MD Form MET 2 ADJ 2020-2025 free printable template

Show details

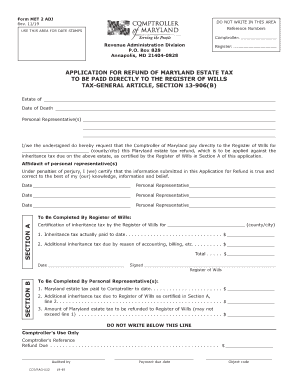

Form MET 2 ADJ Rev. 09/20DO NOT WRITE IN THIS AREA Reference Numbers USE THIS AREA FOR DATE STAMPSComptroller: Revenue Administration Division P.O. Box 828 Annapolis, MD 214040828Register: APPLICATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign met 2 adj refunn pdf form

Edit your adj maryland form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adj maryland form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing the adj maryland online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit met 2 maryland form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Form MET 2 ADJ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out adj of maryland 2020-2025

How to fill out MD Form MET 2 ADJ

01

Gather all necessary personal information, including your name, address, and contact details.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the sections regarding the purpose of the request clearly and accurately.

04

Include any required supporting documentation as specified in the form guidelines.

05

Review your entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form via the designated method (mail, fax, or online), following any submission guidelines.

Who needs MD Form MET 2 ADJ?

01

Individuals or entities seeking to adjust a previous action or request filed with the relevant authority.

02

Those needing to update information or respond to a notice related to their case.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a deceased person's Maryland tax return?

File the return within nine (9) months after the decedent's date of death, or by the approved extension date. The Maryland estate tax return must be filed directly with the Comptroller of Maryland. The Comptroller of Maryland will submit the MET-1 to the Register of Wills for certification on Section III.

Does the estate of a deceased person need to file a tax return?

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

What is the gift tax in Maryland?

Hence, with proper planning, a married couple can shelter up to $10,000,000 in assets from Maryland Estate Tax. The state of Maryland does not have a gift tax and therefore, making lifetime gifts is an effective way of reducing your exposure to Maryland estate tax. On January 13, 2023, Rep.

Who is exempt from Maryland estate tax?

Property passing to a child or other lineal descendant, spouse of a child or other lineal descendant, spouse, parent, grandparent, stepchild or stepparent, siblings or a corporation having only certain of these persons as stockholders is exempt from taxation. 10% on property passing to other individuals.

Who must file a Maryland estate tax return?

A Maryland estate tax return is required for every estate whose federal gross estate, plus adjusted taxable gifts, plus property for which a Maryland Qualified Terminal Interest Property (QTIP) election was previously made on a Maryland estate tax return filed for the estate of the decedent's predeceased spouse, equals

What is the estate tax exemption in Maryland 2023?

Maryland Estate Tax Exemption The estate tax threshold for Maryland is $5 million as of 2023. This means that if you die and your total estate is worth less than $5 million, the estate owes nothing at all to the state of Maryland.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete adj of maryland 2020-2025 online?

pdfFiller has made it simple to fill out and eSign adj of maryland 2020-2025. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the adj of maryland 2020-2025 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your adj of maryland 2020-2025 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit adj of maryland 2020-2025 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign adj of maryland 2020-2025 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is MD Form MET 2 ADJ?

MD Form MET 2 ADJ is a specific form used for the adjustment of the Maryland tax assessment for certain properties.

Who is required to file MD Form MET 2 ADJ?

Property owners or authorized representatives who wish to contest an assessment or seek an adjustment of their property's assessed value are required to file MD Form MET 2 ADJ.

How to fill out MD Form MET 2 ADJ?

To fill out MD Form MET 2 ADJ, gather necessary property information, accurately complete all sections of the form, provide details supporting the requested adjustment, and submit it to the appropriate Maryland state agency.

What is the purpose of MD Form MET 2 ADJ?

The purpose of MD Form MET 2 ADJ is to allow property owners to formally request adjustments to their property tax assessments based on new evidence or changes in property value.

What information must be reported on MD Form MET 2 ADJ?

MD Form MET 2 ADJ requires information such as the property owner's name and address, the property's identification number, assessment details, reasons for the adjustment request, and any supporting documentation.

Fill out your adj of maryland 2020-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Adj Of Maryland 2020-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.