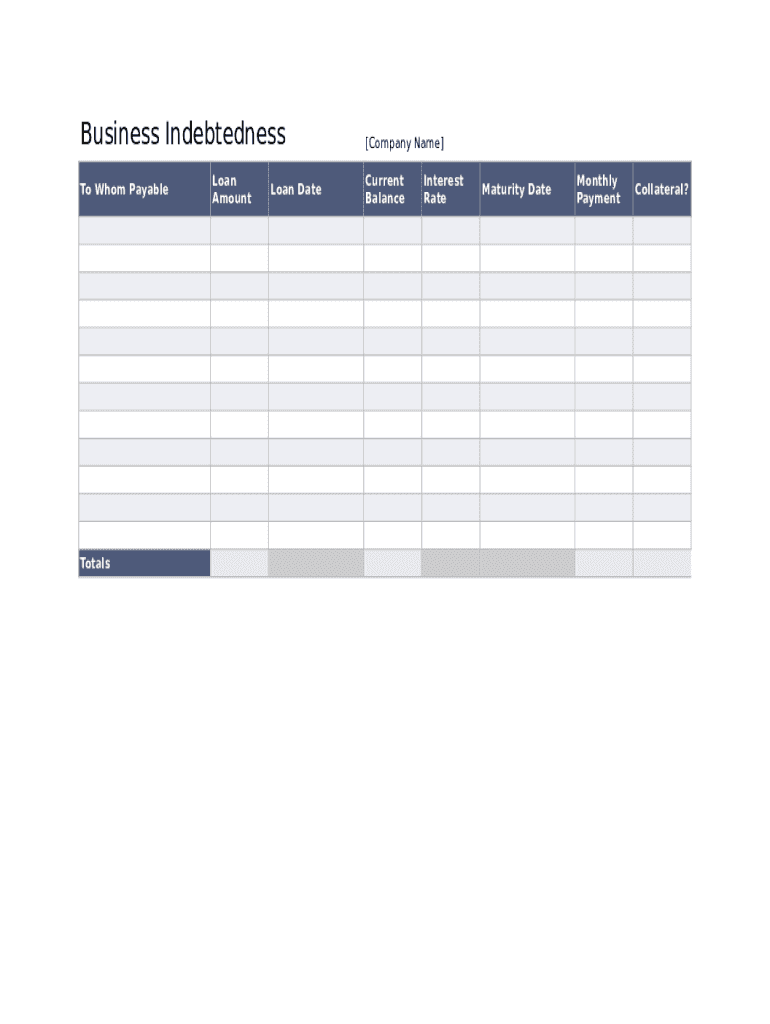

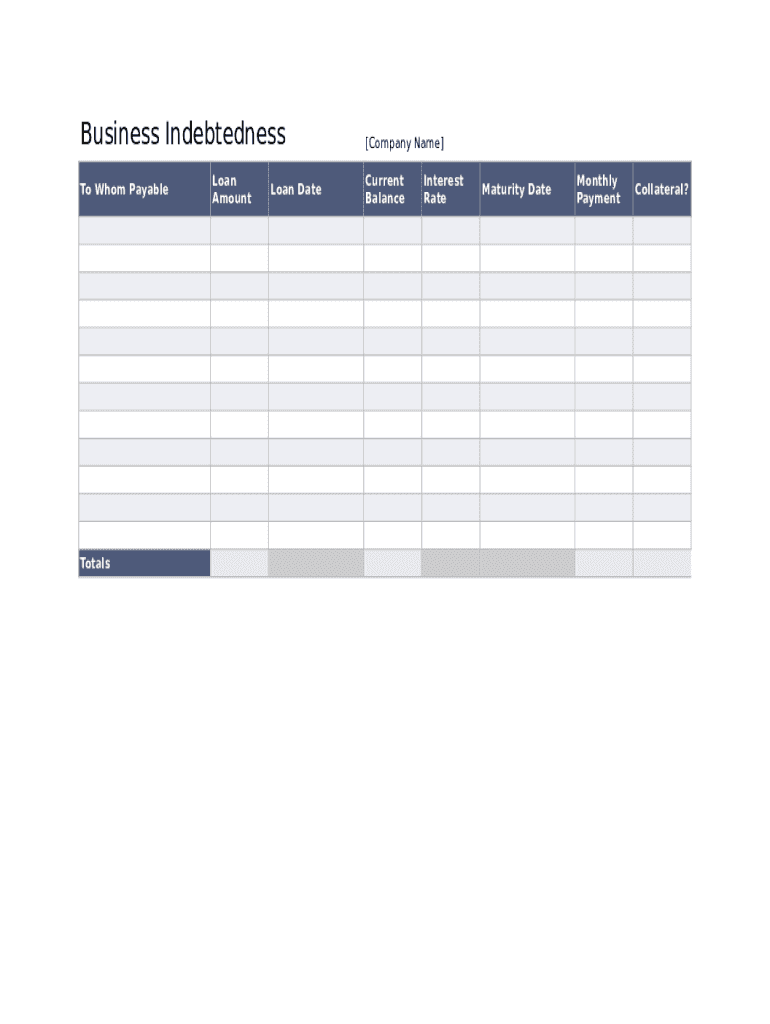

Business Indebtedness free printable template

Show details

Business Indebtedness To Whom PayableTotalsLoan AmountLoan Date Company Name Current BalanceInterest Prematurity DateMonthly PaymentCollateral? Date Current or Past Due Amt.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business indebtedness

Edit your business indebtedness form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business indebtedness form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business indebtedness online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business indebtedness. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business indebtedness

How to fill out Business Indebtedness

01

Gather information: Collect all necessary financial documents related to your business debts.

02

List your debts: Create a comprehensive list of all your existing business loans, credit lines, and any other forms of indebtedness.

03

Detail each debt: For each entry, specify the creditor's name, the original loan amount, current balance, interest rate, and due dates.

04

Outline the purpose: Explain the reason for each debt, such as purchasing equipment, inventory, or operational expenses.

05

Review repayment terms: Clearly outline the repayment schedule and terms for each debt, including any collateral involved.

06

Summarize total indebtedness: Calculate the total amount of business indebtedness and highlight any immediate repayment issues.

07

Consult a professional: Consider seeking advice from a financial advisor or accountant for accuracy and compliance.

Who needs Business Indebtedness?

01

Business owners seeking financing to expand their operations or invest in new projects.

02

Companies with existing debts that need to assess their financial health and repayment capacity.

03

Startups looking to demonstrate their financial obligations to potential investors or lenders.

04

Organizations preparing for loan applications or refinancing existing debt.

05

Small to medium-sized enterprises (SMEs) managing their cash flow and financial strategy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business indebtedness directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your business indebtedness and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send business indebtedness to be eSigned by others?

When you're ready to share your business indebtedness, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit business indebtedness in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your business indebtedness, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is Business Indebtedness?

Business Indebtedness refers to the total amount of debt that a business entity has incurred in order to finance its operations and growth. This includes loans, credit lines, and any other obligations that require repayment over time.

Who is required to file Business Indebtedness?

Typically, businesses that have outstanding debts or loans, including corporations, partnerships, and sole proprietorships, are required to file information regarding their Business Indebtedness. This may also apply to businesses wishing to report their financial standing for regulatory purposes.

How to fill out Business Indebtedness?

To fill out Business Indebtedness, businesses must provide detailed information about all outstanding debts, including the creditor's name, amount owed, interest rates, and repayment terms. This information is usually organized in a standardized form or report.

What is the purpose of Business Indebtedness?

The purpose of Business Indebtedness is to assess a business's financial leverage and ability to repay its debts. It helps stakeholders, including investors and creditors, evaluate the financial health of the business.

What information must be reported on Business Indebtedness?

The information that must be reported on Business Indebtedness typically includes the total amount of business debt, the types of debts (secured or unsecured), interest rates, repayment schedules, and the identity of creditors.

Fill out your business indebtedness online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Indebtedness is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.