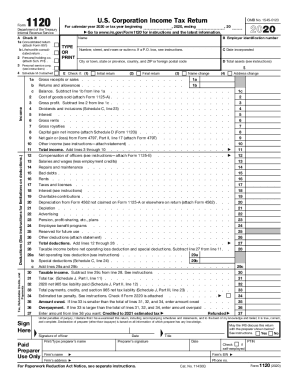

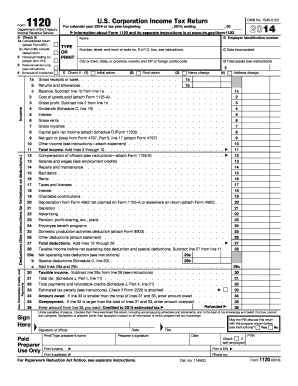

IRS 1120-PC 2020 free printable template

Show details

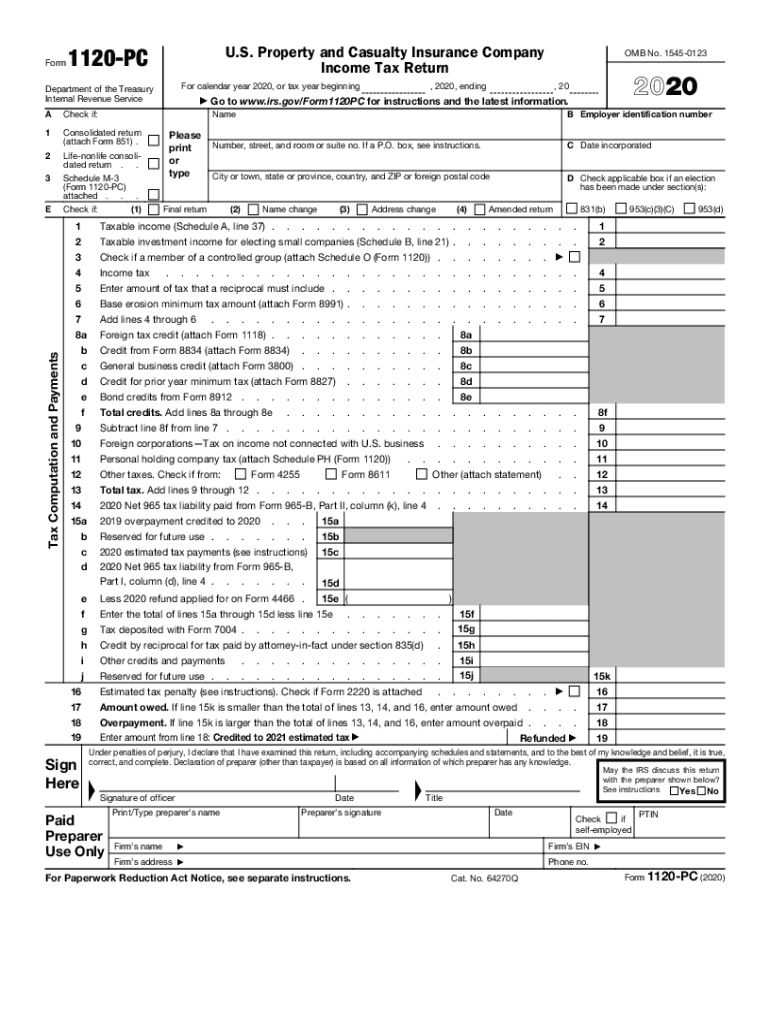

Form. S. Property and Casualty Insurance Company

Income Tax Return1120PCFor calendar year 2020, or tax year beginningDepartment of the Treasury

Internal Revenue Service

Check if:1Consolidated return

(attach

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-PC

How to edit IRS 1120-PC

How to fill out IRS 1120-PC

Instructions and Help about IRS 1120-PC

How to edit IRS 1120-PC

To edit IRS 1120-PC, use a reliable PDF editing platform like pdfFiller. Upload the form to the platform, make the necessary changes, and save the edited document. Ensure that all entries comply with IRS regulations to avoid errors during submission.

How to fill out IRS 1120-PC

Filling out IRS 1120-PC involves several key steps. First, gather all necessary documents, including financial statements and any prior tax filings related to this form. Next, follow the instructions provided on the form, ensuring that all fields are completed accurately.

Be mindful of the specific income sources and deductions applicable to your entity. It is advisable to review each section methodically to minimize errors.

About IRS 1120-PC 2020 previous version

What is IRS 1120-PC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-PC 2020 previous version

What is IRS 1120-PC?

IRS 1120-PC is a tax form used by certain insurance companies to report income, deductions, and tax liabilities. Specifically designed for property and casualty insurance providers, this form helps calculate the taxes owed by these entities to the Internal Revenue Service (IRS).

What is the purpose of this form?

The main purpose of IRS 1120-PC is to provide a comprehensive overview of an insurance company's financial activities during the tax year. By detailing income, expenses, and applicable credits, the form ensures accurate tax calculations and compliance with federal tax laws.

Who needs the form?

Insurance companies classified as property and casualty insurers need to file IRS 1120-PC annually. This includes entities that derive their primary income from insuring risks associated with property damage and liability claims.

When am I exempt from filling out this form?

Exemptions from filing IRS 1120-PC typically apply to companies that do not meet the definition of a property and casualty insurance provider. Entities that operate exclusively in other areas, such as life insurance, may not be required to submit this form. Additionally, certain small insurance companies may qualify for simplified reporting options based on their income levels.

Components of the form

IRS 1120-PC comprises various components that capture essential financial data. Key sections include income reporting, deductions for business expenses, details on policyholder dividends, and a calculation of taxable income. Completing each section accurately is crucial for determining the correct tax liability.

What are the penalties for not issuing the form?

Failing to file IRS 1120-PC can result in significant penalties, including fines imposed by the IRS. Additionally, late filings may incur interest charges on any unpaid taxes. It is crucial for insurance companies to adhere to filing deadlines to avoid these consequences.

What information do you need when you file the form?

When filing IRS 1120-PC, be prepared to provide comprehensive financial data, including total income from premiums, expenses related to claims and operations, investment income, and any applicable tax credits. Having your accounting records organized will facilitate accurate reporting.

Is the form accompanied by other forms?

IRS 1120-PC may need to be filed alongside other forms or schedules, particularly if the insurance company has specific deductions, credits, or additional business activities. Review IRS guidelines to determine if additional documentation is necessary for your specific situation.

Where do I send the form?

The submission address for IRS 1120-PC depends on the location of the filing entity and whether the return is filed electronically or by mail. Refer to the IRS instructions on the form for the specific mailing address corresponding to your submission method.

See what our users say