MD SRPS Form 9 2020-2025 free printable template

Show details

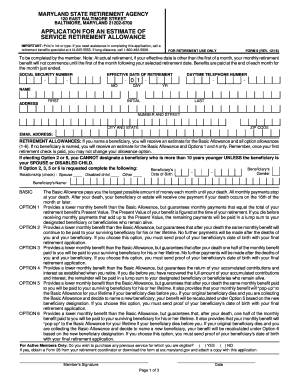

Maryland State Retirement and Pension System 120 East Baltimore Street Baltimore MD 21202-6700 sra.maryland. At retirement your employer will certify any unused sick leave days to the Retirement Agency but you must retire within 30 days of separating from employment in order to be credited with these days. Gov Estimate of Service Retirement Allowance Form 9 Continued from previous page. o Provide a beneficiary s name relationship to you date of birth and gender if you are interested in a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sra maryland gov

Edit your sra maryland gov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sra maryland gov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sra maryland gov online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sra maryland gov. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD SRPS Form 9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sra maryland gov

How to fill out MD SRPS Form 9

01

Obtain the MD SRPS Form 9 from the relevant agency or website.

02

Fill in your personal information in the designated fields, including your name, address, and contact details.

03

Provide details of your employment history, including employer names, positions held, and dates of employment.

04

Include any relevant information about your educational background and qualifications.

05

Specify the reason for filling out the form, such as applying for benefits or services.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom to certify that the information is true.

08

Submit the completed form to the appropriate agency as instructed.

Who needs MD SRPS Form 9?

01

Individuals applying for retirement benefits, disability benefits, or other services provided by the Maryland State Retirement and Pension System.

Fill

form

: Try Risk Free

People Also Ask about

What is a vested pension state of Maryland?

Vested Benefits A vested benefit refers to a benefit that is not payable at the time of separation from employment, but is deferred until the former member reaches normal retirement age. To qualify for this deferred vested benefit, you must not withdraw your contributions.

What are the rules for Maryland state retirement?

Age 60 with 30 years of service, or . Age 63 with 27 years of service. Members with at least 10 years of eligibility service become eligible for normal service retirement at age 65. When you retire, you will be able to choose from a number of payment options.

How long do you have to work before you get your pension?

The minimum retirement age for service retirement for most members is 50 years with five years of service credit. The more service credit you have, the higher your retirement benefits will be.

How many years do you have to work for the state to retire?

The minimum retirement age for service retirement for most members is 50 years with five years of service credit. The more service credit you have, the higher your retirement benefits will be. There are three basic types of retirement: service, disability, and industrial disability.

What are Maryland state retirement death benefits?

Your surviving spouse or a surviving designated beneficiary qualifies for a monthly benefit equal to 50% of the retirement allowance that would be payable to you or a lump sum payment consisting of your accumulated contributions and an amount equal to your annual salary at time of death.

What is a vested employee state of Maryland?

Vesting: Employees are vested in the pension system after five years of service and has increased to ten years of service if employed on or after July 1, 2011. Death Benefits: The Maryland State Retirement and Pension System administers the employee death benefit provision.

How is state of Maryland pension calculated?

Full service retirement allowances equal 1/55 (1.818 percent) of the highest three years' average final salary (AFS) multiplied by the number of years and months of accumulated creditable service.

How long do I have to work for the state of Maryland to get a pension?

Retirement eligibility at age 65 with at least 10 years of service, or age 60 with at least 15 years of service at a reduced benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sra maryland gov without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including sra maryland gov, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit sra maryland gov on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing sra maryland gov.

How do I complete sra maryland gov on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your sra maryland gov, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is MD SRPS Form 9?

MD SRPS Form 9 is a form used by Maryland State Retirement and Pension System (SRPS) members for reporting eligibility and service information.

Who is required to file MD SRPS Form 9?

Those who are members of the Maryland State Retirement and Pension System and need to report certain employment or eligibility details are required to file MD SRPS Form 9.

How to fill out MD SRPS Form 9?

To fill out MD SRPS Form 9, accurately complete the sections regarding personal details, employment history, and any required declarations. Follow the provided instructions carefully.

What is the purpose of MD SRPS Form 9?

The purpose of MD SRPS Form 9 is to collect necessary information from members regarding their service and eligibility for retirement benefits.

What information must be reported on MD SRPS Form 9?

Information that must be reported on MD SRPS Form 9 includes personal identification details, employment history, service credit, and any other relevant data necessary for retirement calculations.

Fill out your sra maryland gov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sra Maryland Gov is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.