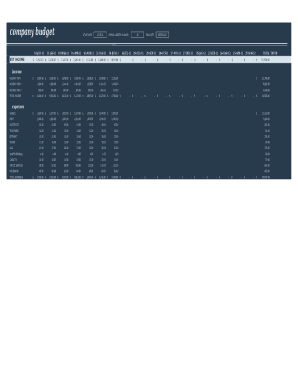

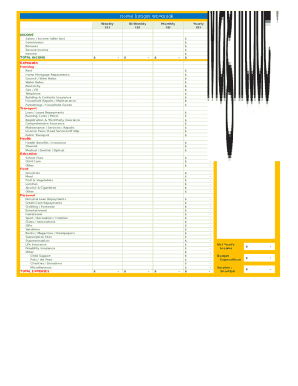

What is 18 Period Budget?

The 18 Period Budget is a financial planning tool that spans over 18 periods, usually months, to forecast and manage expenses and revenue over an extended period. It allows businesses to have a more long-term view of their financial situation and plan accordingly.

What are the types of 18 Period Budget?

There are several types of 18 Period Budget that businesses can use depending on their needs and goals. Some common types include:

How to complete 18 Period Budget

Completing an 18 Period Budget requires careful planning and attention to detail. Here are some steps to help you successfully complete your 18 Period Budget:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.