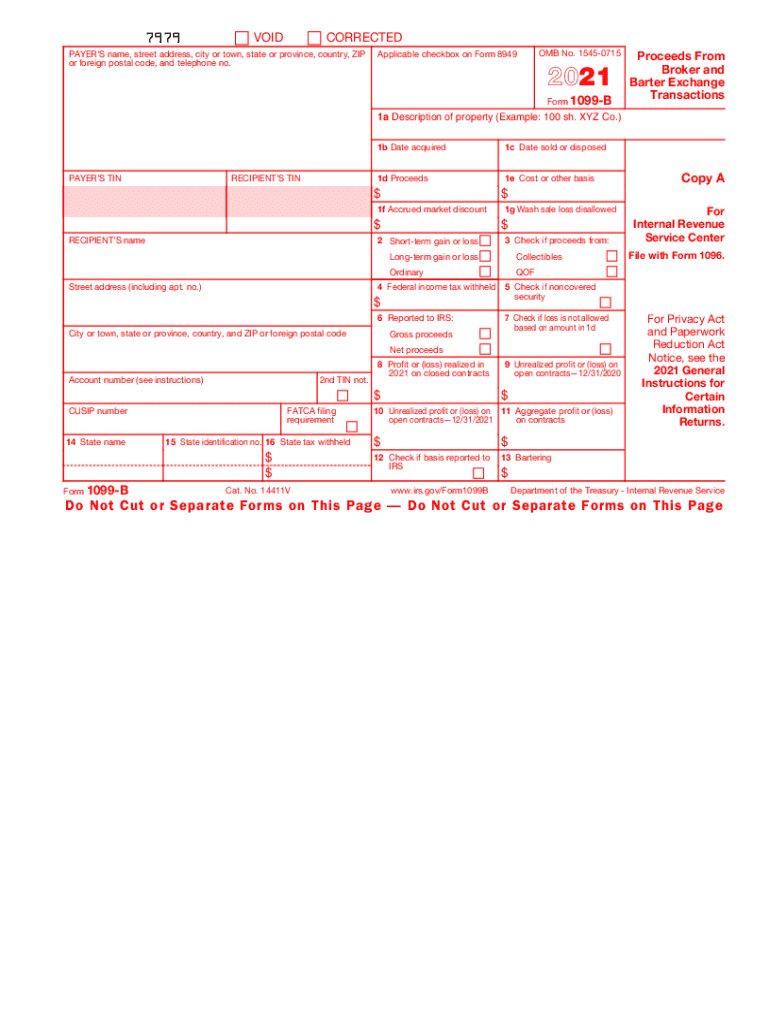

IRS 1099-B 2021 free printable template

Instructions and Help about IRS 1099-B

How to edit IRS 1099-B

How to fill out IRS 1099-B

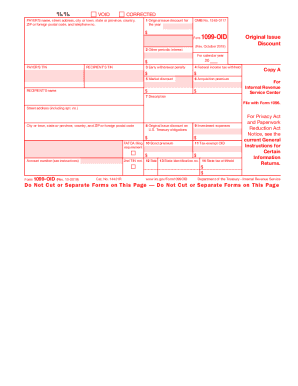

About IRS 1099-B 2021 previous version

What is IRS 1099-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

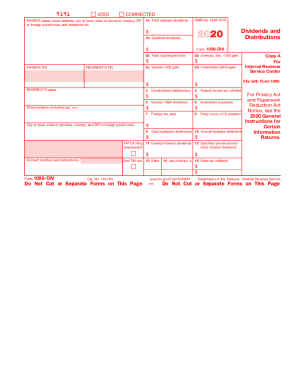

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-B

What should I do if I discover an error on my IRS 1099-B after filing?

If you find an error post-filing, you should prepare an amended IRS 1099-B. Use Form 1099-B to indicate the corrections and submit it following the guidelines for amended returns. Ensure you provide a clear explanation of the changes made to avoid any processing delays.

How can I track the status of my IRS 1099-B submission?

To track the status of your IRS 1099-B submission, you can utilize the IRS's e-file portal for updates or check with the software you used if applicable. Be on the lookout for e-file rejection codes, which can provide insights into any issues that need addressing before acceptance.

What should I consider regarding e-signatures when filing my IRS 1099-B?

When filing your IRS 1099-B electronically, ensure that the e-signature you use complies with IRS guidelines. Electronic signatures are generally accepted, but it's vital to maintain proper records to validate your submission and protect against potential audits.

Are there special considerations for non-residents when filing an IRS 1099-B?

Non-residents must adhere to specific treaty provisions and IRS regulations when filing an IRS 1099-B. It's essential to accurately report income while considering any relevant tax treaties that may reduce withholding or provide exemptions.

What common errors should I avoid when preparing my IRS 1099-B?

Common errors include mismatches in taxpayer identification numbers and incorrect transaction details. Always double-check the information you report and ensure consistency with other IRS forms to prevent delays or rejection during processing.

See what our users say