NM PIT-B 2019 free printable template

Show details

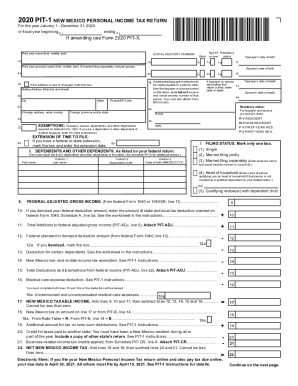

2019 PIT-B *190580200* NEW MEXICO ALLOCATION AND APPORTIONMENT OF INCOME SCHEDULE YOUR SOCIAL SECURITY NUMBER Print your name (first, middle, last) Taxpayers who allocate and apportion income from

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM PIT-B

Edit your NM PIT-B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM PIT-B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM PIT-B online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM PIT-B. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM PIT-B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM PIT-B

How to fill out NM PIT-B

01

Gather your personal information including your Social Security number and residency status.

02

Collect all income information including W-2 forms and 1099 forms for the tax year.

03

Report your total income on the designated lines in the NM PIT-B form.

04

Claim any applicable deductions such as standard deductions or itemized deductions.

05

Calculate your taxable income by subtracting deductions from your total income.

06

Use the tax tables provided in the instructions to determine your tax liability.

07

Fill out credits that you may qualify for, such as the primary taxpayer credit.

08

Review all entries carefully for accuracy before submitting.

09

Sign and date the form before submitting it to the New Mexico Taxation and Revenue Department.

Who needs NM PIT-B?

01

Residents of New Mexico who earn income and need to report it for tax purposes.

02

Individuals or businesses who are required to file taxes in New Mexico.

03

Taxpayers looking to claim any deductions or credits applicable to their situation.

Fill

form

: Try Risk Free

People Also Ask about

What does pit stand for in taxes?

Employers Depositing Only Personal Income Tax (PIT) Withholding (Including Payers of Pensions and Annuities)

What is PIT in employment?

Wages are subject to all employment (payroll) taxes and reportable as Personal Income Tax (PIT) wages unless otherwise stated. Wages paid to employees are taxable, regardless of the method of payment, whether by private agreement, consent, or mandate.

How do I get New Mexico tax forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

What is the meaning of PIT rate?

Personal Income Tax (PIT) is a direct tax levied on personal income including wages and salaries, director's fees, dividends, royalties and rental income, amongst others. PIT is paid by resident and non-resident individuals once they engage in taxable or income-generating activities in the country in question.

What does pit mean in HR?

Personal Income Tax (PIT), also known as individual income tax, is a tax on employee earnings. ing to the IRS, earned income is money earned as an employee or as the owner of a business or farm.

What is New Mexico Schedule Pit B?

Schedule PIT-B provides a credit against New Mexico tax equal to the New Mexico source income divided by total income everywhere. NOTE: Qualifying residents may be eligible to claim credit for taxes paid to another state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NM PIT-B to be eSigned by others?

When your NM PIT-B is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit NM PIT-B online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your NM PIT-B and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the NM PIT-B electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NM PIT-B.

What is NM PIT-B?

NM PIT-B is the New Mexico Personal Income Tax B form used by residents and non-residents of New Mexico to report income and calculate state tax obligations.

Who is required to file NM PIT-B?

Individuals who have New Mexico-sourced income or are residents of New Mexico and meet the filing thresholds are required to file NM PIT-B.

How to fill out NM PIT-B?

To fill out NM PIT-B, individuals must provide their personal information, report their income, claim deductions, and calculate their tax liability according to the instructions provided on the form.

What is the purpose of NM PIT-B?

The purpose of NM PIT-B is to ensure that individuals report their taxable income accurately and pay the appropriate amount of personal income tax to the state of New Mexico.

What information must be reported on NM PIT-B?

NM PIT-B requires reporting personal identification details, income amounts from various sources, applicable deductions, credits, and the total tax owed or refundable.

Fill out your NM PIT-B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM PIT-B is not the form you're looking for?Search for another form here.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.