IRS 709 Instructions 2020 free printable template

Show details

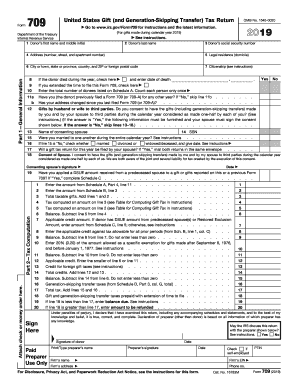

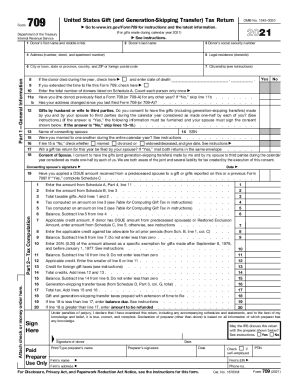

2020Department of the Treasury Internal Revenue ServiceInstructions for Form 709United States Gift (and Generation Skipping Transfer) Tax Return For gifts made during calendar year 2020 Section references

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 709 Instructions

Edit your IRS 709 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 709 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 709 Instructions online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 709 Instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 709 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 709 Instructions

How to fill out IRS 709 Instructions

01

Gather all necessary documentation related to gifts you have given during the tax year.

02

Determine if your gifts exceed the annual exclusion amount for the year.

03

Complete the top section of Form 709 with your personal information.

04

List each gift made on the appropriate section of the form, providing details such as the recipient, gift amount, and date of the gift.

05

Calculate any total amounts and exclusions applicable according to IRS guidelines.

06

Review the instructions provided for any specific requirements regarding the type of gifts.

07

Sign and date the form before submitting it to the IRS.

08

Keep a copy of the filled form and any documentation for your records.

Who needs IRS 709 Instructions?

01

Individuals who have made gifts exceeding the annual exclusion amount.

02

Those who are required to report gifts made to non-citizen spouses.

03

Donors involved in transferring property or other assets that require reporting.

04

Persons who want to take advantage of the lifetime gift tax exemption.

Fill

form

: Try Risk Free

People Also Ask about

What is the requirement to file Form 709?

IRS Form 709 – Filing Requirements Generally, Form 709: U.S. Gift (and Generation-Skipping Transfer) Tax Return is required if any of the following apply: An individual makes one or more gifts to any one person (other than his or her citizen spouse) that are more than the annual exclusion for the year.

Do you have to report all gifts on Form 709?

In general, a gift will be considered adequately disclosed if the return or statement includes the following. A full and complete Form 709. A description of the transferred property and any consideration received by the donor. The identity of, and relationship between, the donor and each donee.

Do you report charitable gifts on 709?

Donors are required to report gifts on Form 709, U.S. Gift (and Generation-Skipping Transfer) Tax Return. Several types of gifts do not have to be reported, such as gifts that do not exceed the annual exclusion amount, deductible charitable gifts, gifts to a spouse, and gifts that the donee properly disclaims.

How does the IRS know if you give a gift?

The IRS finds out if you gave a gift when you file a form 709 as is required if you gift over the annual exclusion. If you fail to file this form, the IRS can find out via an audit.

What is the IRS rule for gifting money to family members?

The gift tax limit was $16,000 in 2022 and is $17,000 in 2023. The gift tax rates range from 18% to 40%. The gift giver is the one who generally pays the tax, not the receiver.

Do you have to report all gifts on gift tax return?

Whenever a donor is required to file a gift tax return for the purpose of reporting taxable gifts, he or she must also report all charitable gifts made during the applicable tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 709 Instructions without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IRS 709 Instructions into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit IRS 709 Instructions online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your IRS 709 Instructions to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my IRS 709 Instructions in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IRS 709 Instructions directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is IRS 709 Instructions?

IRS 709 Instructions provide guidelines for filing the United States Gift (and Generation-Skipping Transfer) Tax Return, including how to report gifts that exceed the annual exclusion amount.

Who is required to file IRS 709 Instructions?

Individuals who make gifts exceeding the annual exclusion amount or those who wish to allocate their lifetime gift tax exemption must file IRS 709 Instructions.

How to fill out IRS 709 Instructions?

To fill out IRS 709 Instructions, taxpayers must complete the form with information regarding the donor, recipient, and details of gifts made, including any applicable deductions or exemptions.

What is the purpose of IRS 709 Instructions?

The purpose of IRS 709 Instructions is to ensure that individuals correctly report their gift tax obligations and comply with federal tax laws regarding gifting.

What information must be reported on IRS 709 Instructions?

The information that must be reported on IRS 709 Instructions includes the names of the donor and recipient, a description of the gifts, their value, and any applicable exclusions or deductions.

Fill out your IRS 709 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 709 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.