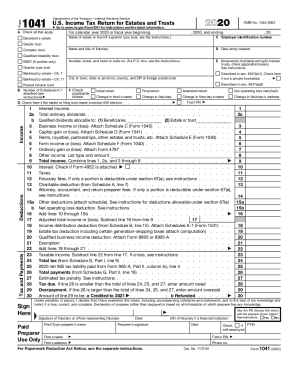

IRS 1041 - Schedule I 2020 free printable template

Instructions and Help about IRS 1041 - Schedule I

How to edit IRS 1041 - Schedule I

How to fill out IRS 1041 - Schedule I

About IRS 1041 - Schedule I 2020 previous version

What is IRS 1041 - Schedule I?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041 - Schedule I

What should I do if I made a mistake on my IRS 1041 - Schedule I?

If you've made an error on your IRS 1041 - Schedule I, you can file an amended return to correct the mistake. It's crucial to follow IRS guidelines and use Form 1041-X to report the changes. Ensure all relevant information is accurately revised and provide clear explanations for corrections to avoid delays.

How can I track the status of my filed IRS 1041 - Schedule I?

To verify the receipt and processing of your IRS 1041 - Schedule I, you can use the IRS 'Where's My Refund?' tool, although it is primarily for individual tax returns. For estate tax returns, you may need to contact the IRS directly to confirm status and check for any possible delays or issues.

What should I do if I receive a notice about my IRS 1041 - Schedule I?

Upon receiving a notice from the IRS regarding your IRS 1041 - Schedule I, read the notice carefully to understand its content. Gather any requested documentation and respond within the specified timeframe, ensuring to keep records of all communications for your file.

Are there any specific technical requirements for e-filing IRS 1041 - Schedule I?

When e-filing your IRS 1041 - Schedule I, ensure your software is compatible with the IRS e-file standard. Check that your internet browser is updated and capable of securely transmitting sensitive data. Confirm that any e-signature meets IRS requirements for acceptance.