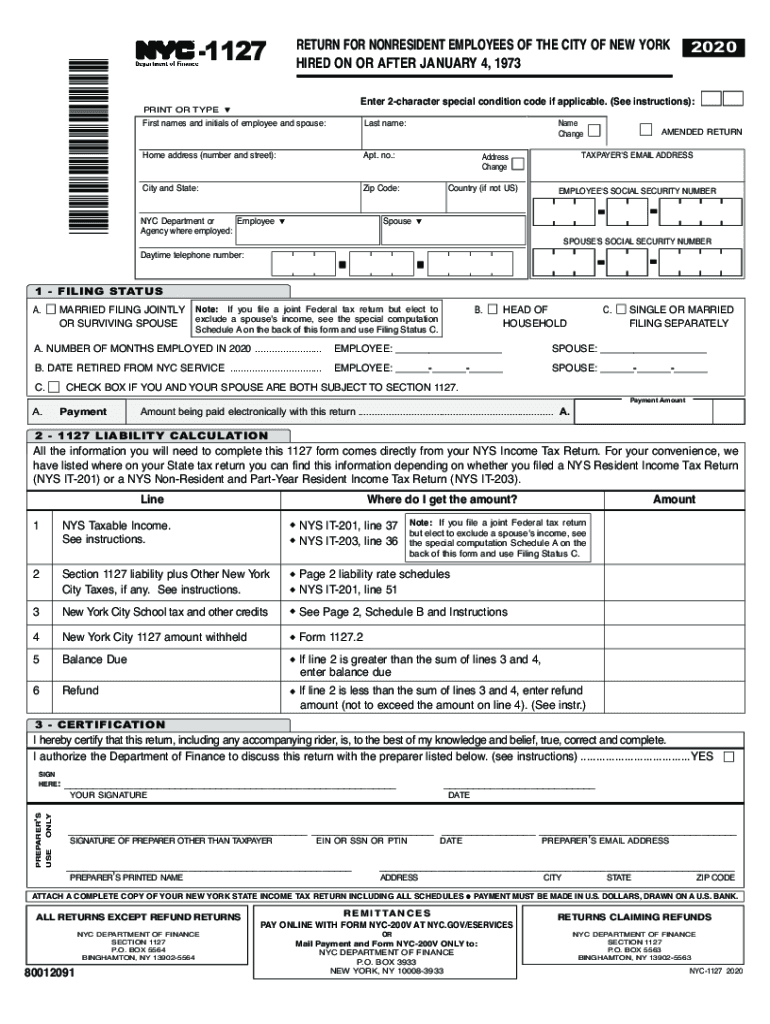

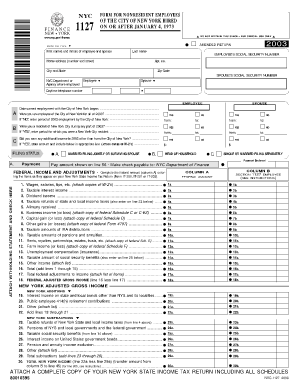

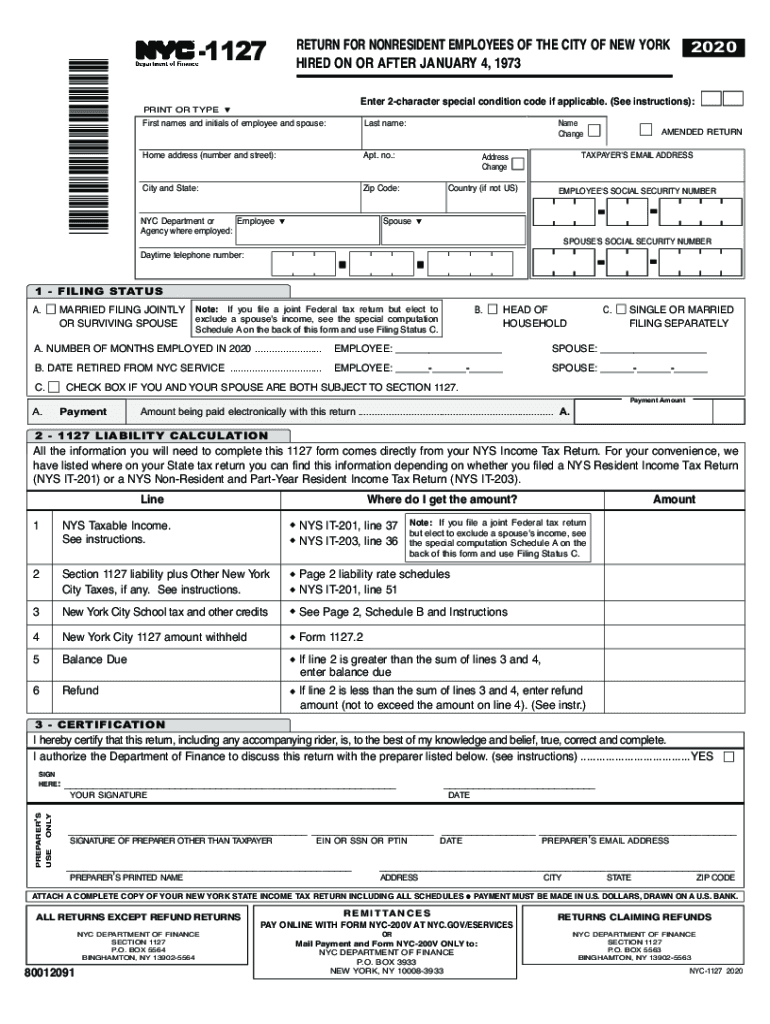

NY NYC-1127 2020 free printable template

Get, Create, Make and Sign NY NYC-1127

Editing NY NYC-1127 online

Uncompromising security for your PDF editing and eSignature needs

NY NYC-1127 Form Versions

How to fill out NY NYC-1127

How to fill out NY NYC-1127

Who needs NY NYC-1127?

Instructions and Help about NY NYC-1127

Hi I'm mark for attacks comm if you live in New Jersey, but you're employed in New York you'll file a New Jersey resident return which taxes all your income you'll also have to file a non-resident return from New York paying taxes on the income you earned in New York now while it may seem like you're paying taxes on the same income twice you're given the ability to claim a credit for the taxes paid in New York New Jersey residents are allotted a tax credit for any income taxes paid to New York this credit is deducted on the New Jersey schedule NJ — com for more information visit e tax com

People Also Ask about

What is Section 1127 of the New York City Charter?

Who qualifies for NYC school tax credit?

How to claim New York City School tax credit 2022?

Are NYC DOE employees exempt from 1127?

Do I need to fill out NYC-1127?

Can you file NYC-1127 online?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY NYC-1127 online?

How do I make edits in NY NYC-1127 without leaving Chrome?

How can I fill out NY NYC-1127 on an iOS device?

What is NY NYC-1127?

Who is required to file NY NYC-1127?

How to fill out NY NYC-1127?

What is the purpose of NY NYC-1127?

What information must be reported on NY NYC-1127?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.