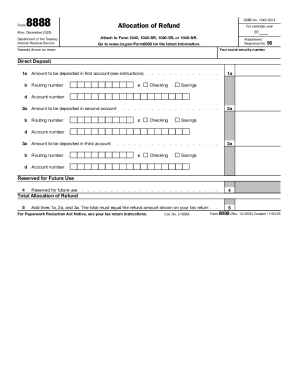

IRS 8888 2020 free printable template

Instructions and Help about IRS 8888

How to edit IRS 8888

How to fill out IRS 8888

About IRS 8 previous version

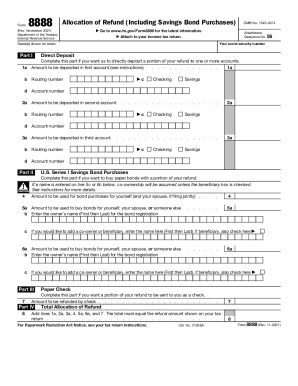

What is IRS 8888?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8888

What should I do if I notice an error on my IRS 8888 after filing?

If you find a mistake on your submitted IRS 8888, you should file an amended return using Form 1040-X. Ensure you include the correct information and indicate that you're correcting the initial submission. Keep in mind that processing times for amendments may vary.

How can I track the status of my IRS 8888 submission?

To check the status of your IRS 8888, visit the IRS 'Where's My Refund?' tool online. You can track the progress of your refund and confirm whether your submission was processed successfully. Have your personal information ready for accurate tracking.

What should I do if my IRS 8888 submission is rejected?

If your IRS 8888 is rejected, the IRS will provide a rejection code explaining the issue. Review the specific error, correct it in your form, and resubmit as soon as possible to avoid any delays in processing. Always keep a record of the rejection notice for your files.

Are electronic signatures acceptable for submitting the IRS 8888?

Yes, electronic signatures are acceptable when e-filing your IRS 8888. Ensure your software or e-filing service adheres to IRS guidelines for electronic submissions, as they provide the necessary security and verification processes.

How long should I retain a copy of my IRS 8888 after filing?

It is recommended to keep a copy of your IRS 8888 and all related documents for at least three years after the filing date. This ensures you have the necessary paperwork in case of any future audits or discrepancies.

See what our users say