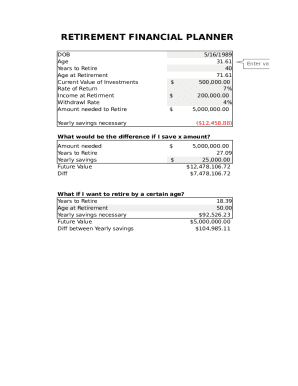

What is Retirement Financial Planner?

A Retirement Financial Planner is a professional who helps individuals plan for their financial future during retirement. They assist in creating a comprehensive strategy to ensure a comfortable and secure retirement by analyzing income, expenses, investments, and other financial aspects.

What are the types of Retirement Financial Planner?

There are various types of Retirement Financial Planners, including:

Certified Financial Planner (CFP)

Chartered Retirement Planning Counselor (CRPC)

Registered Investment Advisor (RIA)

Chartered Financial Consultant (ChFC)

How to complete Retirement Financial Planner

To successfully complete your Retirement Financial Planner, follow these steps:

01

Assess your current financial situation and retirement goals

02

Consult with a Retirement Financial Planner to create a personalized retirement plan

03

Implement the plan and regularly review and adjust as needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Retirement Financial Planner

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between a financial planner and a retirement planner?

While financial planning focuses on your current finances and investments for your future, retirement planning focuses specifically on your finances within your retirement and how to ensure you have the adequate funds available for the life you desire after you retire.

Is it worth going to a financial planner?

A financial advisor is worth the money if you are uncertain about how to manage your money, invest for your future, and take care of your family. Expert financial advice may be needed at various turning points in your life: when you have a child, get a promotion, or come into an inheritance.

Who is the best person to talk to about retirement?

If you're looking for help building a retirement nest egg, you most likely want a certified financial planner (CFP) with expertise in retirement planning. Other financial advisors who may specialize in retirement planning can be identified by various credentials following their names.

Are retirement planners worth it?

Ultimately, whether or not a financial advisor will be worth your money depends on your specific situation and the financial advisor you choose to team up with. If they align with your goals, listen to your needs and act in your best interests, they will most likely be a good financial investment.

Should I use a financial planner for retirement?

Using a financial advisor isn't mandatory. If you can't afford, don't trust, or otherwise would prefer not to use an advisor, managing your retirement is always an option. You have to map out a sensible plan and be willing to follow it.

What is the difference between a financial advisor and retirement planner?

While financial planning focuses on your current finances and investments for your future, retirement planning focuses specifically on your finances within your retirement and how to ensure you have the adequate funds available for the life you desire after you retire.

Related templates