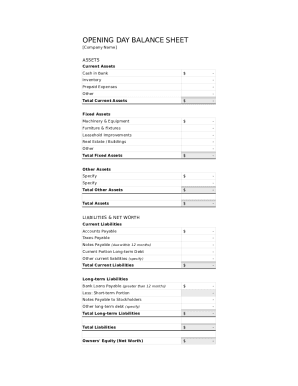

What is Opening Day Balance Sheet?

The Opening Day Balance Sheet is a financial statement that shows the balances of a company's assets, liabilities, and equity at the beginning of a specific accounting period.

What are the types of Opening Day Balance Sheet?

There are two main types of Opening Day Balance Sheet: detailed balance sheet and summarized balance sheet.

Detailed balance sheet: Provides a comprehensive breakdown of all assets, liabilities, and equity accounts.

Summarized balance sheet: Presents a condensed summary of the key financial information.

How to complete Opening Day Balance Sheet

Completing an Opening Day Balance Sheet involves the following steps:

01

Gather all financial documents and records for the beginning of the accounting period.

02

List all assets, liabilities, and equity accounts with their corresponding balances.

03

Calculate the total assets, total liabilities, and total equity.

04

Verify that the equation Assets = Liabilities + Equity balances.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Opening Day Balance Sheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you account for opening balances?

How opening balances are recorded. All transactions have to conform to double entry bookkeeping rules so opening balance must have both a debit and credit value. One side of the transaction is recorded against the ledger account entered, or the ledger account linked to the bank, custiomer or supplier record.

How do I record opening balance in QuickBooks?

Edit opening balances Go to Settings ⚙ and select Chart of accounts. Locate the account and select Account history. Find the opening balance entry. Tip: Sort the date column to show the oldest entries first. Select the opening balance entry. Edit the date, then the amount. Select Save.

What is the journal entry of opening balance?

What is opening entry. Opening entry is referred to as the first entry that is recorded or which is brought forward from a previous accounting period to the new accounting period. In an ongoing business, the closing balance of the previous accounting period serves as an opening balance for the current accounting period

Where does opening balance go on balance sheet?

Opening Balance Equity accounts show up under the equity section of a balance sheet along with the other equity accounts like retained earnings. It may not show up on the balance sheet if the balance is zero.

How do you prepare an opening day balance sheet?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

What is a balance sheet before starting a business?

What is a Startup Balance Sheet? A startup balance sheet or projected balance sheet is a financial statement highlighting a business startup's assets, liabilities, and owners' equity. In other words, a balance sheet shows what a business owns, the amount that it owes, and the amount that the business owner may claim.