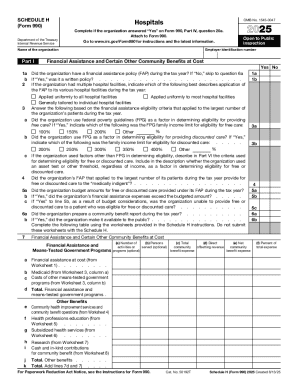

IRS 990 - Schedule H 2020 free printable template

Instructions and Help about IRS 990 - Schedule H

How to edit IRS 990 - Schedule H

How to fill out IRS 990 - Schedule H

About IRS 990 - Schedule H 2020 previous version

What is IRS 990 - Schedule H?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 - Schedule H

What should I do if I realize I made a mistake after filing the h?

If you discover an error after submitting your h, you can file an amended version to correct it. Ensure to include any necessary explanations and supporting documents to clarify the amendment. Keep a copy for your records, as this helps maintain a clear audit trail.

How can I verify if my h has been received and processed?

You can track the status of your h by using the online tracking system provided by the filing agency. If you filed electronically, check for confirmation emails or messages indicating successful receipt. For paper filings, consider contacting their customer service for verification.

Are there any common errors that filers encounter with the h, and how can they be avoided?

Common errors include incorrect Social Security numbers and mismatches between reported payments and recipient information. To avoid these mistakes, double-check all data and ensure it matches the recipient’s tax information before submission. Implementing a thorough review process can significantly reduce errors.

What should I do if I receive a notice regarding my h filing?

If you receive a notice or letter about your h, carefully read the correspondence to understand its nature. Gather all relevant documentation and respond by the specified deadline, addressing each point raised in the notice. If uncertain, consider seeking assistance from a tax professional.