What is Checkbook List Sheet?

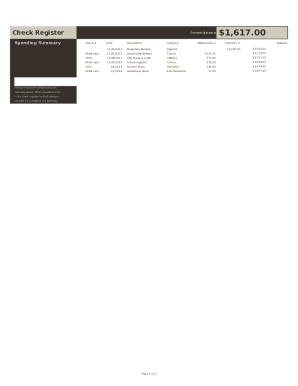

A Checkbook List Sheet is a document used to keep track of all the transactions made on a specific checking account. It helps users monitor their spending, track deposits and withdrawals, and maintain an accurate balance.

What are the types of Checkbook List Sheet?

There are two main types of Checkbook List Sheets: manual and electronic. Manual Checkbook List Sheets are physical sheets of paper where users write down their transactions by hand. Electronic Checkbook List Sheets can be created, edited, and stored digitally using software or online tools.

How to complete Checkbook List Sheet

Completing a Checkbook List Sheet is a simple process that involves recording all transactions accurately. Here are the steps to complete a Checkbook List Sheet:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.