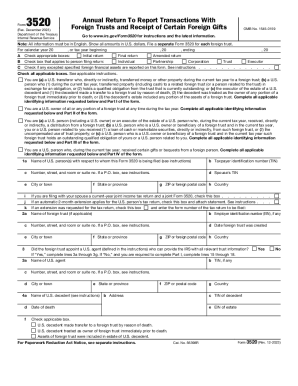

IRS 3520 2020 free printable template

Instructions and Help about IRS 3520

How to edit IRS 3520

How to fill out IRS 3520

About IRS 3 previous version

What is IRS 3520?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 3520

How can I correct mistakes on my IRS 3520 form after filing?

If you need to correct errors on your IRS 3520 after submission, it's essential to file an amended return using Form 3520-A or another appropriate form. Make sure to include a detailed explanation of the corrections and submit it as soon as possible to avoid penalties. It's advisable to also keep copies of any previous submissions for reference.

What should I do if my IRS 3520 form is rejected when e-filing?

In the case of an e-filing rejection for your IRS 3520, review the error code provided in the rejection notice. Common issues include incorrect Personal Identification Numbers (PINs) or mismatched names and Social Security Numbers. Make the necessary corrections and resubmit the form to ensure compliance and timely processing.

Are e-signatures accepted for filing the IRS 3520?

Yes, when filing the IRS 3520 electronically, e-signatures are generally accepted, provided that the software used for filing complies with IRS guidelines. Ensure that you follow all necessary steps outlined by your e-filing service to authenticate your submission securely.

What should I do if I receive a notice from the IRS regarding my 3520 submission?

Upon receiving a notice from the IRS concerning your IRS 3520, carefully read the notice to understand its purpose, whether it is a request for additional information or details about an audit. Respond promptly with any requested documentation and keep a record of your correspondence with the IRS to ensure a clear trail should questions arise.

What are common errors to avoid while filing the IRS 3520?

Common errors to watch for when filing your IRS 3520 include neglecting to report all required foreign assets and miscalculating values. Additionally, be cautious with typos in names and other identifying information. Double-checking your form against the instructions can significantly reduce the likelihood of these errors.

See what our users say