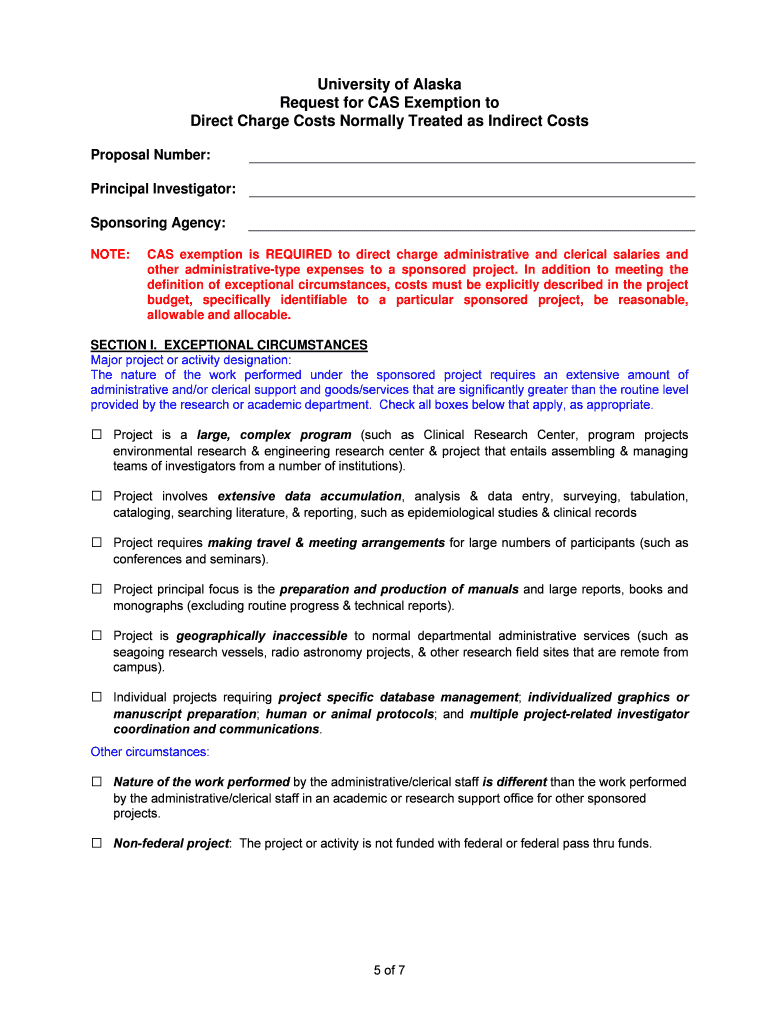

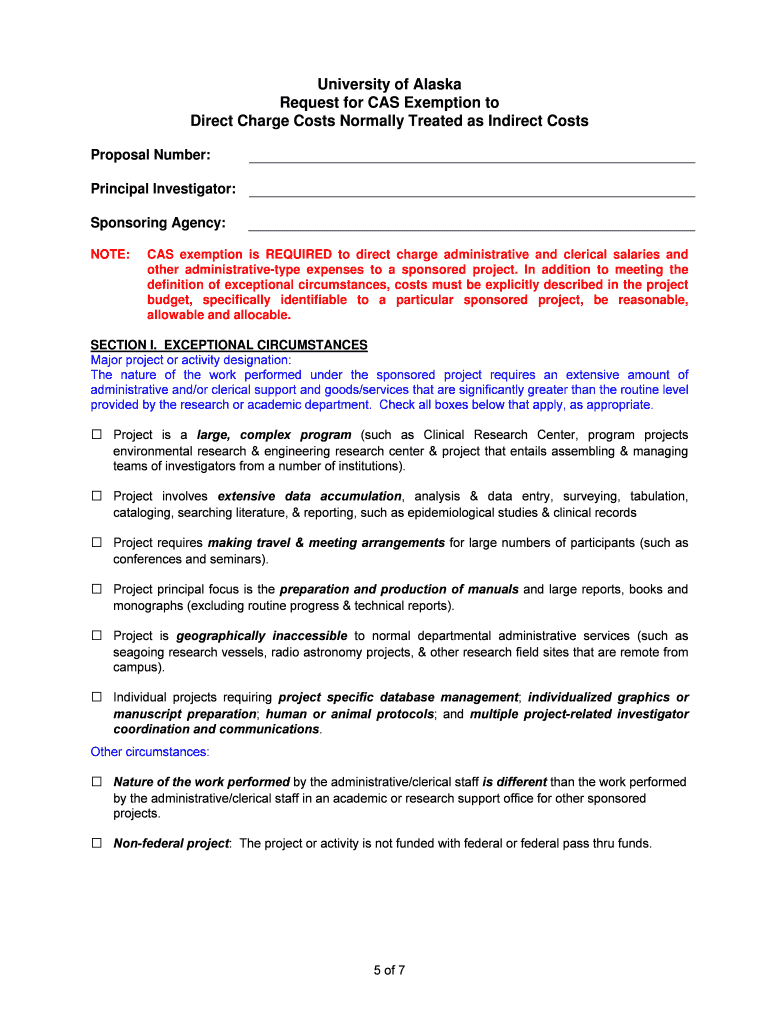

This document is a request form used by the University of Alaska to seek an exemption from the Cost Accounting Standards (CAS) for direct charging administrative and clerical salaries and other related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for cas exemption

Edit your request for cas exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for cas exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for cas exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for cas exemption. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for cas exemption

How to fill out Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs

01

Obtain the Request for CAS Exemption form from the relevant agency or department.

02

Identify the specific costs you wish to charge directly and ensure they meet the criteria for a CAS exemption.

03

Complete the form with detailed explanations for each cost you are requesting to charge directly.

04

Gather supporting documentation that substantiates your claims and rationale for direct charging.

05

Review the completed form and documentation for accuracy and completeness.

06

Submit the form and all supporting documents to the designated authority or department for review.

Who needs Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs?

01

Organizations or institutions that wish to direct charge certain costs that are typically classified as indirect costs.

02

Entities involved in federal contracts or grants that require justification for different cost treatment under CAS.

Fill

form

: Try Risk Free

People Also Ask about

What is the indirect cost exemption?

An indirect cost exception is the official authorization to accept indirect cost recovery other than what would be recovered under the appropriate federally-negotiated rate agreement or UC Rate for a given award.

Which of these expenses is normally treated as an indirect cost?

Examples of costs usually treated as indirect include those incurred for facility operation and maintenance, depreciation, and administrative salaries. By contrast, direct costs can be attributed directly to a specific cost objective and tracked in discrete categories such as personnel, travel, supplies, etc.

What is the meaning of direct cost and indirect cost?

As we can see, direct costs are those that are directly involved with bringing your product to market, while indirect costs are those incurred during the processes that support this. Both are important, as they are part of your bottom line, and provide an insight into your company's profitability.

What is direct and indirect cost with an example?

The wages of line managers or administrative staff, however, is an indirect cost because it does not directly impact the product. Sales commissions are also considered a direct cost because they play a vital role in delivering the product to the customer.

What are examples of direct vs indirect?

In the sentence "You forgave me my mistake" the thing being forgiven is the mistake, so "my mistake" is the direct object. The mistake is being forgiven for me so "me" is the indirect object.

What are CAS exemptions?

CAS Exemptions & Applicability Contract is awarded under sealed-bid procedures. Award is firm-fixed price (FFP) contract for commercial item(s) Price is set by law or regulation. Award is a firm-fixed-price contract awarded on the basis of adequate price competition without submission of cost or pricing data.

What do you mean by indirect costs?

What are indirect costs? Employee salaries. Employee benefits. Rent. Utilities. Office supplies and equipment. Computers, printers and cell phones. Company vehicle expenses. Marketing and promotion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs?

The Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs is a formal request made by contractors or grantees to seek approval to directly charge certain costs that are typically classified as indirect costs. This request is in accordance with the Cost Accounting Standards (CAS) to ensure that these costs are properly allocated and justified.

Who is required to file Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs?

Organizations that receive federal funding or contracts and wish to allocate certain costs that are usually considered indirect as direct charges are required to file this request. Typically, this includes contractors, grantees, or research institutions.

How to fill out Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs?

To fill out the Request for CAS Exemption, the organization must provide detailed information about the costs being requested for direct charging, justification for the exemption, relevant supporting documentation, and a description of how these costs will be allocated and managed within the project.

What is the purpose of Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs?

The purpose of the Request for CAS Exemption is to obtain permission to charge costs that are not typically direct to be allocated directly to a specific project or contract. This helps provide better financial accountability and cost management for federally funded projects.

What information must be reported on Request for CAS Exemption to Direct Charge Costs Normally Treated as Indirect Costs?

The request must report information such as the specific costs to be charged directly, the rationale for the request, supporting documentation that demonstrates the necessity of the costs, how the costs align with the project objectives, and the impact of these charges on the overall budget.

Fill out your request for cas exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Cas Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.