Get the free Provider's Escrow Certification

Show details

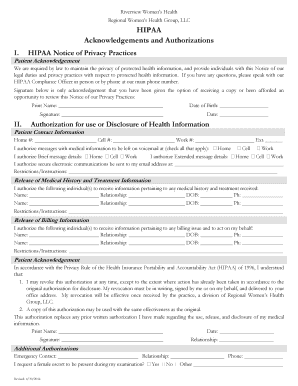

This form is required to be executed and attached by the Provider to the escrow statement submitted to the Office of Insurance Regulation for each calendar quarter, certifying the investment of escrow

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign providers escrow certification

Edit your providers escrow certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your providers escrow certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing providers escrow certification online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit providers escrow certification. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out providers escrow certification

How to fill out Provider's Escrow Certification

01

Obtain the Provider's Escrow Certification form from the appropriate regulatory authority or website.

02

Carefully read the instructions provided with the form.

03

Fill out your personal or business information in the designated fields, ensuring accuracy.

04

Provide details about the escrow account, including account number and institution.

05

Indicate the purpose of the escrow and any relevant contracts or agreements that relate.

06

Include any signatures required, such as the provider and possibly a witness or notary.

07

Review the completed form for any errors or omissions.

08

Submit the form to the designated authority, either electronically or via mail as instructed.

Who needs Provider's Escrow Certification?

01

Providers involved in escrow agreements for services such as legal, financial, or real estate transactions.

02

Businesses that require certification to comply with regulatory requirements regarding escrow accounts.

03

Individuals or organizations seeking to establish credibility and transparency in handling client funds.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean when your real estate license is in escrow?

"In escrow" is often used in real estate transactions when property, cash, and the property's title are held in escrow until predetermined conditions are met. Escrow is often associated with real estate transactions, but it can apply to any situation in which funds will pass from one party to another.

Do you need a degree to be an escrow assistant?

A bachelor's degree is the level of education sought the most by employers of escrow assistants. ing to job data, a bachelor's degree was required for 36% of positions. In 36% of job listings no education level was listed and in 24% of postings a High School diploma or GED was required.

What is a certified escrow officer?

The California Escrow Association (CEA) states that you might handle real property sales, loan escrows, subdivision escrows, mobile homes or land contracts. Other types of escrows include exchanges and deed of sale trusts). The term 'escrow officer' tends to be common in the western states.

What do you need to be an escrow agent?

How to become an escrow officer Earn a high school diploma. A high school diploma or equivalent is the minimum education requirement for most employers that hire escrow officers. Gain relevant experience. Create your resume. Apply for a state license. Obtain insurance. Become a notary public.

How much do escrow officers make per transaction?

0:13 2:36 To $74,888 while some escrow officers might earn commissions based on their performance. This is notMoreTo $74,888 while some escrow officers might earn commissions based on their performance. This is not the standard practice most often they receive a base salary along with benefits.

What does it take to be an escrow agent?

Satisfy All Eligibility/Licensing Requirements The specific procedures for earning a license can also vary from state to state, but might include taking an escrow officer training course and passing an exam. You may also need hours of relevant work experience before becoming eligible for this process.

How long does it take to become an escrow officer?

You must have two or more years of closing experience, either as an escrow assistant or in real estate accounting and math skills to calculate interest, taxes, and commissions accurately.

How do escrow agents make money?

How do escrow officers get paid? Escrow agents usually earn a salary. Unlike real estate agents and loan officers, their pay isn't solely based on a percentage of the sales price or loan amount. That said, many escrow officers earn commissions or bonuses on top of their regular salaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

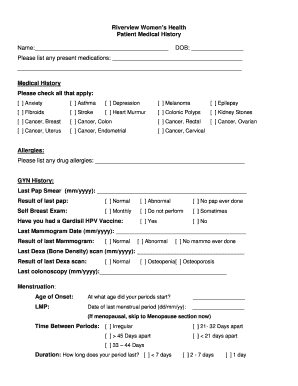

What is Provider's Escrow Certification?

Provider's Escrow Certification is a document that verifies the existence and management of funds held in escrow accounts for providers offering services in certain industries, ensuring compliance with regulations.

Who is required to file Provider's Escrow Certification?

Providers who manage or operate escrow accounts as part of their business operations are required to file the Provider's Escrow Certification to maintain regulatory compliance.

How to fill out Provider's Escrow Certification?

To fill out the Provider's Escrow Certification, one must accurately provide details about the escrow account, including account number, financial institution information, and compliance with relevant regulations.

What is the purpose of Provider's Escrow Certification?

The purpose of the Provider's Escrow Certification is to ensure transparency and accountability in the management of escrow funds, safeguarding the interests of clients and compliance with industry regulations.

What information must be reported on Provider's Escrow Certification?

Information reported on the Provider's Escrow Certification typically includes account details, the amount of funds held in escrow, the purpose of the escrow, and details of the entity managing the escrow account.

Fill out your providers escrow certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Providers Escrow Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.