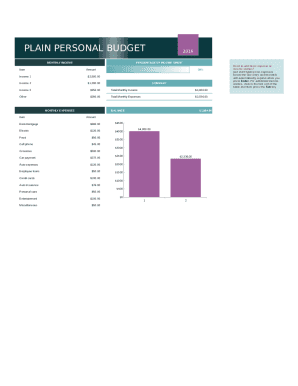

What is Plain Personal Budget?

A Plain Personal Budget is a detailed breakdown of an individual's income and expenses that helps them track their spending and savings. By creating a budget, you can better manage your finances, set financial goals, and plan for future expenses.

What are the types of Plain Personal Budget?

There are several types of Plain Personal Budgets that individuals can choose from based on their financial goals and preferences. Some common types include:

How to complete Plain Personal Budget

Completing a Plain Personal Budget is essential for effective financial management. Follow these steps to create and maintain your budget:

Using pdfFiller empowers you to effortlessly create, edit, and share your Plain Personal Budget online. With unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor to help you stay organized and achieve financial success.