Get the free pdffiller

Show details

Notice

Tax Year

Notice date

Social Security number

AUR control number

To contact department of the Treasury

Internal Revenue Service

PO Box 16335

Philadelphia, PA 191140439CP2000

2017

January 30,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs audit letter example form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out irs audit letter cp2000?

01

Review the letter: carefully read through the letter received from the IRS to understand the specific issues they are addressing and the suggested changes.

02

Verify information: cross-check the information mentioned in the letter with your own records, including income, deductions, and credits claimed.

03

Gather supporting documents: gather all relevant documents such as W-2s, 1099s, receipts, and any other evidence that validates your claimed deductions or credits.

04

Respond within the deadline: ensure that you respond to the letter within the given timeframe mentioned in the letter. Failure to respond may result in penalties or further actions from the IRS.

05

Prepare a response: construct a clear and concise response, addressing each issue raised by the IRS. Provide explanations, supporting documents, and any additional information necessary to support your position.

06

Seek professional assistance if needed: if you find the process overwhelming or if you are unsure about how to respond appropriately, consider seeking assistance from a tax professional who can guide you through the process.

07

Submit the response: once you have reviewed your response and accompanying documents, make copies for your records and mail them to the address provided in the IRS letter.

Who needs irs audit letter cp2000?

01

Taxpayers who have been identified by the IRS as having potentially underreported their income or claimed incorrect deductions or credits on their tax return.

02

Individuals or businesses who received income that was not reported to the IRS, such as 1099 income, and the IRS is requesting additional information or adjustments.

03

Any taxpayer who has been notified by the IRS that they are being audited or that there are discrepancies on their tax return that need to be resolved.

Fill

form

: Try Risk Free

People Also Ask about

Will CP2000 lead to audit?

CP2000 notices aren't audits, but they work the same. It's important to fully respond by the IRS deadline. You have the right to contest penalties and appeal a CP2000 determination.

How often are CP2000 wrong?

IRS statistics show that one out of every three CP2000 notices (also called underreporter inquiries) doesn't result in the taxpayer owing more taxes. But, to show the IRS that you don't owe, you must respond effectively.

What is a CP2000 audit?

When you get a CP2000 notice in the mail from the IRS, it means that the IRS thinks you left income off your tax return. CP2000 notices feel a lot like an audit. But really, the IRS is just asking you to explain why there's a mismatch between your return and IRS records.

What is the difference between CP2000 and audit?

A CP2000 is not a notification of an audit; you are not automatically being audited if you receive one of these letters. Nor is it a bill. Rather, it's a notice of proposed changes to your tax return.

Can a CP2000 turn into an audit?

Can the IRS turn a CP2000 into an audit? Yes, but this is rare. If the CP2000 involves complex interpretation of the facts or tax law, the IRS or the taxpayer can request that the CP2000 be transferred to IRS audit.

Should I be worried about a CP2000?

Scams and identity theft In some rare cases, getting a CP2000 might also alert you to the fact that someone else is using your name and Social Security number. If you suspect you might be the victim of identity theft, contact the IRS and your state tax agency.

How much does an IRS audit defense cost?

With TaxAudit, you should never have to meet the IRS or state taxing authority! An Audit Defense Membership can be purchased each tax year for a nominal, one-time fee of only $49.99 — rather than fees over $150/hour that other tax professionals charge. Become a member today!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pdffiller form?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your pdffiller form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out the pdffiller form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign pdffiller form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete pdffiller form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your pdffiller form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

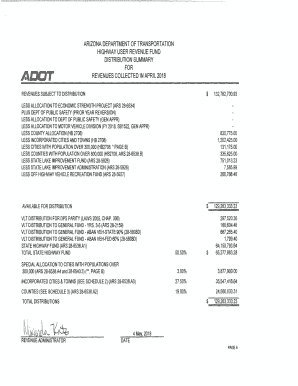

What is irs audit letter cp2000?

The IRS audit letter CP2000 is a notice sent by the Internal Revenue Service (IRS) to inform taxpayers that there is a discrepancy between the income reported on their tax return and the income reported to the IRS by third parties, such as employers or banks.

Who is required to file irs audit letter cp2000?

Taxpayers who receive a CP2000 notice are required to respond to it, providing clarification or corrections regarding any discrepancies noted by the IRS. It is not a filing requirement per se, but rather a response to an inquiry.

How to fill out irs audit letter cp2000?

To respond to a CP2000 notice, taxpayers should review the notice carefully, gather necessary documentation to support their claims, and complete the response form included with the notice. They should provide clear explanations for any discrepancies and submit their response by the deadline specified.

What is the purpose of irs audit letter cp2000?

The purpose of the CP2000 letter is to notify taxpayers of discrepancies in their tax return information, giving them an opportunity to explain or correct the reported income and resolve any potential tax liabilities before the IRS makes a formal adjustment.

What information must be reported on irs audit letter cp2000?

Taxpayers must report information including their correct income figures, explanations for any discrepancies, supporting documentation (such as W-2s or 1099s), and any adjustments they believe are necessary to remedy the issues raised in the letter.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.