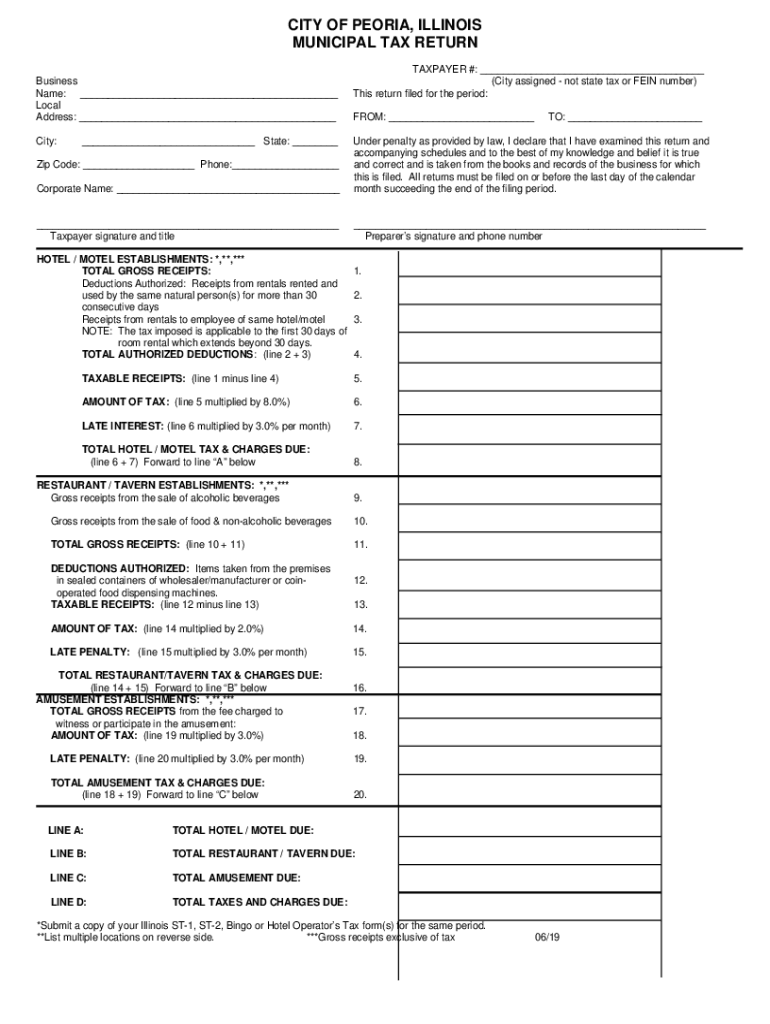

IL Municipal Tax Return 2019-2025 free printable template

Get, Create, Make and Sign il peoria tax return

How to edit il peoria tax return online

Uncompromising security for your PDF editing and eSignature needs

IL Municipal Tax Return Form Versions

How to fill out il peoria tax return

How to fill out IL Municipal Tax Return

Who needs IL Municipal Tax Return?

Instructions and Help about il peoria tax return

Drink pouring — Voice over In the early1900s there was a saloon one saloon for every 300 people And that would have been 30x the amount of saloons that you had today — Peoria whiskey capital of the world That wasn't just a catchphrase it was fact Prior to 1920 Peoria was home to a total of 73 distilleries and 24 breweries and that meant wealth Houses on Moss Avenue and High Street reflected the money of the day Facilities for all Persians to use funded by whiskey barons dotted the cityscape The Grand Opera House The Grand Army of the Republic Hall ornate theaters artwork and much more upbeat swing music It meant jobs for many and the US Government benefited as the Peoria area paid more in Federal Texas than any other tax district in America The production of alcohol began in the city in 1837 when Andrew Title built the first brewery and Albion Cole erected Peoria's first distillery six years later The industry burgeoned and liquor was an elixir for Persians for more than 80 years But times change and the laws changed The 18th Amendment It went into effect in January 1920, and it was a last call of the heady days of alcohol slow 1920s music While Constitutional Amendments have a seven-year time limit for passage it took just 11 months for the necessary three quarters of the then 48 states to ratify to Amendment that banned the production transport and sale of alcohol But temperance efforts started much earlier than that — Maine was the first state to forbid the sale of alcohol in 1851 And though they repealed that law five years later there was a huge pressure system of temperance settling over America's breadbasket as organizations were being formed to prohibit the sale of alcohol In Chicago in 1869 the Prohibition Party was founded Five years later the Women'Christian Temperance Union was created in Cleveland They focused not only on Prohibition but also on Suffrage — They were protesting liquor They wanted prohibition They saw that the way to really seal that would be to have the vote So those two things we're reworking at the same time But women were truly leading in Peoria Lucy Tying was very involved in the starting of the temperance movement here in Peoria It started as a local group for a couple of years and then affiliated with national — Despite these efforts in reform alcohol production grew to enormous proportions Especially here in Central Illinois where the water gave Peoria distillers a unique advantage The secret was held inside the bluffs below me — They wanted water that came out of a limestone quarry or a limestone well or had gone through a limestone filter — The limestone bluffs have springs with very good water and when they needed more water than that if you drill here toucan tap into aquifers underground rivers of very good quality water — When the Civil War began Congress needed cash to pay for the Union's war effort With the growth of the adult beverage industry they decided to impose a luxury tax on alcohol as well as...

People Also Ask about

Does Illinois have property tax relief for seniors?

Who qualifies for Illinois property tax credit?

Is there any property tax relief in Illinois?

What age do you stop paying property taxes in Illinois?

What are the exemptions for Illinois?

Who qualifies for senior freeze in Illinois?

How can I pay less property taxes in Illinois?

How do I get senior discount on property taxes in Illinois?

Who is exempt from paying property taxes in Illinois?

How long do you have to pay property taxes in Illinois?

Does Illinois have a mortgage exemption?

Who qualifies for the Illinois property tax credit?

Do disabled pay property taxes in Illinois?

When should I file Homeowners exemption?

At what age do seniors stop paying property taxes in Illinois?

Does Illinois have a property tax exemption for seniors?

Do seniors get a break on property taxes in Illinois?

Who qualifies for homeowners exemption in Illinois?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my il peoria tax return in Gmail?

Can I edit il peoria tax return on an Android device?

How do I fill out il peoria tax return on an Android device?

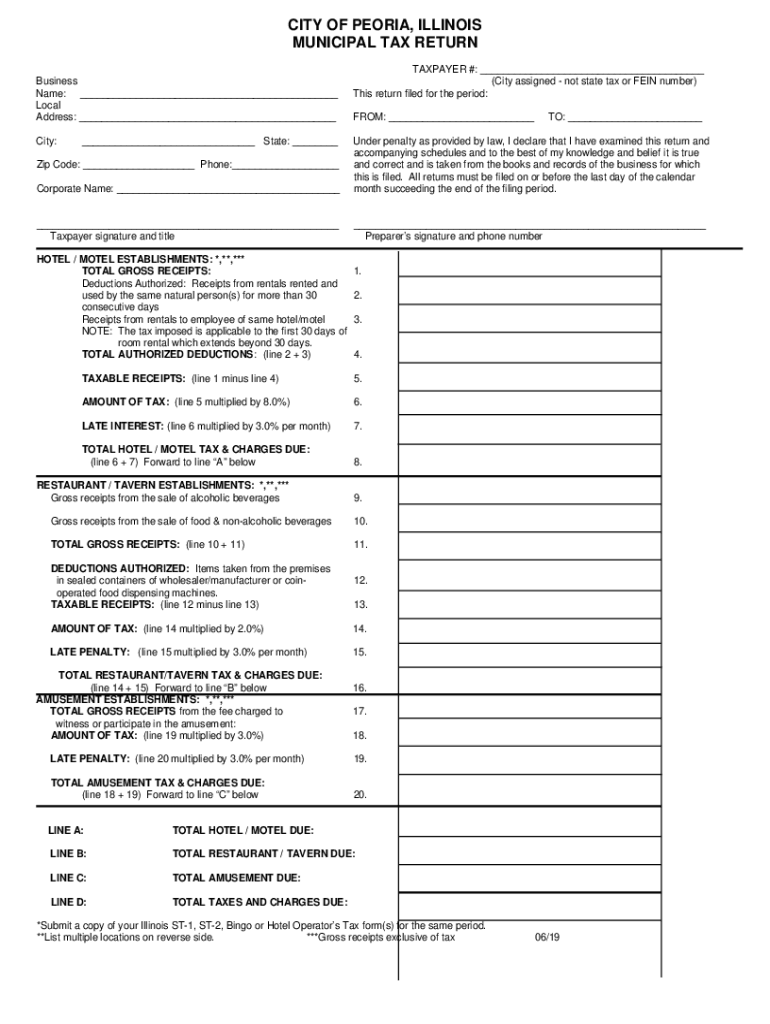

What is IL Municipal Tax Return?

Who is required to file IL Municipal Tax Return?

How to fill out IL Municipal Tax Return?

What is the purpose of IL Municipal Tax Return?

What information must be reported on IL Municipal Tax Return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.