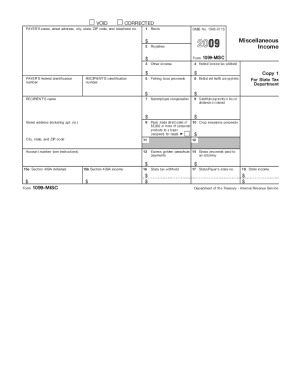

IRS 1099-MISC 2011 free printable template

Show details

The products you should use to complete Form 1099-MISC are the Returns and the 2011 Instructions for Form 1099-MISC. 13 Excess golden parachute 14 Gross proceeds paid to payments an attorney 15a Section 409A deferrals 1099-MISC Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice see the 2011 General Instructions for Certain Returns. Attention This form is provided for informational purposes only. Copy A appears in red similar to the official...IRS form* Do not file copy A downloaded from this website. The official printed version of this IRS form is scannable but the online version of it printed from this website is not. A penalty may be imposed for filing forms that can t be scanned* See part O in the current General Instructions for Certain Information Returns for more information about penalties. To order official IRS forms call 1-800-TAX-FORM 1-800-829-3676 or Order Information Returns and Employer Returns Online and we ll mail...you the scannable forms and other products. See IRS Publications 1141 1167 1179 and other IRS resources for information about printing these tax forms. VOID CORRECTED PAYER S name street address city state ZIP code and telephone no. Rents OMB No* 1545-0115 Royalties Form Other income PAYER S federal identification number RECIPIENT S identification RECIPIENT S name City state and ZIP code Nonemployee compensation 2nd TIN not. 13 Excess golden parachute 14 Gross proceeds paid to payments an...attorney 15a Section 409A deferrals 1099-MISC Internal Revenue Service Center File with Form 1096. For Privacy Act and Paperwork Reduction Act Notice see the 2011 General Instructions for Certain Returns. 17 State/Payer s state no. 18 State income Cat* No* 14425J Do Not Cut or Separate Forms on This Page Copy A State tax withheld 8 Substitute payments in lieu of dividends or interest Payer made direct sales of 10 Crop insurance proceeds 5 000 or more of consumer products to a buyer recipient for...resale Account number see instructions 6 Medical and health care payments Street address including apt* no* 4 Federal income tax withheld Fishing boat proceeds Miscellaneous Income Department of the Treasury - Internal Revenue Service Copy 1 For State Tax Department CORRECTED if checked Copy B For Recipient keep for your records This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return a negligence penalty or other sanction...may be imposed on you if this income is taxable and the IRS determines that it has not been reported* assigned to distinguish your account. Amounts shown may be subject to self-employment SE tax. If your net income from self-employment is 400 or more you must file a return and compute your SE tax on Schedule SE Form 1040. See Pub. 334 for more information* If no income or social security and Medicare taxes were withheld and you are still receiving these payments see Form 1040-ES* Individuals...must report these amounts as explained in the box 7 instructions on this page.

pdfFiller is not affiliated with IRS

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

PDF Filler is very convenient and user friendly so far.

good, rated it a 4 star rather than a 5 because it often freezes up and you have to restart the application. Good but needs improvement.

See what our users say