TX Cube Tax Service Individual Income Tax Preparation Engagement Letter 2019 free printable template

Show details

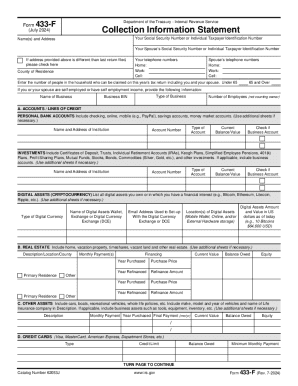

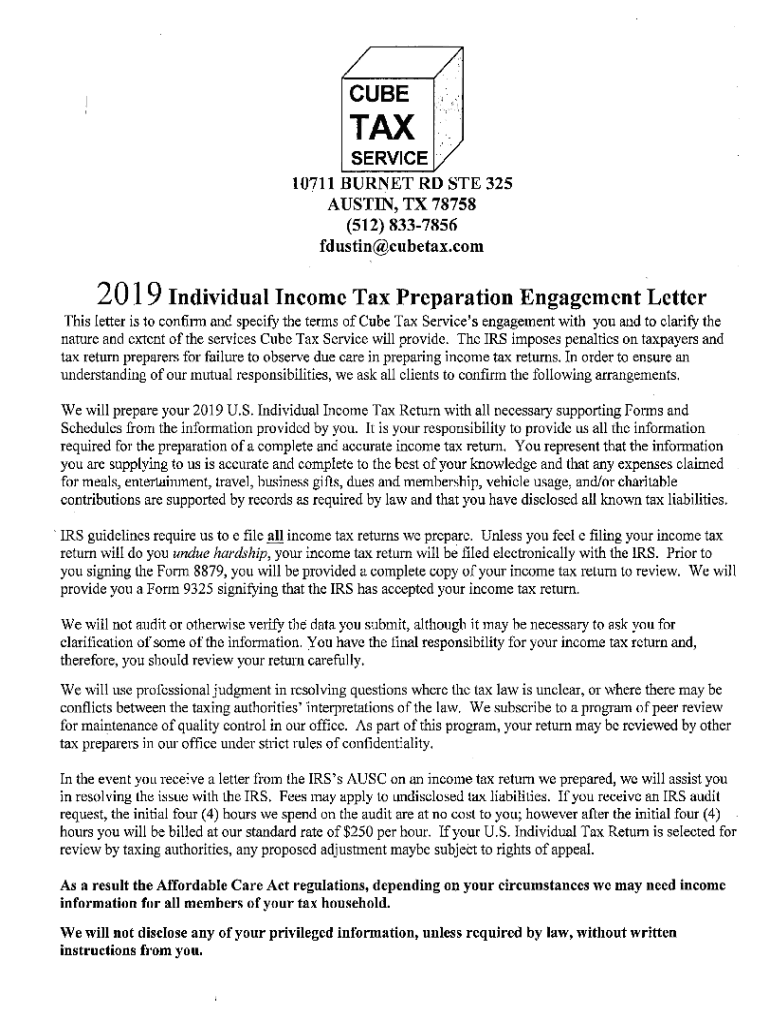

CUBE TAX SERVICE 10711 Burnet Road Suite 325 Austin TX 78758 512-833-7856 2018 Individual Income Tax Preparation Engagement Letter This letter is to confirm and specify the terms of Cube Tax Service s engagement with you and to clarify the nature and extent of the services Cube Tax Service will provide. The IRS imposes penalties on taxpayers and tax return preparers for failure to observe due care in preparing income tax returns. In order to ensure an understanding of our mutual...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Cube Tax Service Individual Income

Edit your TX Cube Tax Service Individual Income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Cube Tax Service Individual Income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Cube Tax Service Individual Income online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX Cube Tax Service Individual Income. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Cube Tax Service Individual Income Tax Preparation Engagement Letter Form Versions

Version

Form Popularity

Fillable & printabley

4.6 Satisfied (44 Votes)

4.8 Satisfied (30 Votes)

4.4 Satisfied (297 Votes)

4.3 Satisfied (42 Votes)

4.4 Satisfied (198 Votes)

How to fill out TX Cube Tax Service Individual Income

How to fill out TX Cube Tax Service Individual Income Tax

01

Gather all necessary documentation such as W-2 forms, 1099s, and any other income statements.

02

Organize deduction records, including receipts for expenses and any relevant tax credits.

03

Visit the TX Cube Tax Service website or office to access the Individual Income Tax forms.

04

Begin filling out the form by entering your personal information accurately.

05

Input your income data from the gathered documents in the designated fields.

06

Complete sections regarding deductions and credits based on your organized records.

07

Review all information for accuracy and completeness.

08

Submit your completed tax form either electronically through TX Cube or via mail.

Who needs TX Cube Tax Service Individual Income Tax?

01

Individuals who have earned income and need to file their personal income tax.

02

Self-employed individuals looking to report their earnings and deductions.

03

Residents of Texas who are seeking professional assistance with their tax filings.

04

People who want to maximize their tax refunds through detailed tax preparation services.

Fill

form

: Try Risk Free

People Also Ask about

Who needs an engagement letter?

Engagement letters are frequently used by accountants and bookkeepers when working with companies or individual clients. In fact, many insurance companies will require these in order to limit an accountant's professional liability.

Are tax engagement letters required?

While engagement letters are required for attest services, they are not required for certain other accounting services. However, best practices would dictate using them, especially when providing tax services.

What is an IRS engagement letter?

2022 Individual Tax Return Engagement Letter – Form 1040 2022 Individual Tax Return Engagement Letter – Form 1040. Resource download available. An engagement letter is a contract that establishes the services a practitioner will provide to his or her clients.

Do accountants need an engagement letter?

Accountants are required to have engagement letters with each client. Engagement letters help set expectations and define the business contract between a professional firm and its clients. It outlines the fee structure, responsibilities and obligations of the accounting firm and its client.

How do I write an engagement letter for tax preparation?

Thank you for choosing our firm, _ ("Accountant") to assist you with your tax returns. This letter confirms the terms of my engagement with you and outlines the nature and extent of the services I will provide. I will prepare your federal and state income tax returns.

Are letters of engagement mandatory?

A letter of engagement is a mandatory requirement which sets out the legal relationship between a professional firm and its client.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TX Cube Tax Service Individual Income from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like TX Cube Tax Service Individual Income, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete TX Cube Tax Service Individual Income online?

pdfFiller makes it easy to finish and sign TX Cube Tax Service Individual Income online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out TX Cube Tax Service Individual Income using my mobile device?

Use the pdfFiller mobile app to complete and sign TX Cube Tax Service Individual Income on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is TX Cube Tax Service Individual Income Tax?

TX Cube Tax Service Individual Income Tax is a service provided to assist individuals in preparing and filing their personal income tax returns. It encompasses various tax preparation and advisory services to ensure compliance with federal and state tax regulations.

Who is required to file TX Cube Tax Service Individual Income Tax?

Individuals who have a certain level of income, meet specific filing requirements based on their filing status, and those who owe taxes or are eligible for refunds are required to file TX Cube Tax Service Individual Income Tax.

How to fill out TX Cube Tax Service Individual Income Tax?

To fill out TX Cube Tax Service Individual Income Tax, individuals typically need to gather their financial documents, such as W-2s, 1099s, and any other relevant income statements. They then follow the service's instructions to complete the necessary forms either online or through paper submission.

What is the purpose of TX Cube Tax Service Individual Income Tax?

The purpose of TX Cube Tax Service Individual Income Tax is to facilitate the accurate reporting of individuals' income, calculate tax liability, and ensure compliance with tax laws, as well as to maximize potential tax refunds for eligible taxpayers.

What information must be reported on TX Cube Tax Service Individual Income Tax?

Information that must be reported includes personal identification details, total income earned, deductions and credits claimed, tax payments made, and any other relevant financial data impacting the taxpayer's total taxable income.

Fill out your TX Cube Tax Service Individual Income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Cube Tax Service Individual Income is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.