What is Net Present Value Calculator?

A Net Present Value (NPV) Calculator is a financial tool used to evaluate the profitability of an investment by calculating the present value of expected future cash flows. It helps users determine whether an investment will generate a positive return based on the time value of money.

What are the types of Net Present Value Calculator?

There are two main types of Net Present Value Calculators: Basic NPV Calculator and Discounted Cash Flow (DCF) NPV Calculator.

Basic NPV Calculator: Calculates the present value of expected cash flows without considering the time value of money.

Discounted Cash Flow (DCF) NPV Calculator: Considers the time value of money by discounting future cash flows to their present value.

How to complete Net Present Value Calculator

To complete a Net Present Value Calculator, follow these steps:

01

Input the initial investment cost.

02

Enter the expected cash flows for each period.

03

Specify the discount rate, which represents the cost of capital or desired rate of return.

04

Calculate the NPV by discounting each cash flow to its present value and subtracting the initial investment.

05

Interpret the NPV result: A positive NPV indicates a profitable investment, while a negative NPV means the investment may not be worthwhile.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Net Present Value Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is NPV example?

Put another way, it is the compound annual return an investor expects to earn (or actually earned) over the life of an investment. For example, if a security offers a series of cash flows with an NPV of $50,000 and an investor pays exactly $50,000 for it, then the investor's NPV is $0.

What is the first step in determining the NPV?

The first step to determining the NPV is to estimate the future cash flows that can be expected from the investment. Then use the appropriate discount rate to discount the future cash flows to find the present value of the cash flows so that they can be compared with the initial investment cost.

What is the present value of $500.00 to be paid in two years if the interest rate is 5 percent?

Answer and Explanation: The present value is A. $453.51. The future cash flow is $500, the interest rate is 5%,

What is net present value with example?

Put another way, it is the compound annual return an investor expects to earn (or actually earned) over the life of an investment. For example, if a security offers a series of cash flows with an NPV of $50,000 and an investor pays exactly $50,000 for it, then the investor's NPV is $0.

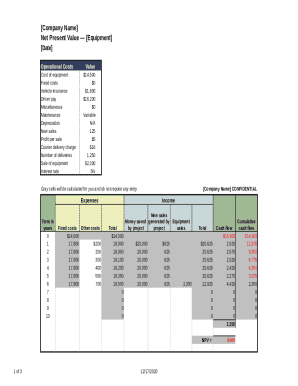

How do I calculate NPV in Excel?

How to Use the NPV Formula in Excel =NPV(discount rate, series of cash flow) Step 1: Set a discount rate in a cell. Step 2: Establish a series of cash flows (must be in consecutive cells). Step 3: Type “=NPV(“ and select the discount rate “,” then select the cash flow cells and “)”.

How do I calculate net present value?

What is the formula for net present value? NPV = Cash flow / (1 + i)^t – initial investment. NPV = Today's value of the expected cash flows − Today's value of invested cash. ROI = (Total benefits – total costs) / total costs.