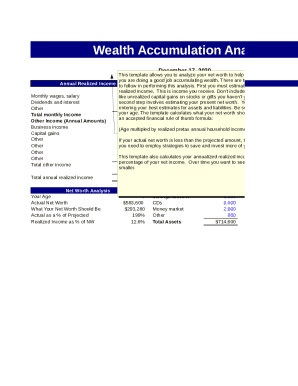

Wealth Accumulation Calculator

What is Wealth Accumulation Calculator?

A Wealth Accumulation Calculator is a tool used to estimate the growth of your investments over time. By inputting details such as initial investment amount, expected rate of return, and timeframe, the calculator can provide an estimate of how much wealth you can accumulate.

What are the types of Wealth Accumulation Calculator?

There are several types of Wealth Accumulation Calculators available, including:

Compound Interest Calculator

Savings Goal Calculator

Retirement Calculator

Investment Calculator

How to complete Wealth Accumulation Calculator

Completing a Wealth Accumulation Calculator is easy and straightforward. Follow these steps:

01

Enter your initial investment amount

02

Input the expected rate of return on your investments

03

Specify the timeframe for which you want to calculate wealth accumulation

04

Click on calculate to get your estimated wealth accumulation

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Wealth Accumulation Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the factor for accumulating wealth?

The Two Most Important Factors to Build Wealth A sustained high savings rate. and. Consistent investing.

What is the Rule of 72 in wealth management?

Do you know the Rule of 72? It's an easy way to calculate just how long it's going to take for your money to double. Just take the number 72 and divide it by the interest rate you hope to earn. That number gives you the approximate number of years it will take for your investment to double.

How much interest does $100000 earn in a year?

How much interest can $100,000 earn in a year? If you put $100,000 in CDs, high-yield savings or a money market account for a year, you could earn anywhere from $3,000 to $5,000 based on current interest rates.

How much money do I need to invest to make $3000 a month?

ing to FIRE, your portfolio should cover 25 times your annual expenses. Then, if you withdraw 4% of your portfolio every year, your portfolio will continue to grow and won't be compromised. We can apply this formula to the goal of making $3,000 a month like this: $3,000 x 12 months x 25 years = $900,000.

What is the accumulation of wealth?

Wealth accumulation is acquiring money, properties, or other assets that increase a person's net worth over time. Individuals can achieve it through investing and actively earning returns through them. Typically, a person does it to secure a financially stable future for them the coming years.

How do you calculate wealth accumulation?

Wealth is determined by taking the total market value of all physical and intangible assets owned, then subtracting all debts. Essentially, wealth is the accumulation of scarce resources.