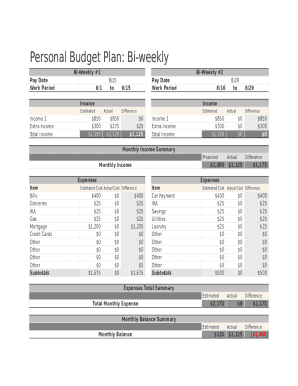

What is Bi-weekly Budget Sheet?

A bi-weekly budget sheet is a financial tool used to track and manage income and expenses on a bi-weekly basis. It helps individuals or families stay on top of their finances by providing a clear overview of where their money is going and how much is coming in.

What are the types of Bi-weekly Budget Sheet?

There are two main types of bi-weekly budget sheets: basic and detailed.

Basic bi-weekly budget sheet: This type includes essential categories such as income, expenses, and savings, providing a simplified overview of finances.

Detailed bi-weekly budget sheet: This type includes more specific categories such as utilities, groceries, entertainment, and debt payments, offering a more comprehensive analysis of spending habits.

How to complete Bi-weekly Budget Sheet

Completing a bi-weekly budget sheet is easy and can be done in a few simple steps:

01

Gather all your financial statements, including pay stubs, bills, and receipts.

02

List all sources of income for the upcoming two weeks.

03

Record all expenses, categorizing them into fixed (rent, utilities) and variable (entertainment, dining out).

04

Calculate your total income and subtract your total expenses to determine your surplus or deficit.

05

Adjust your budget as needed to ensure you are living within your means.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Bi-weekly Budget Sheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is there a budget app for pay period?

EveryTwo is a low-cost and easy-to-use budget app that lets you fully customize your budget schedule whether it's weekly, biweekly, every three weeks, monthly, or any other time frame you need. You can also fully customize the time frame for your recurring income and expenses.

How do I make a budget when I pay every 2 weeks?

To create a biweekly budget, list all your expenses and add them to a bill calendar. Then add up variable spending and set savings goals. Create a budget for each pay period of the month, and then track your progress.

What is the 50 30 20 rule bi weekly?

The basic rule of thumb is 50% for needs, 30% for wants, and 20% for savings or paying off debt. From here you can adjust your spending habits to be smarter and put money in the right places!

What is the best budget for biweekly pay?

How much of my biweekly paycheck should I save? As a general rule, you should aim to save at least 20% of your take-home income each paycheck. For example, if you're following the 50/30/20 budget rule, this means you'll want to set aside: 50% of your paycheck to put towards your needs (living essentials)

How do you budget when you get paid weekly and biweekly?

Step 1: Know your paydays. Grab a monthly calendar and write down every single day that you're paid. Step 2: Add your bills to the same calendar. Step 3: List out all other expenses. Step 4: “Assign” your paychecks to cover your bills and expenses. Step 5: Write your weekly budget.

What is the best budget for biweekly paycheck?

How much of my biweekly paycheck should I save? As a general rule, you should aim to save at least 20% of your take-home income each paycheck. For example, if you're following the 50/30/20 budget rule, this means you'll want to set aside: 50% of your paycheck to put towards your needs (living essentials)

Related templates