Net Present Value Calculator free printable template

Show details

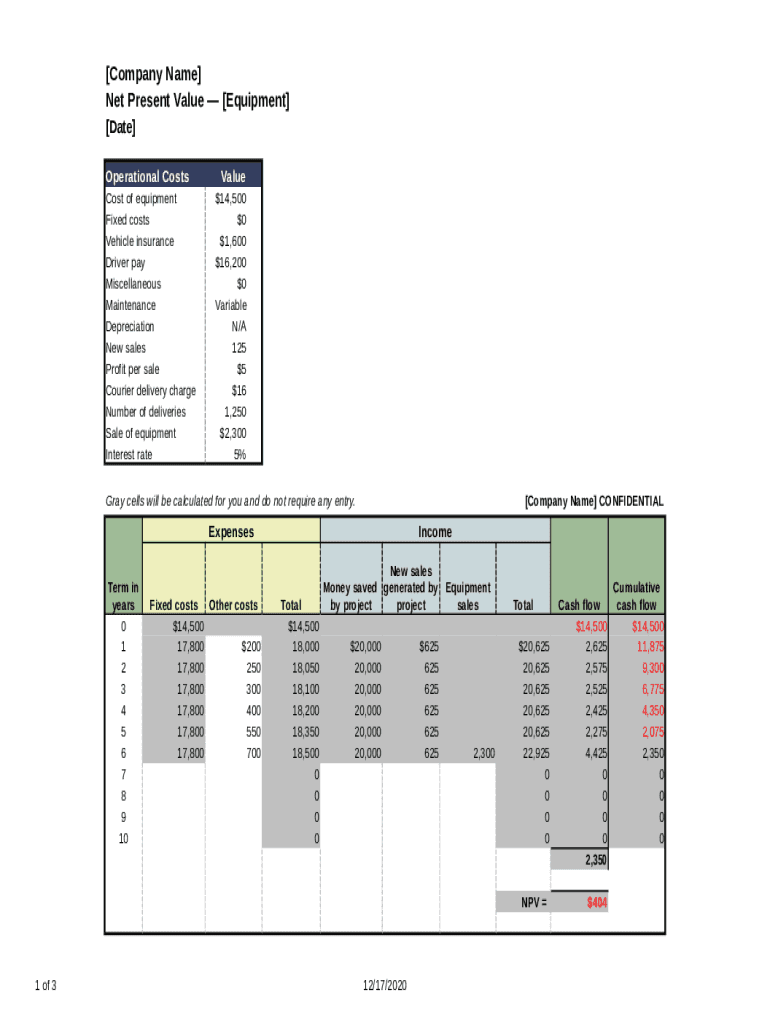

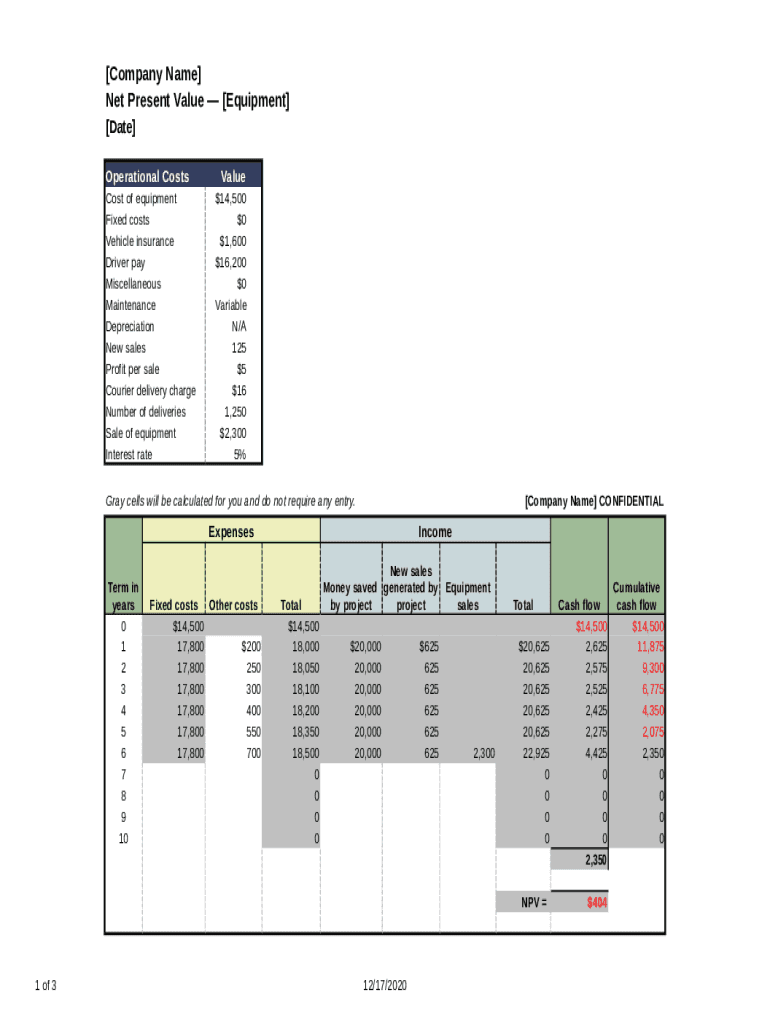

Company Name Net Present Value Equipment Date Operational Costs Cost of equipment Fixed costs Vehicle insurance Driver pay Miscellaneous Maintenance Depreciation New sales Profit per sale Courier

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Net Present Value Calculator

Edit your Net Present Value Calculator form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Net Present Value Calculator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Net Present Value Calculator online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Net Present Value Calculator. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Net Present Value Calculator

How to fill out Net Present Value Calculator

01

Identify the cash inflows and outflows for the investment.

02

Determine the expected time period for the cash flows.

03

Select an appropriate discount rate, usually based on the cost of capital or required rate of return.

04

Enter the cash flows for each period into the NPV calculator.

05

Input the discount rate into the relevant field.

06

Click on the calculate button to obtain the Net Present Value.

07

Analyze the result: if NPV is positive, the investment may be considered good; if negative, it may not be worth pursuing.

Who needs Net Present Value Calculator?

01

Investors looking to evaluate potential investments.

02

Companies assessing project viability.

03

Financial analysts conducting valuations.

04

Business students learning about financial metrics.

05

Individuals planning personal investments or retirement funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Net Present Value Calculator directly from Gmail?

Net Present Value Calculator and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit Net Present Value Calculator online?

With pdfFiller, the editing process is straightforward. Open your Net Present Value Calculator in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the Net Present Value Calculator in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your Net Present Value Calculator right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is Net Present Value Calculator?

A Net Present Value (NPV) Calculator is a financial tool used to determine the value of a series of cash flows over time, discounted back to their present value. It helps in assessing the profitability of an investment.

Who is required to file Net Present Value Calculator?

Individuals or businesses that are evaluating the feasibility of investments, projects, or financial decisions using projected cash flows are typically required to use a Net Present Value Calculator.

How to fill out Net Present Value Calculator?

To fill out a Net Present Value Calculator, you need to input the expected cash inflows and outflows over a specific period, the discount rate, and the initial investment. The calculator will then compute the NPV.

What is the purpose of Net Present Value Calculator?

The purpose of a Net Present Value Calculator is to evaluate the profitability of an investment by comparing the present value of cash inflows to the present value of cash outflows, helping investors make informed financial decisions.

What information must be reported on Net Present Value Calculator?

Information that must be reported includes initial investment amount, expected cash inflows for each period, expected cash outflows, the discount rate, and the time period over which the investment will be evaluated.

Fill out your Net Present Value Calculator online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Net Present Value Calculator is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.