OFSR 305G 2020-2025 free printable template

Show details

PROCEDURES FOR PUNY EMPLOYEE TUITION WAIVER PLEASE READ BEFORE COMPLETING THE TUITION WAIVER FORM (FSR 305): As part the “Economic Growth and Tax Relief Reconciliation Act of 2001 (EXTRA), which

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deduction job form

Edit your refundable restrictions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your students job work form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deduction tax 2020-2025 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deduction tax 2020-2025 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OFSR 305G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out deduction tax 2020-2025 form

How to fill out OFSR 305G

01

Obtain the OFSR 305G form from the official website or designated office.

02

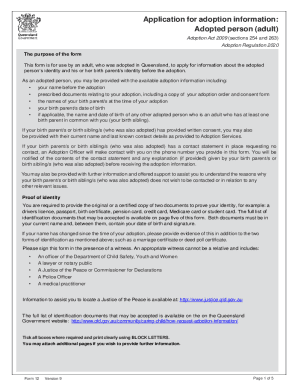

Read the instructions carefully to ensure you understand the requirements.

03

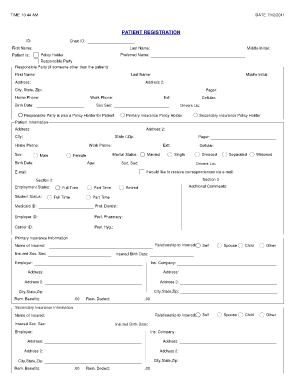

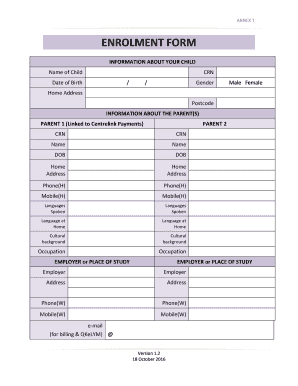

Fill in your personal information, including your name, address, and contact details.

04

Provide the required details about the specific fiscal period you are reporting on.

05

Accurately enter the financial figures as requested in the relevant sections.

06

Double-check all entries for accuracy to avoid errors.

07

Sign and date the form where indicated.

08

Submit the completed form via the prescribed method, such as online or by mail.

Who needs OFSR 305G?

01

Individuals or businesses required to report financial information for regulatory compliance.

02

Taxpayers who need to provide detailed financial data to tax authorities.

03

Organizations seeking grants or funding that require financial disclosures.

Fill

form

: Try Risk Free

People Also Ask about

Are tuition waivers taxable?

Free or reduced tuition provided by eligible educational institutions to its employees may be excludable from gross income as a qualified tuition reduction.

Do SUNY employees get free tuition?

The SUNY Tuition Waiver Program waives employee tuition expenses for career-related, credit bearing course work taken at SUNY State-operated campuses. Partial tuition, generally 75% per course, but not exceeding a total of $750 per fiscal year, is waived subject to availability of funds.

How do I get a fee waiver for CUNY?

Fee Waivers. Current CUNY students: if you're currently enrolled at CUNY and intend to transfer without a gap in your enrollment, answer the CUNY Enrollment question on the application to waive your application fee.

How do I ask for a fee waiver code?

Just ask the college! Call the college admissions office or university you plan on applying to and ask what their fee waiver policy is. Many schools have straightforward processes for fee waivers and might request you send in a letter from your guidance counselor or mentor explaining your financial situation.

How do I get a CUNY fee waiver code?

You may obtain this printout from your assigned worker, or from a New York City Human Resources Administration Medicaid Office or call 1 (877) HRA-8411.

How do I get a CUNY issued fee waiver?

Eligible students currently need to request a unique fee waiver code which is generated by CUNY's University Admissions Office and distributed through their school guidance counselors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my deduction tax 2020-2025 form directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your deduction tax 2020-2025 form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make changes in deduction tax 2020-2025 form?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your deduction tax 2020-2025 form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in deduction tax 2020-2025 form without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing deduction tax 2020-2025 form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is OFSR 305G?

OFSR 305G is a form required by the U.S. government that is used to gather information on foreign ownership and control of certain entities and individuals.

Who is required to file OFSR 305G?

Entities and individuals who are engaged in certain activities involving foreign investment or ownership, as mandated by the relevant regulatory authorities, are required to file OFSR 305G.

How to fill out OFSR 305G?

To fill out OFSR 305G, the filer must provide accurate details regarding the entity's structure, ownership, and any foreign interests, ensuring all required fields are completed correctly.

What is the purpose of OFSR 305G?

The purpose of OFSR 305G is to monitor and assess foreign investment in U.S. entities, ensuring compliance with national security regulations and other federal requirements.

What information must be reported on OFSR 305G?

Information that must be reported on OFSR 305G includes the entity's name, address, ownership details, the nature of foreign interests, and any relevant agreements.

Fill out your deduction tax 2020-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deduction Tax 2020-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.