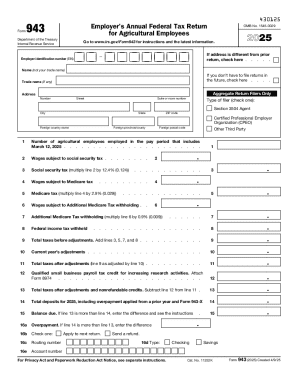

IRS 943 2020 free printable template

Instructions and Help about IRS 943

How to edit IRS 943

How to fill out IRS 943

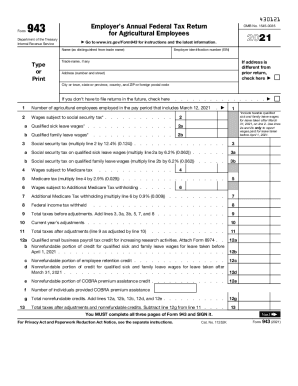

About IRS previous version

What is IRS 943?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

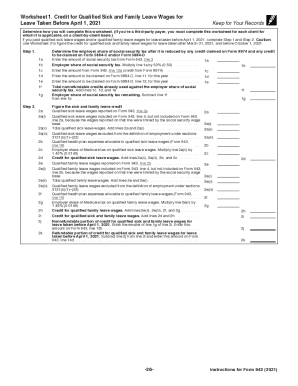

Is the form accompanied by other forms?

FAQ about IRS 943

What should I do if I realize I made an error on my IRS 943 after filing?

If you discover an error on your IRS 943 after submission, you should file an amended return using Form 943-X. This form allows for corrections to be made without incurring penalties if it's filed correctly. Ensure that you provide a clear explanation of the changes being made and retain copies of all documents for your records.

How can I check the status of my submitted IRS 943?

To verify the status of your IRS 943 submission, you can contact the IRS directly or use their online tools. Keep your filing details handy, including the exact date of submission and any confirmation numbers received, as these can assist in tracking your return. If you filed electronically, be aware of common rejection codes that may necessitate resubmission.

What are common errors people make when filing IRS 943?

Common mistakes when filing IRS 943 include incorrect taxpayer identification numbers, misreporting wages or withholdings, and failing to sign the form. To avoid these pitfalls, double-check all entries and ensure you follow the guidelines for reporting accurately as these errors can lead to delays in processing or additional scrutiny by the IRS.

What steps should I take if I receive a notice regarding my IRS 943?

If you receive a notice or letter from the IRS about your IRS 943, read it carefully to understand the issue raised. Respond promptly, and prepare any necessary documentation to support your case. It may be beneficial to consult with a tax professional if the notice requires complex actions or if you're unsure how to proceed.

Are there any technical requirements I should be aware of for e-filing IRS 943?

For e-filing your IRS 943, ensure that your software meets the IRS requirements for electronic submissions. This includes compatibility with the latest tax updates and having a secure internet connection for data protection. Additionally, check that your filing methods support e-signatures if applicable, which can streamline the process.

See what our users say