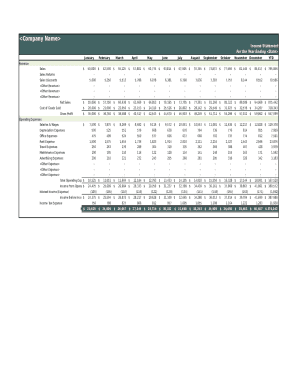

What is Monthly Income Statement?

A Monthly Income Statement is a financial document that summarizes a company's revenues, expenses, and profits over a specific period. It provides a snapshot of a company's financial performance and helps stakeholders assess its profitability and efficiency.

What are the types of Monthly Income Statement?

There are two main types of Monthly Income Statements: Single-step and Multi-step. The Single-step Income Statement calculates total revenues and subtracts total expenses to determine net income. On the other hand, the Multi-step Income Statement breaks down revenues and expenses into operating and non-operating categories for a more detailed analysis.

How to complete Monthly Income Statement

Completing a Monthly Income Statement is essential for tracking your business's financial health. Follow these steps to create a comprehensive statement:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.